Will Strong Q2 Earnings and Automotive Recovery Signals Shift NXP Semiconductors' (NXPI) Investment Narrative?

- On July 21, 2025, NXP Semiconductors released its second quarter earnings, reporting sales of US$2.93 billion and net income of US$445 million, alongside issuing a third quarter revenue guidance of US$3.05 billion to US$3.25 billion.

- An important insight is that management sees Western automotive inventory normalization marking a potential turning point, with broad-based recovery signals in industrial and IoT sectors beginning to appear.

- With fresh guidance above analyst forecasts and indications that automotive inventory digestion is ending, we'll explore what this could mean for NXP Semiconductors' investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NXP Semiconductors Investment Narrative Recap

To be a shareholder in NXP Semiconductors, you need to believe in the company's ability to capture renewed growth as automotive inventory normalization in Western markets sets the stage for direct-to-demand shipments and more reliable earnings visibility. The latest Q2 report and raised Q3 outlook confirm that recovery is underway, yet modest year-on-year declines in sales and ongoing pressure in China remain important risks to watch; the biggest short-term catalyst, true auto demand returning, now looks increasingly tangible, while the largest risk continues to be competitive pricing and margin pressure in key regions.

The most relevant recent announcement to these catalysts is NXP's completion of its multi-year share buyback program, which returned over US$2.1 billion to shareholders. While this reinforces management’s commitment to capital returns in a period of transition for end markets, its impact on the company's operating performance and ability to respond to shifting market conditions remains limited compared to fundamental revenue growth drivers.

However, beneath these encouraging signs, investors should be aware that competition and pricing pressure in China...

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors' outlook anticipates $15.6 billion in revenue and $3.5 billion in earnings by 2028. This scenario relies on annual revenue growth of 8.7% and a $1.4 billion increase in earnings from the current $2.1 billion.

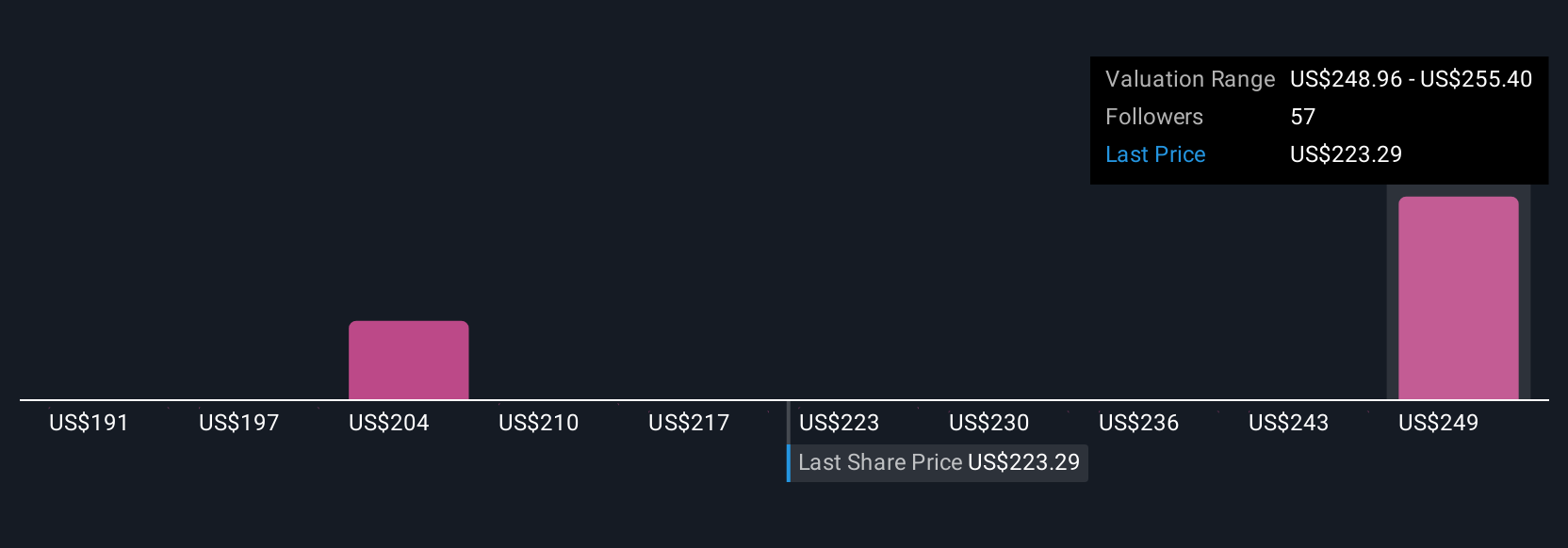

Uncover how NXP Semiconductors' forecasts yield a $255.40 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for NXP Semiconductors range from US$191 to US$255 across 8 individual perspectives on Simply Wall St. Against these varied opinions, the company’s ongoing margin pressure in China remains a key issue to explore for future performance.

Explore 8 other fair value estimates on NXP Semiconductors - why the stock might be worth 16% less than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal