EU Approval of Zenrelia Might Change the Case for Investing in Elanco Animal Health (ELAN)

- Elanco Animal Health recently announced that the European Commission has approved Zenrelia™ (ilunocitinib), a once-daily oral JAK inhibitor for treating pruritus and atopic dermatitis in dogs, marking a significant regulatory milestone for the company in the EU.

- This approval not only strengthens Elanco’s presence in the European canine dermatology market but also highlights its ongoing geographic expansion and portfolio diversification efforts.

- We'll now examine how EU approval of Zenrelia may influence Elanco's prospects, especially as a new driver for its product pipeline.

Elanco Animal Health Investment Narrative Recap

To own Elanco Animal Health stock, you need to believe the company's expanding portfolio and geographic reach can drive consistent growth, even as execution risks and increasing operating expenses present near-term challenges. The European Commission approval for Zenrelia™ marks a milestone, supporting innovation momentum, but its immediate impact on reversing margin pressures or ensuring fast product adoption remains to be seen. The most important short-term catalyst remains the successful commercialization of new products, while the biggest risk centers on Elanco’s ability to quickly translate investment in launches into profitability.

Among recent announcements, the July approval of Credelio Quattro™ as a new oral parasiticide stands out alongside Zenrelia™, reflecting Elanco's push for innovation-led revenue and supporting the product pipeline narrative that underpins growth expectations. When considered together, both approvals highlight the company's focus on broadening its advanced companion animal offerings, which is essential for boosting sales and delivering on future earnings targets.

However, in contrast to expected benefits, ongoing risks such as delayed adoption of new products could threaten forecasts if...

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health is expected to reach $4.9 billion in revenue and $160.1 million in earnings by 2028. This projection implies a 3.2% annual revenue growth rate but a decrease in earnings of $177.9 million from current earnings of $338.0 million.

Exploring Other Perspectives

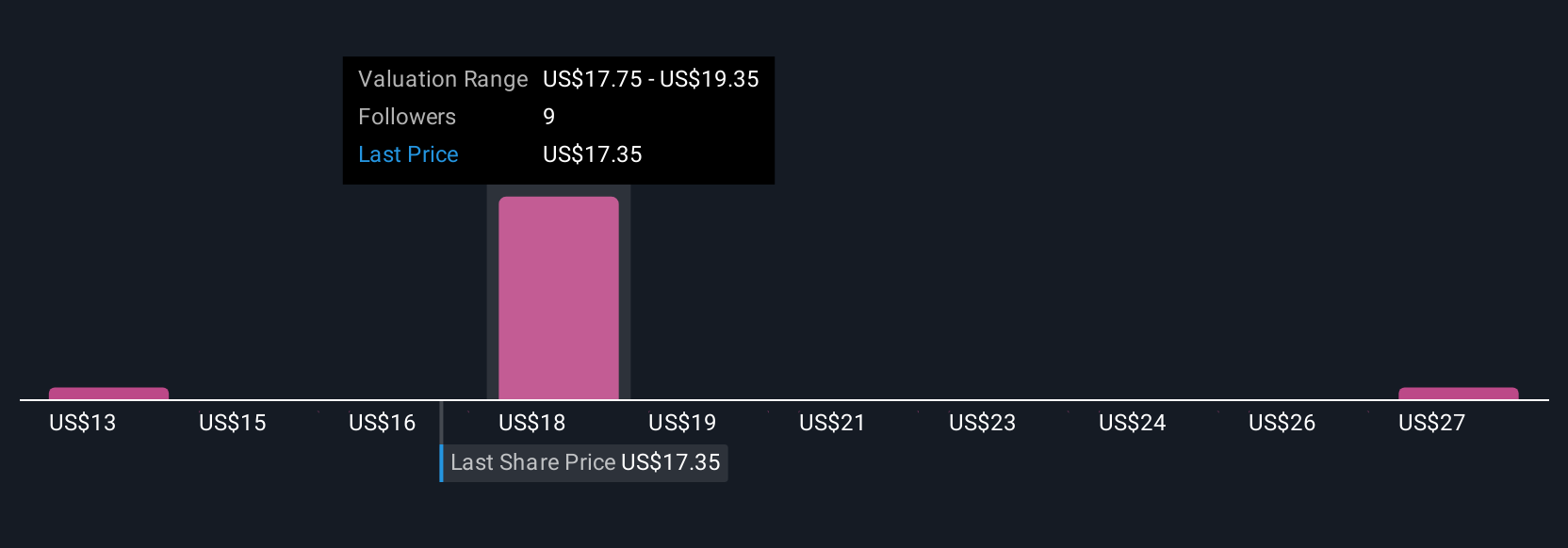

Three community fair value estimates for Elanco Animal Health range widely from US$12.93 to US$49.78. With strong focus on new product launches, you can see how opinions vary, so explore multiple viewpoints.

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal