Why BKV (BKV) Is Down 7.4% After New Texas CCS Project Agreement and What's Next

- BKV Corporation recently announced it has signed an agreement with a major midstream energy company to develop a carbon capture and sequestration (CCS) project at an operating natural gas processing plant in East Texas, building on its previous CCS initiative in South Texas.

- This project, utilizing a co-located Class II injection well to avoid high-pressure pipeline investment, highlights BKV’s expansion in carbon management and aligns with its ongoing sustainability efforts in Texas and beyond.

- We’ll explore how the addition of a co-located CCS project supports BKV’s investment narrative and long-term carbon management objectives.

What Is BKV's Investment Narrative?

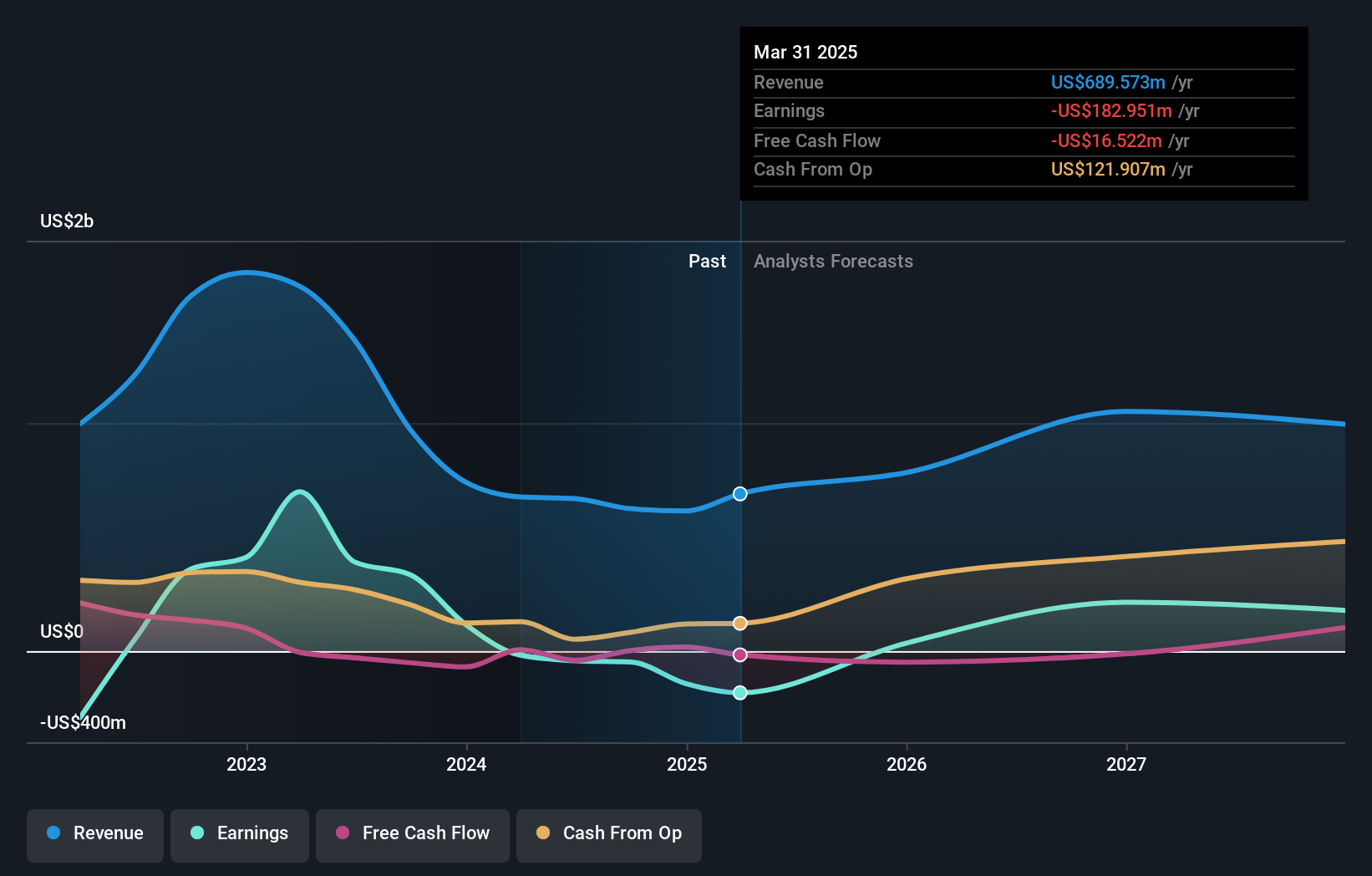

For potential shareholders, the big picture on BKV centers around the belief that carbon capture and sequestration (CCS) can become a viable, growth-oriented business model within the energy sector. The recently announced East Texas CCS project, which leverages BKV’s own injection well to reduce infrastructure costs, underscores this focus. While the share price has moved only modestly on the news, the project fits well with BKV’s longer-term shift toward sustainability, but is unlikely to materially shift the biggest short-term catalysts or risks just yet. The loss of Russell index inclusion and high recent net losses remain major issues; executive turnover and rising costs are immediate concerns, while new CCS initiatives extend the company’s narrative but will take time to drive meaningful financial results. For now, profitability and cash flow trends matter more to the business than this incremental CCS expansion.

But significant losses and cost pressures remain key details investors should not overlook. Despite retreating, BKV's shares might still be trading 32% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on BKV - why the stock might be worth just $28.38!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

No Opportunity In BKV?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal