July 2025's Top Penny Stocks To Watch

As the U.S. stock market experiences a mix of record highs and slight retreats amid a wave of corporate earnings reports, investors are keeping a close eye on potential opportunities. Penny stocks, although an older term, continue to capture interest due to their potential for growth at lower price points. These smaller or newer companies can offer unique value when they possess strong financials and clear growth trajectories.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.70 | $607.59M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.48 | $266.61M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9581 | $160.22M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $4.07 | $421.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.845 | $6.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.61 | $100.19M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.92 | $44.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.36 | $28.05M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 420 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ovid Therapeutics (OVID)

Simply Wall St Financial Health Rating: ★★★★☆☆

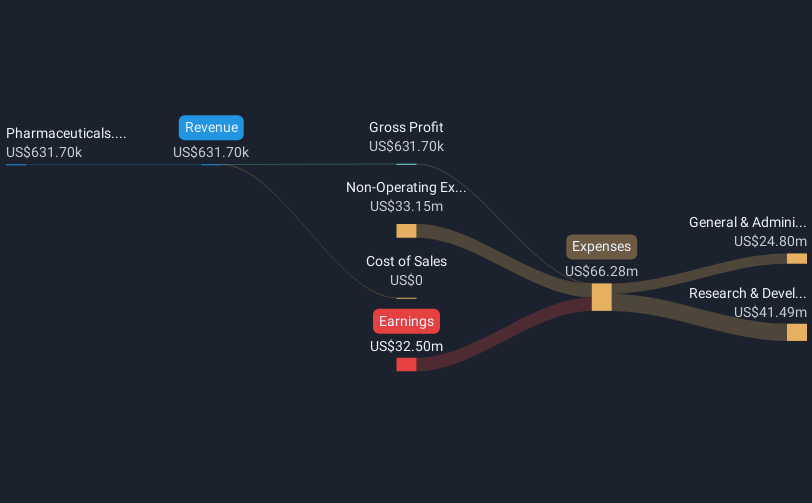

Overview: Ovid Therapeutics Inc. is a biopharmaceutical company focused on developing impactful medicines for epilepsies and seizure-related neurological disorders in the United States, with a market cap of $39.11 million.

Operations: The company generates revenue from its Pharmaceuticals segment, totaling $0.55 million.

Market Cap: $39.11M

Ovid Therapeutics, with a market cap of US$39.11 million, is navigating the challenges typical of penny stocks in the biotech sector. The company is pre-revenue, generating only US$0.55 million from its pharmaceuticals segment and remains unprofitable with increasing losses over five years. Despite having no debt and short-term assets exceeding liabilities, Ovid faces a cash runway of less than a year if free cash flow trends continue. Recent developments include potential reverse stock splits to adjust share structure and ongoing investor presentations to bolster market confidence amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in Ovid Therapeutics' financial health report.

- Assess Ovid Therapeutics' future earnings estimates with our detailed growth reports.

Citizens (CIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Citizens, Inc. is an insurance holding company that offers life insurance products both in the United States and internationally, with a market cap of $178.53 million.

Operations: The company generates revenue through its life insurance segment, contributing $185.31 million, and home service insurance, which brings in $56.81 million.

Market Cap: $178.53M

Citizens, Inc., with a market cap of US$178.53 million, presents a mixed picture in the penny stock landscape. The company is trading significantly below its estimated fair value but faces challenges with declining profit margins and negative earnings growth over the past year. Despite being debt-free and having an experienced management team, Citizens struggles with covering long-term liabilities given short-term assets of US$53 million against liabilities of US$94.2 million. Recent inclusion in multiple Russell indices could enhance visibility and investor interest, although recent financials show a net loss for Q1 2025 compared to income last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Citizens.

- Gain insights into Citizens' outlook and expected performance with our report on the company's earnings estimates.

Douglas Elliman (DOUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

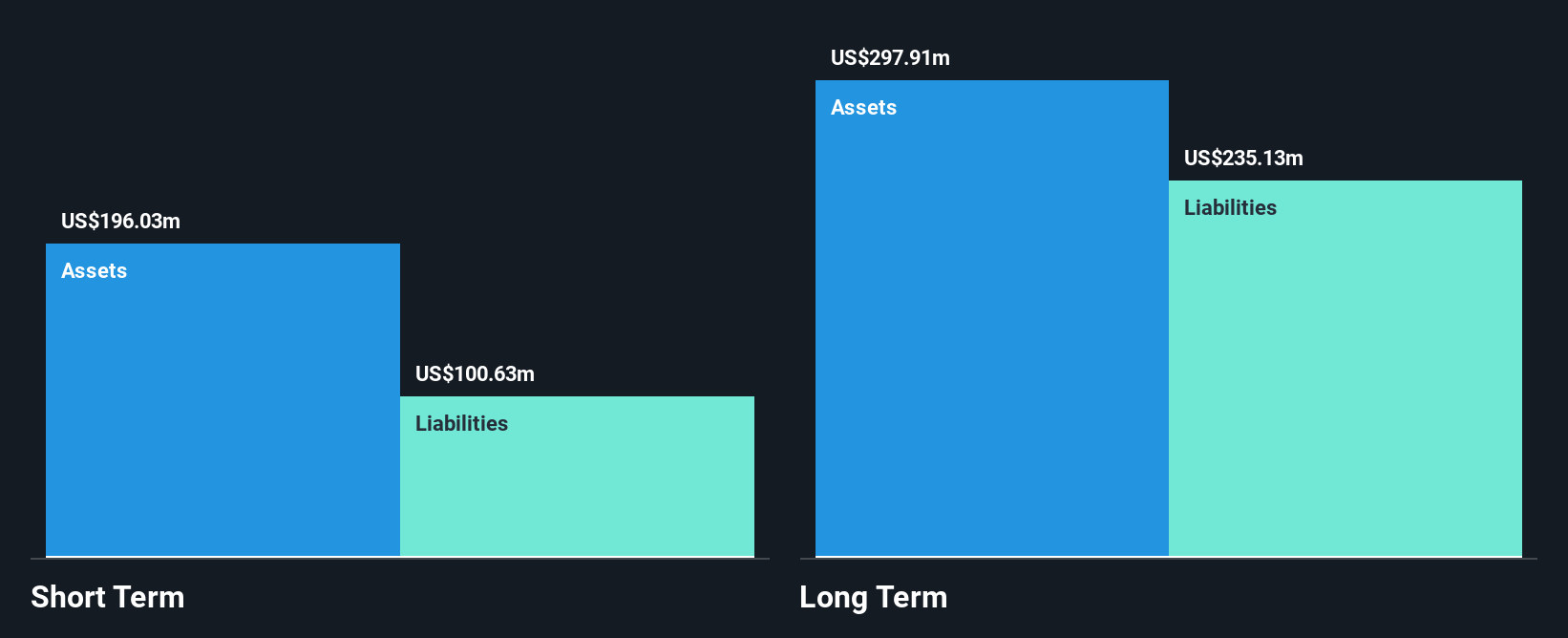

Overview: Douglas Elliman Inc. operates in the real estate services and property technology investment sectors within the United States, with a market cap of approximately $227.17 million.

Operations: The company's revenue is primarily derived from its Real Estate Brokerage segment, which generated $1.05 billion.

Market Cap: $227.17M

Douglas Elliman Inc., with a market cap of US$227.17 million, operates in the real estate services sector and has recently launched Elliman Capital, an innovative mortgage platform enhancing its service offerings. Despite generating US$1.05 billion from its Real Estate Brokerage segment, the company remains unprofitable with increasing losses over five years. Short-term assets of US$196 million exceed liabilities but fall short against long-term obligations of US$235.1 million. The company's inclusion in various Russell indices may boost visibility, yet it faces challenges such as high volatility and negative return on equity at -26.3%.

- Click here to discover the nuances of Douglas Elliman with our detailed analytical financial health report.

- Learn about Douglas Elliman's historical performance here.

Turning Ideas Into Actions

- Jump into our full catalog of 420 US Penny Stocks here.

- Interested In Other Possibilities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal