NYU Professor Warns Companies Against Moving Cash Into Bitcoin — Unless You're Strategy, PayPal, Or A Meme Stock: 'This Is A Bad Idea'

NYU finance professor Aswath Damodaran is urging caution regarding corporate Bitcoin holdings, which have gained traction in recent years, with just four notable exceptions.

Check out the current price of MSTR stock here.

What Happened: On Saturday, in a post on X, Damodaran said that while the strategy has gained traction thanks to Strategy Inc.'s (NASDAQ:MSTR) outsized bets and Michael Saylor's cult-like status, it's fundamentally flawed for most firms.

“In the last few years, Strategy has become a Bitcoin SPAC, with investors attributing savant-like status to Michael Saylor,” he says, noting that this has led more companies to shift their cash holdings into Bitcoin, which he views as “a bad idea, but there are four carveouts.”

See Also: Stock Of The Day – Breakout Time For MicroStrategy?

The renowned valuation expert outlines the exceptions for when, if ever, Bitcoin should be included on a corporate balance sheet. The first is companies whose leadership is especially skilled in trading the digital currency, “much better at timing trades than the average investor.”

However, Damodaran warns that “the peril is that perception is not always reality,” highlighting the risks of misplacing trust in a CEO’s trading acumen in volatile markets like crypto.

The second exception includes firms that use Bitcoin for day-to-day operations. “The bitcoin holdings should be proportional to bitcoin transactions, and operate more like working capital than investing bet,” he says, pointing to PayPal Holdings Inc. (NASDAQ:PYPL) and Coinbase Global Inc. (NASDAQ:COIN).

Third is companies operating in countries with failed fiat currencies could justify bitcoin exposure, “where bitcoin is less volatile and more likely to hold its value than the domestic currency.”

And finally, the fourth exception involves firms with failing business models that have since turned into “meme stocks,” such as AMC Entertainment Holdings Inc. (NYSE:AMC) and GameStop Corp. (NYSE:GME), at which point he says, “The stock becomes a pure trading play.”

Damodaran concludes with a further warning that even with these exceptions, companies will require guardrails, such as “buy-in from shareholders, transparency and disclosure on bitcoin holdings/trades and clearer accounting rules,” he says.

| Stocks / ETFs | Year-To-Date Performance |

| Strategy Inc. (NASDAQ:MSTR) | +41.07% |

| PayPal Holdings Inc. (NASDAQ:PYPL) | -13.94% |

| Coinbase Global Inc. (NASDAQ:COIN) | +63.21% |

| AMC Entertainment Holdings Inc. (NYSE:AMC) | -11.94% |

| GameStop Corp. (NYSE:GME) | -24.07% |

| iShares Bitcoin Trust ETF (NASDAQ:IBIT) | +20.43% |

Why It Matters: Several other prominent experts have warned against this model in recent months, including veteran short-seller James Chanos, who pushed back against Strategy’s claims that its valuations should reflect not just the net asset value (NAVs) of its Bitcoin holdings, but a multiple on its unrealized gains.

This was just weeks after making an arbitrage bet on this by going long on Bitcoin and short on Microstrategy. “We’re buying Bitcoin, selling MicroStrategy stock—an arbitrage play, buying for $1, selling for $2.50,” he said.

Others, such as Tom Lee, the head of research at Fundstrat Global Advisors, have come out in support of this model, especially MSTR.

Lee says that it makes sense that “as Bitcoin goes up, MicroStrategy very likely goes up a lot more,” citing the latter’s innovative financing approach, which allows it to issue convertible debt at “almost no interest cost” to purchase additional Bitcoin.

This “very novel strategy,” he says, has led to the company’s premium valuation mechanism, justifying its trading above its net asset value.

Price Action: Shares of Strategy were down 6.23% on Friday, trading at $423.22, and are up 1.42% after hours.

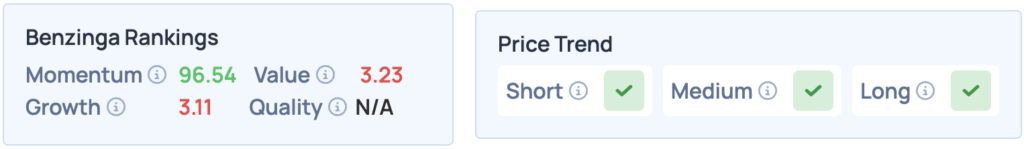

According to Benzinga’s Edge Stock Rankings, Strategy’s shares score high on Momentum, but poorly on other fronts, with a favorable price trend in the short, medium and long terms. How does it compare with other Bitcoin treasury stocks? Click here to find out.

Read More:

Photo courtesy: Shutterstock

Wall Street Journal

Wall Street Journal