Boeing (BA) Secures Gulf Air Order for 12 787 Dreamliners to Expand Global Reach

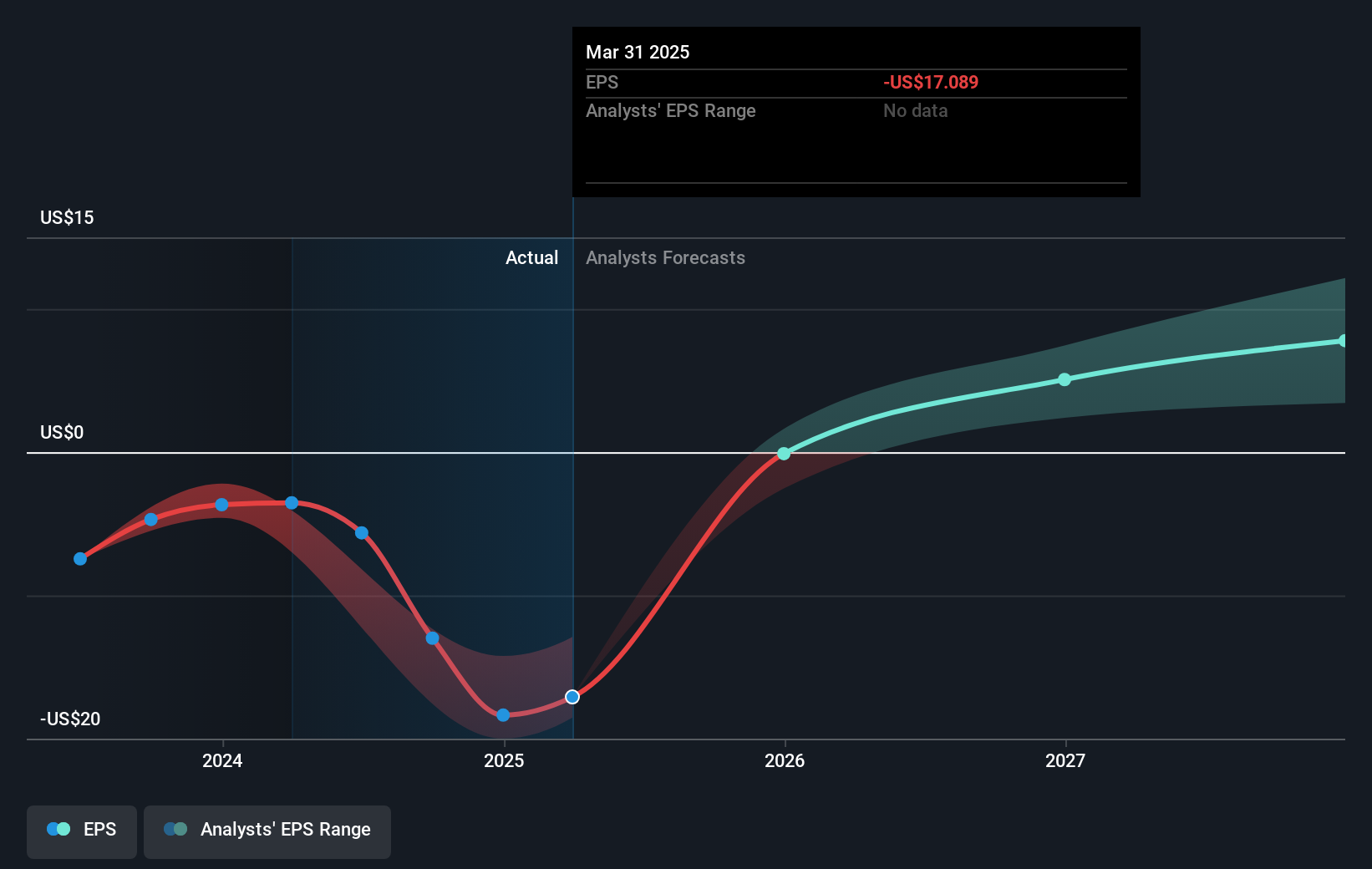

Boeing (BA) recently secured a significant agreement with Gulf Air for the purchase of 12 Boeing 787 Dreamliner jets, potentially expanding to 18, a move supporting approximately 30,000 U.S. jobs. Over the past quarter, Boeing's share price soared by 43%, a substantial increase, potentially influenced by this deal and strong demand for its aircraft from Qatar Airways and China Airlines. This rise was further supported by Boeing's improved financial performance, with a notable reduction in net loss during Q1 2025. These positive developments align with the broader market trend of strength driven by robust corporate earnings and solid economic data.

We've spotted 3 risks for Boeing you should be aware of, and 1 of them is a bit concerning.

The recent agreement Boeing secured with Gulf Air for up to 18 Boeing 787 jets is expected to bolster its revenue stream, supporting the narrative of stabilized production and expanding demand. This aligns with Boeing's strategy to increase production rates of the 737 and 787 models and maintain a strong backlog. Over the past three years, Boeing's total shareholder return was 43.11%, showcasing solid growth compared to the US Market’s 14.1% return over the past year, although it underperformed the US Aerospace & Defense industry, which returned 43.2% over the same period.

The Gulf Air contract, coupled with strong aircraft demand, could positively impact Boeing's future revenue forecasts, potentially aligning with analysts' expectations of a 17.3% annual revenue growth over the next three years. Earnings forecasts also hinge on Boeing's efforts to manage risks such as tariffs and supply chain challenges. With a consensus price target of US$232.82 and a current share price of US$231.00, Boeing is trading slightly below the target, suggesting analysts view it as close to fairly valued at current levels.

Learn about Boeing's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal