Japan's inflation is “high” and the Bank of Japan may raise inflation expectations

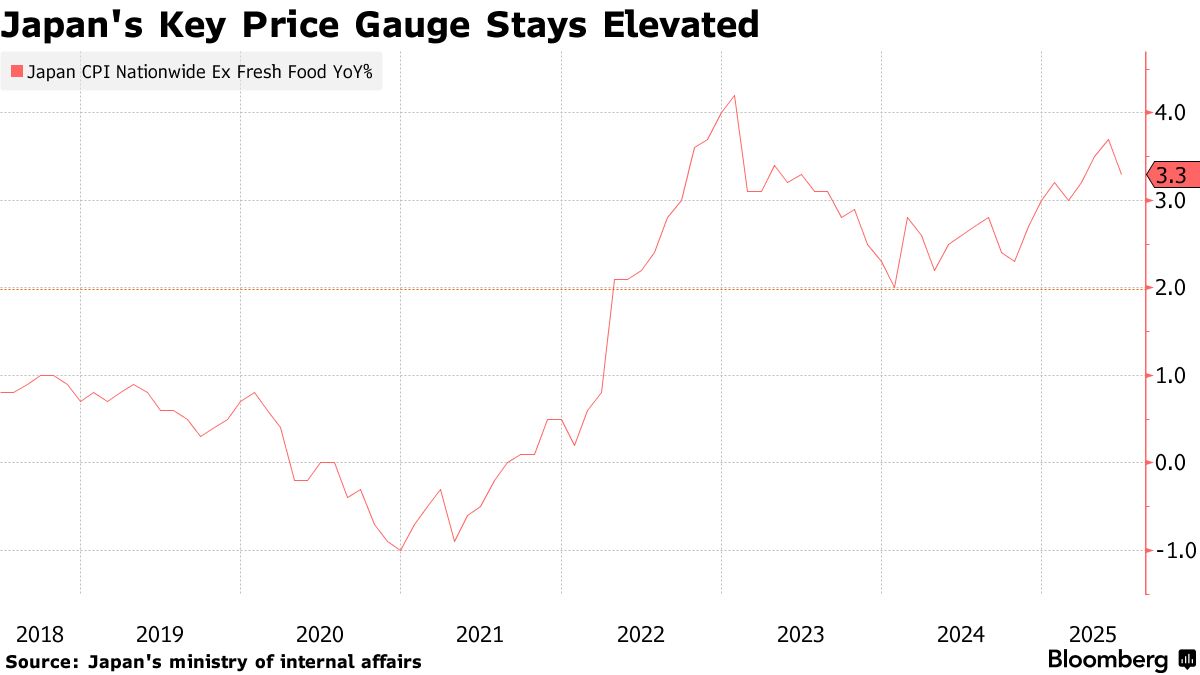

The Zhitong Finance App learned that although Japan's latest major price index has cooled slightly higher than expected, it is still far higher than the Bank of Japan's target. According to data released on Friday, Japan's core consumer price index (CPI) after excluding fresh food rose 3.3% year on year in June, slightly lower than the 3.4% average forecast by economists, and down from the 3.7% year-on-year increase in May (the highest in two years).

The slowdown in energy price increases has become an important reason for this decline in indicators, and government energy subsidies have supported curbing price growth. The deeper inflation index that excludes energy prices (that is, core core CPI) climbed 3.4% year over year, the fastest growth rate since January last year, exceeding the general expectation of 3.3%.

Although the increase has slowed, these figures show the potential intensity of inflation, and the ruling coalition led by Japanese Prime Minister Ishiwari Shigeru is facing the risk of losing a majority of seats in Sunday's Senate election. If Shi Fashimo were to suffer such setbacks, his government might be forced to make concessions to the opposition party, which is making campaign promises to “ease financial restrictions and help families cope with the high cost of living.”

Toru Suehiro, chief economist at Daiwa Securities, said: “There are various one-off factors, so there is no need to worry too much about a slowdown in core CPI.” “If you look at the core core CPI, the rise is accelerating. This strong result will make it more likely that the Bank of Japan will raise inflation expectations later this month.”

The latest inflation data is likely to prompt the Bank of Japan to continue its rate hike path. Bank of Japan Governor Ueda Kazuo is awaiting a definitive outcome of the tariff negotiations with the US. Currently, the market generally expects that the Bank of Japan will keep the benchmark interest rate unchanged at the next policy meeting on July 31.

Economist Taro Kimura said, “The Bank of Japan will focus on the potential intensity of inflation. A wage-price cycle is taking shape, bringing inflation closer to its 2% target. We expect the Bank of Japan to continue to cut monetary stimulus once the direction of trade negotiations with the US becomes more clear and the volatility of the Japanese treasury bond market weakens.”

As the main factor driving inflation since this year, the price of rice in Japan continued to double year-on-year in June. As a staple food, the soaring price of rice attracted attention across Japan, forcing the Ishiwari Shigeru government to take a series of unprecedented measures, including the use of emergency food reserves. According to Teikoku Databank, major Japanese food companies will adjust their prices 2,105 times in July, five times that of the same period last year. Since food inflation is stronger than expected, people familiar with the matter said earlier that Bank of Japan officials may consider raising inflation expectations at this month's meeting.

In addition, the categories that kept inflation high in June also included rising food prices after excluding fresh food and the acceleration of the rise in mobile phone costs. As another key indicator that the Bank of Japan is concerned about, service prices rose 1.5% year on year in June, up slightly from 1.4% last month, and recorded the fastest growth rate since December last year.

At present, Japan's price increase has surpassed that of the rest of the Group of Seven (G7) countries. Over the past seven months, Japan's inflation rate has remained at or above 3%, causing the actual income of households to continue to decline, making the inflation issue an important battleground in elections.

Japan's inflation continues to benefit from changes in public expectations of rising prices, breaking the pattern of long-term deflation. Facing labor shortages and rising costs, Japanese companies are also becoming more willing to pass costs on to consumers. “Although the core CPI has declined somewhat, it is still high, and food inflation is rising,” said Toru Suehiro. “Judging from today's data, Ishiwari Shigeru's government doesn't have much to proudly say in front of voters.

Wall Street Journal

Wall Street Journal