How Investors May Respond To Blue Owl Capital (OWL) Partnership With Voya and Australian Private Credit Launch

- In July 2025, Blue Owl Capital announced a partnership with Voya Financial to develop private markets investment products specifically tailored for defined contribution retirement plans, and also introduced a new private credit strategy for Australian investors through Koda Capital.

- This move aims to expand access to alternative assets in retirement portfolios and marks a significant step in Blue Owl's international and retirement market presence.

- We'll explore how opening retirement channels for private markets exposure could influence Blue Owl’s growth trajectory and investment case.

Blue Owl Capital Investment Narrative Recap

To be a shareholder in Blue Owl Capital, you need to believe in the firm’s ability to expand its private markets platform, capture fee growth, and open new distribution channels, especially in retirement and international markets. The recent partnership with Voya Financial could bolster Blue Owl’s access to the defined contribution retirement space, potentially addressing the most important short-term catalyst of accelerating fee-earning asset growth; however, the risk of a slowdown in institutional fundraising and fundraising headwinds remains material to the business outlook.

Among the most relevant announcements is Blue Owl's July 2025 alliance with Voya Financial, aimed at providing private market investment options for retirement plan participants. By prioritizing fee-based products and diversifying distribution via partnerships like these, Blue Owl can address one of its major growth catalysts, unlocking new, recurring sources of management fees while balancing the uncertainty of institutional capital flows in a changing market environment.

Yet, in contrast to these expansion efforts, investors should be aware that tightened institutional fundraising environments could still...

Read the full narrative on Blue Owl Capital (it's free!)

Blue Owl Capital's narrative projects $4.0 billion revenue and $3.5 billion earnings by 2028. This requires 17.4% yearly revenue growth and a $3.4 billion earnings increase from current earnings of $91.9 million.

Exploring Other Perspectives

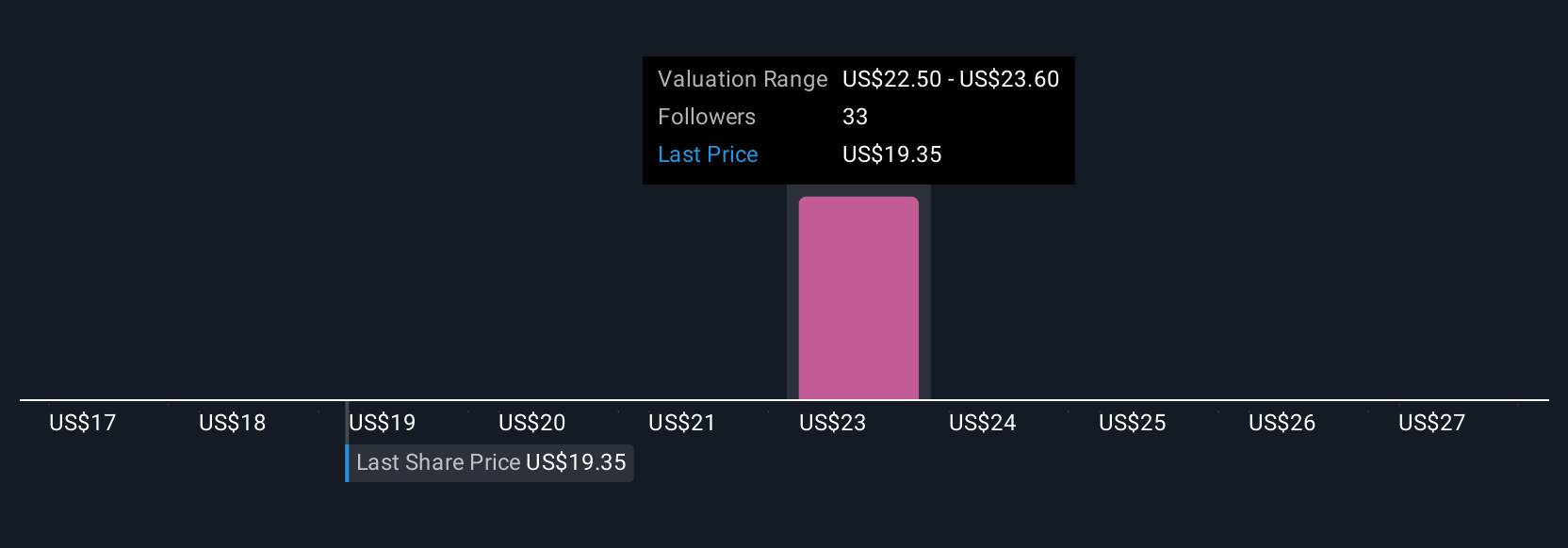

Three community-sourced fair value estimates for Blue Owl Capital range from US$17 to US$33.70, showing a wide spread in investor opinion. With expansion into retirement channels as a core growth catalyst, consider how differing expectations for new asset flows may shape company performance and explore several alternative viewpoints.

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal