Bank of America (BAC) Reports Second Quarter Earnings With Net Income of US$7 Billion

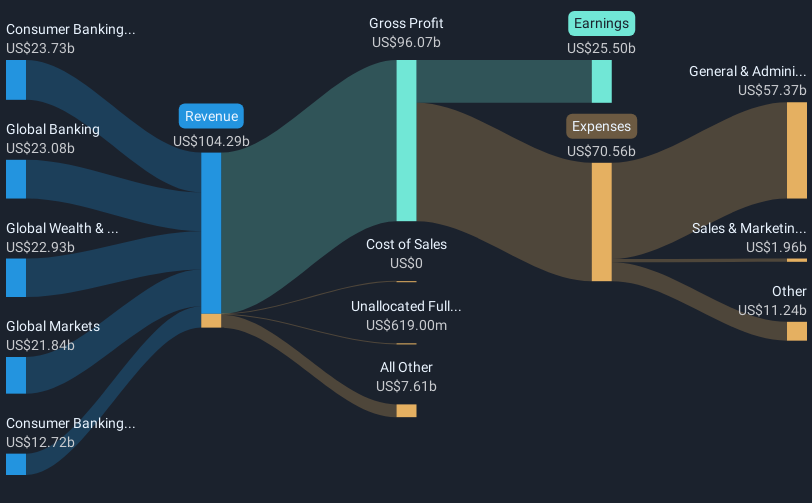

Bank of America (BAC) recently announced second-quarter earnings, revealing a net interest income of $14.67 billion and net income of $7.12 billion, reflecting strong financial health compared to the previous year. These positive earnings coincide with a 24% stock price increase over the last quarter. During this period, the company declared an increase in its quarterly dividend and redeemed significant senior notes, presenting a solid financial footing. While the broader market experienced varied fluctuations amidst geopolitical and monetary policy developments, Bank of America's robust performance in earnings and dividend movements may have strengthened investor confidence, contributing to its stock appreciation.

The recent earnings announcement from Bank of America highlights the company's robust financial health, with a US$14.67 billion net interest income and a net US$7.12 billion income. This has coincided with a 24% stock price rise over the last quarter. Over a longer-term period of five years, the company's total shareholder return, including dividends, has been 113.76%. This impressive performance highlights the gains shareholders have seen, providing significant context to its short-term price movements.

Compared to the US Banks industry, Bank of America's past one-year returns lagged, underscoring the challenges it faces despite recent successes. Notably, the increased dividend announcement combined with the strategic redemption of senior notes suggests that the company is laying a strong foundation for future growth, which could positively influence revenue and earnings forecasts.

With the current share price at US$46.15, Bank of America is trading at a 15.9% discount to the consensus analyst price target of US$52.35. This indicates potential room for appreciation if the company achieves its projected revenue and earnings growth, underpinned by ongoing digital engagement and credit diversification efforts. The strong second-quarter results could bolster confidence in these growth catalysts, aligning with analysts’ expectations for continued advancement.

Review our historical performance report to gain insights into Bank of America's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal