Graphjet Technology Stock Pops 41% After Hours Amid CEO's NASDAQ 'Delisting Survival' Strategy

Graphjet Technology Inc. (NASDAQ:GTI) stock has seen a 41.10% surge, rising to $0.10 in after-hours. This development comes after the company’s CEO revealed a strategic plan to avoid delisting.

What Happened: The surge in Graphjet’s stock value follows the announcement of a strategic plan by the company’s CEO Chris Lai, to prevent delisting from the NASDAQ.

Graphjet Technology, a provider of green graphite solutions, has been facing potential delisting due to non-compliance with NASDAQ regulations. The company’s strategic plan is expected to address these issues and ensure the company’s continued listing on the NASDAQ.

Chris Lai on the plan, "We are confident that our plan to address the non-compliances with the NASDAQ listing requirements can be implemented. In addition, the company will make the necessary announcement when the efforts made for the company's transformation bear fruit."

The stock closed up at 3.84% to $0.073 on July 15.

Why It Matters: Graphjet Technology’s stock value has been subject to significant fluctuations in recent times. The company received a noncompliance letter from the NASDAQ in June, followed by a panel hearing date in June. In response, the company submitted an appeal to the NASDAQ in June, which led to a temporary stay of the delisting process.

Amidst these challenges, the recent surge in stock value following the CEO’s strategic plan announcement indicates a potential turnaround for Graphjet Technology. The company’s shareholders are set to meet on July 30 to vote on a reverse split exercise to address the noncompliance issue.

Price Action: According to Benzinga Pro data, GTI soared 3.84% to $0.073 on Tuesday, with an additional 41.10% gain after-hours, reaching $0.10.

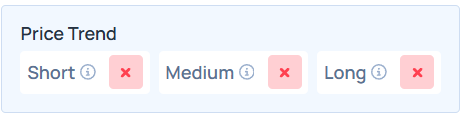

According to Benzinga Edge Stock Rankings, Graphjet stock has negative trend across all time frames. Additional performance details are available here.

Photo Courtesy: T.Dallas on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo:

Wall Street Journal

Wall Street Journal