Okta (OKTA) Expands Partnership With Palo Alto Networks for Enhanced Security Integrations

Okta (OKTA) and Palo Alto Networks recently expanded their partnership with new integrations aimed at improving security solutions. Despite these positive developments, Okta's stock experienced a 6% decline over the past week. This move contrasts with a generally flat broader market, as major indexes showed mixed performances likely influenced by inflation data and tech sector gains led by Nvidia's rally. While Okta’s enhanced partnership could have potentially countered these trends with a positive impact, it seems the broader market dynamics and perhaps other influences overshadowed this effect, resulting in the observed share price decline.

Buy, Hold or Sell Okta? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent partnership expansion between Okta and Palo Alto Networks, aiming for enhanced security solutions, offers potential significance in addressing the narrative of deeper customer integration and accelerated revenue growth. However, Okta's stock, despite the anticipated benefits, saw a 6% decline over the past week, indicating that market factors and possibly execution risks may have outweighed the immediate positive outlook of the new integration efforts.

Over a longer-term context, Okta's total return, factoring in both share price and dividends, showed a 3.66% decline over the past three years. This performance highlights a challenging period for investors relative to both the general market and the US IT industry, where Okta also underperformed in the last year, reflecting a more complex competitive landscape and the need for consistent execution.

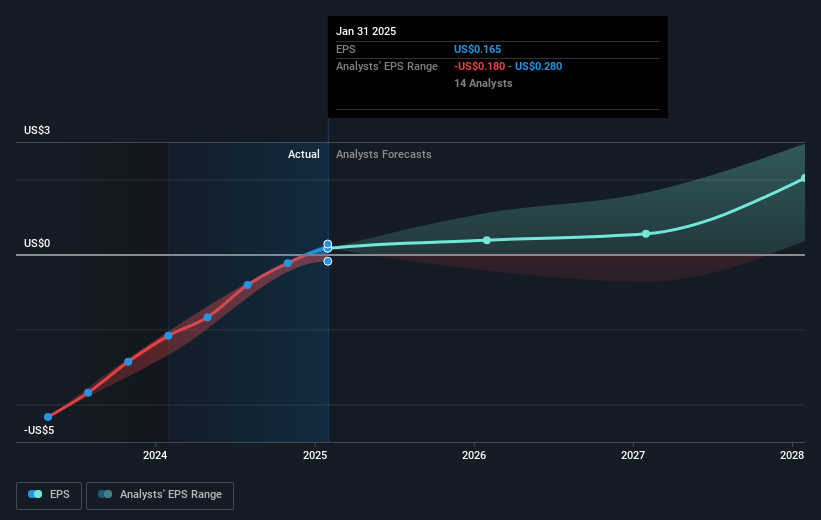

The new partnership could positively impact Okta's revenue and earnings forecasts as integration with Palo Alto Networks might enhance customer retention and upsell opportunities. Analysts expect Okta's revenue to grow by 9.6% annually over the next three years, with an anticipated rise in earnings margins from 4.8% to 10.0%. Yet, the immediate share price movement towards the analyst price target of $122.36 remains key. With the current share price at $91.97, there is a significant potential for upside, assuming the company's strategic initiatives gain traction and address the highlighted risks effectively.

Learn about Okta's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal