Analyst Expectations For SoundHound AI's Future

In the latest quarter, 4 analysts provided ratings for SoundHound AI (NASDAQ:SOUN), showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

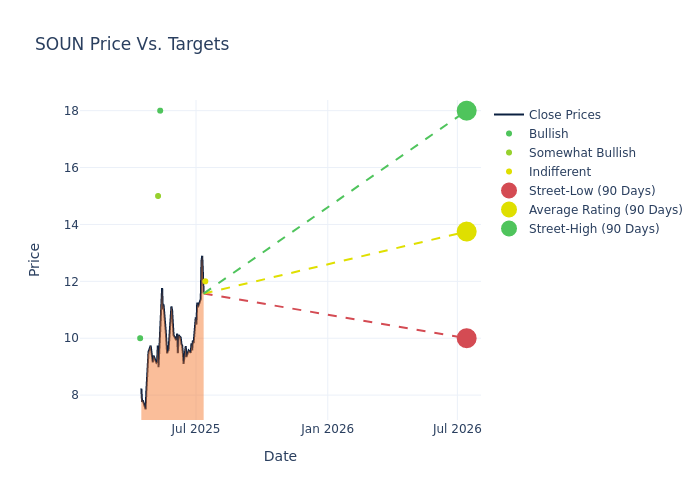

Analysts have recently evaluated SoundHound AI and provided 12-month price targets. The average target is $14.25, accompanied by a high estimate of $18.00 and a low estimate of $12.00. A 28.75% drop is evident in the current average compared to the previous average price target of $20.00.

Interpreting Analyst Ratings: A Closer Look

The perception of SoundHound AI by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Fish | Piper Sandler | Maintains | Neutral | $12.00 | $12.00 |

| James Fish | Piper Sandler | Announces | Overweight | $12.00 | - |

| Scott Buck | HC Wainwright & Co. | Lowers | Buy | $18.00 | $26.00 |

| Daniel Ives | Wedbush | Lowers | Outperform | $15.00 | $22.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to SoundHound AI. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SoundHound AI compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for SoundHound AI's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of SoundHound AI's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on SoundHound AI analyst ratings.

Unveiling the Story Behind SoundHound AI

SoundHound AI Inc is an innovator of conversational intelligence, offering an independent Voice AI platform that enables businesses across industries to deliver high-quality conversational experiences to customers. The company's voice AI delivers speed and accuracy in numerous languages to product creators and service providers across retail, financial services, healthcare, automotive, smart devices, and restaurants via groundbreaking AI-driven products like Smart Answering, Smart Ordering, Dynamic Drive-Thru, and Amelia AI Agents.

Financial Insights: SoundHound AI

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: SoundHound AI's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 151.24%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: SoundHound AI's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 443.64% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): SoundHound AI's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 44.59% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 22.64%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.01, SoundHound AI adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal