Zevra Therapeutics, Inc.'s (NASDAQ:ZVRA) 26% Jump Shows Its Popularity With Investors

Zevra Therapeutics, Inc. (NASDAQ:ZVRA) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 106% in the last year.

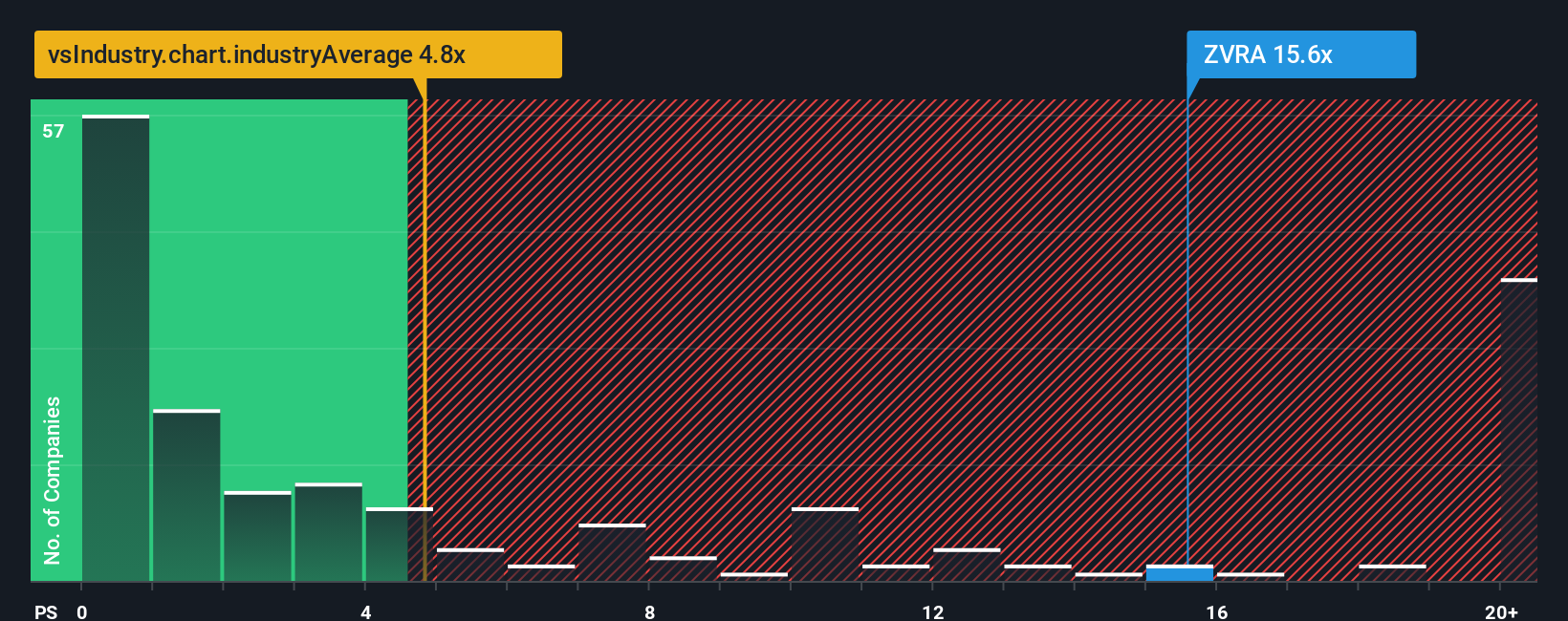

Following the firm bounce in price, Zevra Therapeutics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 15.6x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios under 4.8x and even P/S lower than 1.5x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zevra Therapeutics

What Does Zevra Therapeutics' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Zevra Therapeutics has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Zevra Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Zevra Therapeutics' Revenue Growth Trending?

Zevra Therapeutics' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 46% gain to the company's top line. Pleasingly, revenue has also lifted 98% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 90% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 18% each year, which is noticeably less attractive.

In light of this, it's understandable that Zevra Therapeutics' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Zevra Therapeutics' P/S?

Zevra Therapeutics' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Zevra Therapeutics shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Zevra Therapeutics, and understanding should be part of your investment process.

If you're unsure about the strength of Zevra Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal