How Investors May Respond To PulteGroup (PHM) Leadership Transition Following Debra W. Still’s Retirement

- PulteGroup recently announced that Debra W. Still, Vice Chair of Pulte Financial Services and a 42-year company veteran, will retire at the end of 2025, following a distinguished career that included leading Pulte Mortgage and Pulte Financial Services.

- Her transition marks the culmination of decades of leadership and industry transformation, with succession planning in place as Eric Hart continues as President and CEO of Pulte Financial Services.

- We’ll examine how this leadership transition after a distinguished tenure could shape PulteGroup’s investment narrative and market outlook.

PulteGroup Investment Narrative Recap

To be a PulteGroup shareholder, you need to believe in the company’s ability to manage housing demand and affordability challenges while leveraging its build-to-order and spec home model. The announced retirement of Debra W. Still brings a significant legacy transition but does not materially impact the short-term catalyst of maintaining cost control and margin resilience, especially as Eric Hart ensures stability in financial leadership.

Among recent events, the company’s 10% increase in its quarterly cash dividend to US$0.22 stands out. This move signals ongoing confidence in cash flow strength and may support investor sentiment, even as affordability concerns and the risk of declining new home orders remain key watchpoints around future revenue growth.

However, it’s important to keep in mind that despite these dividend increases, the risk of a steeper drop in demand from key buyer segments could...

Read the full narrative on PulteGroup (it's free!)

PulteGroup is projected to reach $18.4 billion in revenue and $2.3 billion in earnings by 2028. This outlook assumes a 0.9% annual revenue decline and a $0.6 billion decrease in earnings from the current $2.9 billion.

Uncover how PulteGroup's forecasts yield a $123.08 fair value, a 8% upside to its current price.

Exploring Other Perspectives

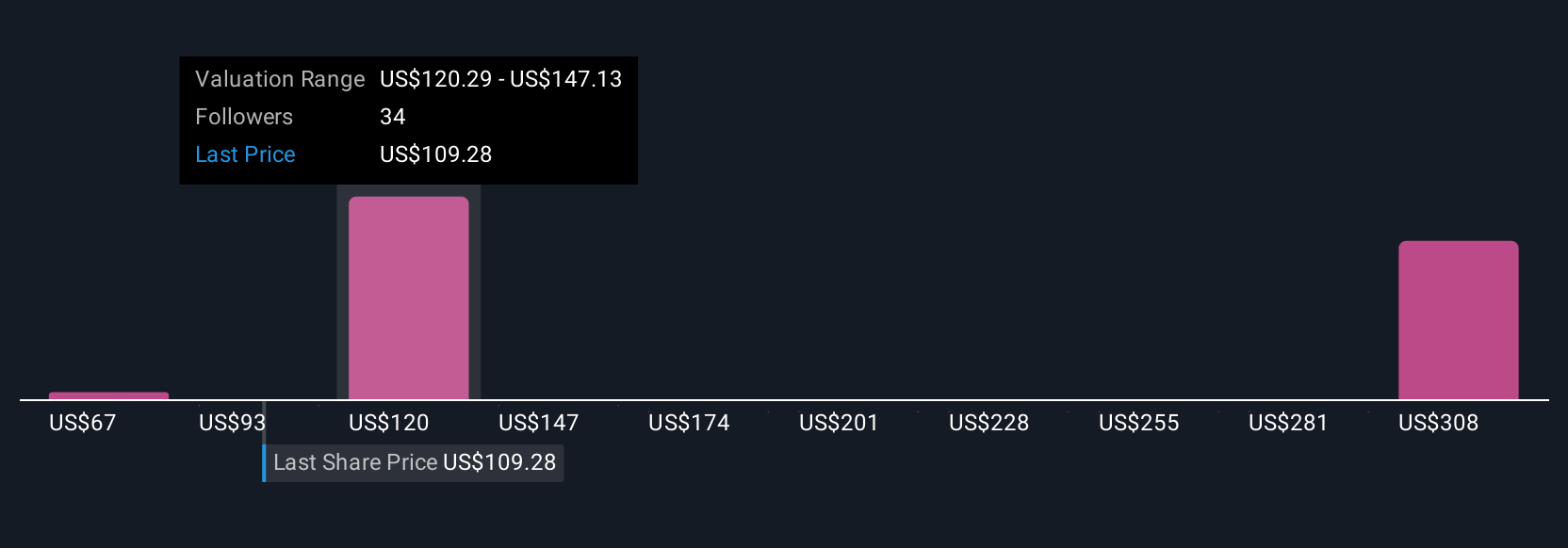

Fair value estimates from eight Simply Wall St Community members range widely from US$66.60 to US$335.18 per share. While opinions differ, many are watching how volatility in homebuyer demand could influence PulteGroup’s financial performance over the next few years.

Build Your Own PulteGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PulteGroup research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PulteGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PulteGroup's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal