Realty Income (NYSE:O) Declares 661st Monthly Dividend of US$3.23 Per Share

Realty Income (NYSE:O) recently affirmed its 661st consecutive monthly dividend, highlighting its consistent commitment to shareholder returns with a dividend of $0.269 per share. Over the past quarter, Realty Income's share price rose by 7%, a performance that aligns with the wider market upswing. Despite this, the company's downward revision of earnings guidance for 2025 may have countered broader market optimism. Meanwhile, steady dividend increases and substantial debt financing initiatives solidified investor sentiment. As major indices remained relatively flat amid tariff uncertainties, Realty Income's financial strategies likely contributed positively to its stock performance.

Realty Income's recent affirmation of its 661st consecutive monthly dividend underscores its commitment to returning value to shareholders, which may have bolstered investor confidence despite a revised earnings guidance for 2025. Over the past five years, Realty Income's total return, including share price appreciation and dividends, was 32.04%, providing a context of steady performance. In the past year, the company's performance underperformed the US market's 12.6% return, indicating some short-term challenges.

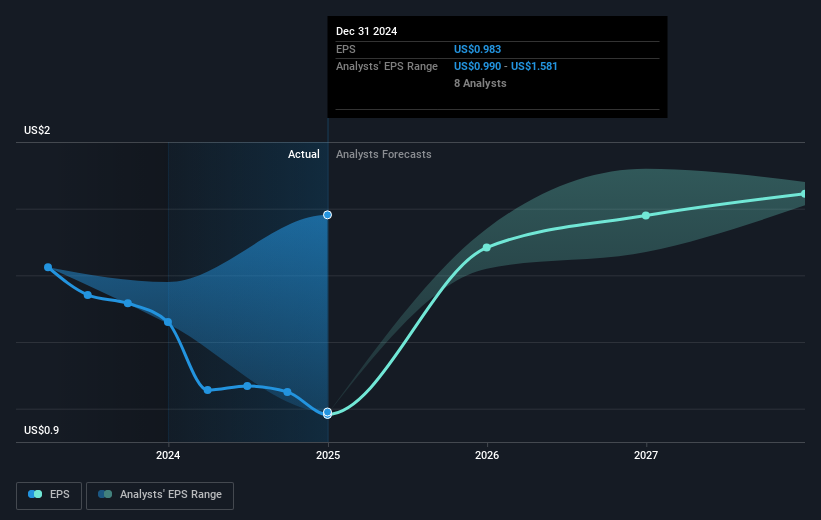

Revenue and earnings forecasts suggest potential growth, with analysts projecting revenue to reach US$5.9 billion and earnings to hit US$1.6 billion by 2028. The company's strategic European investments and U.S. fund development are key growth drivers, but geopolitical and retail sector risks could impact these projections. Realty Income's current share price of US$56.79 is at a discount to the consensus analyst price target of US$61.38, representing a 7.5% potential upside if the growth assumptions are realized.

Click to explore a detailed breakdown of our findings in Realty Income's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal