Bina Puri Holdings Bhd (KLSE:BPURI) Soars 27% But It's A Story Of Risk Vs Reward

Bina Puri Holdings Bhd (KLSE:BPURI) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.5% in the last twelve months.

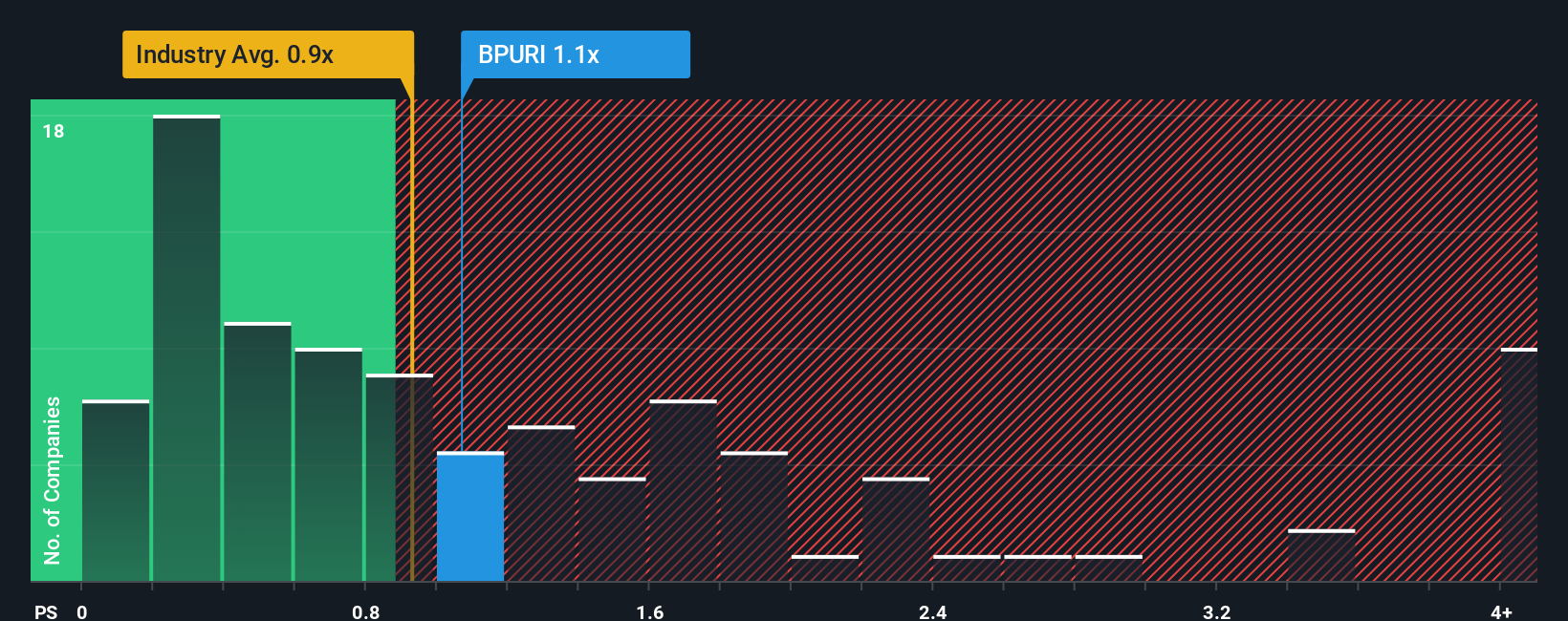

Even after such a large jump in price, it's still not a stretch to say that Bina Puri Holdings Bhd's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Construction industry in Malaysia, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Bina Puri Holdings Bhd

What Does Bina Puri Holdings Bhd's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Bina Puri Holdings Bhd has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Bina Puri Holdings Bhd will help you uncover what's on the horizon.How Is Bina Puri Holdings Bhd's Revenue Growth Trending?

Bina Puri Holdings Bhd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 85% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 54% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 23% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Bina Puri Holdings Bhd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Bina Puri Holdings Bhd's P/S?

Bina Puri Holdings Bhd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bina Puri Holdings Bhd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 5 warning signs for Bina Puri Holdings Bhd (1 is a bit concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal