Oscar Health (NYSE:OSCR) Q1 2025 Results: Revenue Soars To US$3,046M

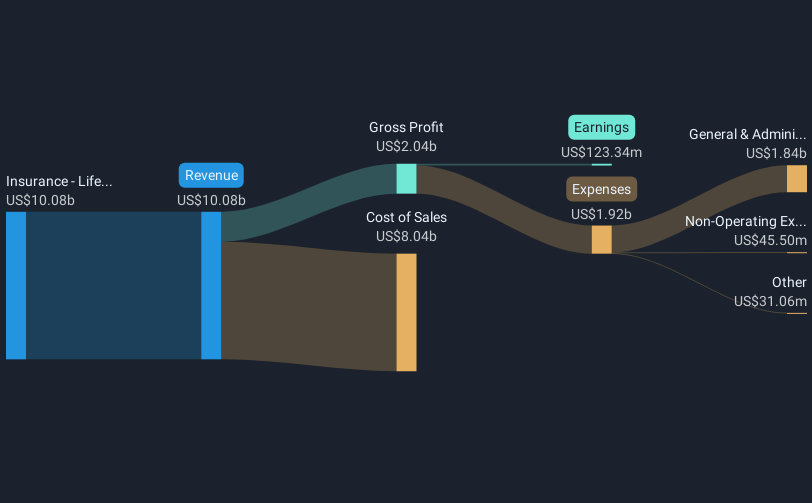

Oscar Health (NYSE:OSCR) reported impressive financial results for Q1 2025, with revenue climbing to USD 3,046 million and net income growing to USD 275 million compared to the previous year. This news likely contributed to the company's 22% share price increase over the last quarter. Additionally, the announcement of their upcoming annual meeting and agenda may have provided further investor confidence. While Oscar Health experienced significant gains, broader market trends, including the S&P 500 and Nasdaq reaching new all-time highs, indicate general positive sentiment and strong corporate results across the board.

The recent financial results reported for Oscar Health, with revenue reaching US$3.05 billion and net income climbing to US$275 million, suggest positive momentum for the company. This financial performance, combined with the upcoming annual meeting, likely boosted investor confidence, contributing to the recent 22% share price increase. Analysts expect that strategic initiatives like AI integration and expansion into new markets could further enhance revenue and earnings forecasts, supporting the upward shift. However, reliance on assumptions and possible regulatory changes remain risk factors.

Over the past three years, Oscar Health's total shareholder returns reached a very large 246.97%, indicating strong gains in shareholder value, despite the company's shares underperforming the US Insurance industry's 14.5% return over the last year. This longer-term success contrasts with recent volatility and underscores the potential resilience of Oscar Health's business model. Nevertheless, the current share price at US$13.07 is still at a 32.5% discount to the analyst price target of US$19.36, highlighting room for potential growth if the company achieves its revenue and earnings projections.

Learn about Oscar Health's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal