Why Investors Shouldn't Be Surprised By Local Bounti Corporation's (NYSE:LOCL) 38% Share Price Surge

Those holding Local Bounti Corporation (NYSE:LOCL) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.7% over the last year.

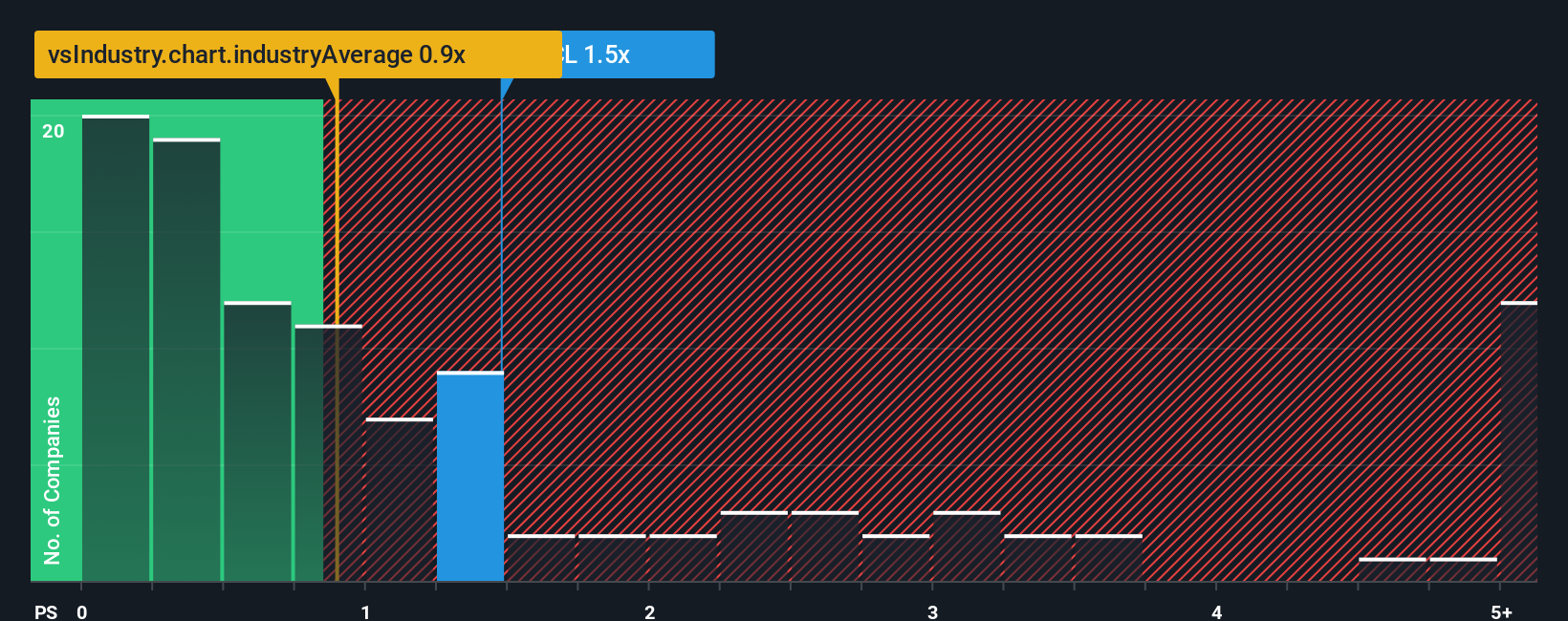

Since its price has surged higher, given close to half the companies operating in the United States' Food industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Local Bounti as a stock to potentially avoid with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Local Bounti

What Does Local Bounti's P/S Mean For Shareholders?

Local Bounti certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Local Bounti.Is There Enough Revenue Growth Forecasted For Local Bounti?

The only time you'd be truly comfortable seeing a P/S as high as Local Bounti's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 71% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 2.9% growth forecast for the broader industry.

With this information, we can see why Local Bounti is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Local Bounti's P/S Mean For Investors?

The large bounce in Local Bounti's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Local Bounti maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Food industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 6 warning signs for Local Bounti (3 are potentially serious!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal