There's No Escaping Hovnanian Enterprises, Inc.'s (NYSE:HOV) Muted Earnings Despite A 26% Share Price Rise

Hovnanian Enterprises, Inc. (NYSE:HOV) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

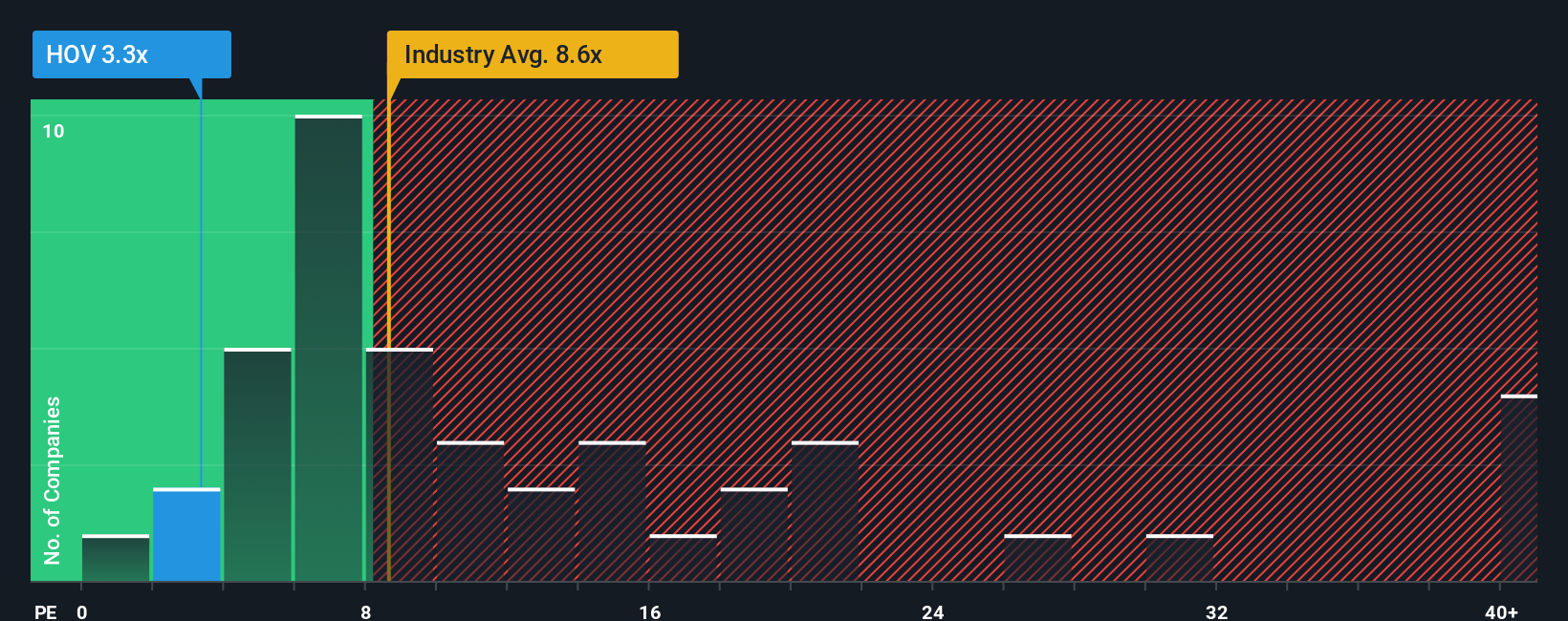

In spite of the firm bounce in price, Hovnanian Enterprises may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 3.3x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Hovnanian Enterprises hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Hovnanian Enterprises

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Hovnanian Enterprises would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.8%. Still, the latest three year period has seen an excellent 34% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 67% as estimated by the one analyst watching the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

In light of this, it's understandable that Hovnanian Enterprises' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Shares in Hovnanian Enterprises are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hovnanian Enterprises maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Hovnanian Enterprises has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might also be able to find a better stock than Hovnanian Enterprises. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal