Undervalued Small Caps With Insider Buying Across Regions In July 2025

The United States market has shown robust performance, with a 2.9% increase over the last week and a 14% rise over the past year, while earnings are anticipated to grow by 15% annually in the coming years. In this favorable environment, identifying small-cap stocks that appear undervalued and exhibit insider buying can present intriguing opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 29.46% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 39.45% | ★★★★★☆ |

| Southside Bancshares | 10.1x | 3.5x | 41.74% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 42.36% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 31.39% | ★★★★☆☆ |

| Standard Motor Products | 11.7x | 0.4x | -2209.42% | ★★★☆☆☆ |

| Farmland Partners | 9.2x | 9.3x | -17.97% | ★★★☆☆☆ |

| BlueLinx Holdings | 15.5x | 0.2x | -88.93% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -366.67% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 1.0x | 1.21% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

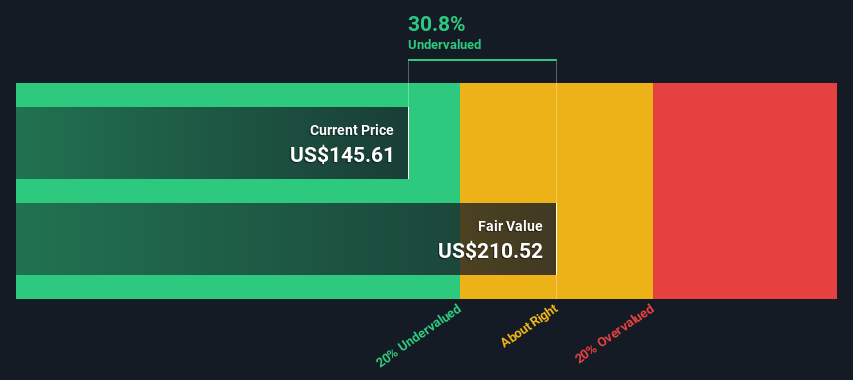

Diamond Hill Investment Group (DHIL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Diamond Hill Investment Group is a company that provides investment advisory and fund administration services, with a market capitalization of approximately $0.5 billion.

Operations: The company's revenue is primarily derived from providing investment advisory and fund administration services, totaling $151.92 million in the most recent period. The cost of goods sold (COGS) stood at $78.94 million, impacting the gross profit margin, which was 48.04%. Operating expenses were reported at $24.33 million, with sales and marketing expenses contributing $7.64 million to this figure. The net income margin for the same period was 26.68%.

PE: 9.8x

Diamond Hill Investment Group, a small company, has shown insider confidence with Jo Quinif purchasing 2,750 shares worth US$396,028 in May 2025. Despite a decline in earnings over the past five years by 2.2% annually and reliance on higher-risk external funding, the company continues to pay dividends of US$1.50 per share and repurchased 24,270 shares for US$3.61 million in Q1 2025. Austin Hawley’s appointment as Director may bring fresh strategic insights to their operations.

- Click here and access our complete valuation analysis report to understand the dynamics of Diamond Hill Investment Group.

Learn about Diamond Hill Investment Group's historical performance.

Century Communities (CCS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Century Communities is a home construction company operating across various U.S. regions, including the West, Texas, Mountain, Southeast, and Century Complete segments, with a market cap of approximately $1.75 billion.

Operations: Century Communities generates revenue from various regional segments, with the Mountain and Century Complete segments contributing significantly. The company's cost of goods sold (COGS) has a substantial impact on its gross profit, which was $933.04 million as of June 30, 2025. Over recent periods, the net income margin has shown variability but was at 7.10% in the latest quarter ending June 30, 2025. Operating expenses are primarily driven by general and administrative costs and non-operating expenses also play a role in financial outcomes.

PE: 5.6x

Century Communities, a smaller player in the housing sector, is expanding despite recent index exclusions. The company has been actively launching new communities across various states, including Nevada and Texas, highlighting its strategic focus on growth. However, financial challenges loom with earnings expected to decline by 16.3% annually over the next three years. Insider confidence was evident with recent purchases between January and February 2025 as they acquired shares worth US$15.33 million. Despite high-risk funding from external borrowing and declining revenues—US$903 million in Q1 2025 compared to US$949 million a year ago—Century's diverse offerings and geographic expansion present potential opportunities for value-focused investors seeking exposure to this segment of the market.

- Click to explore a detailed breakdown of our findings in Century Communities' valuation report.

Assess Century Communities' past performance with our detailed historical performance reports.

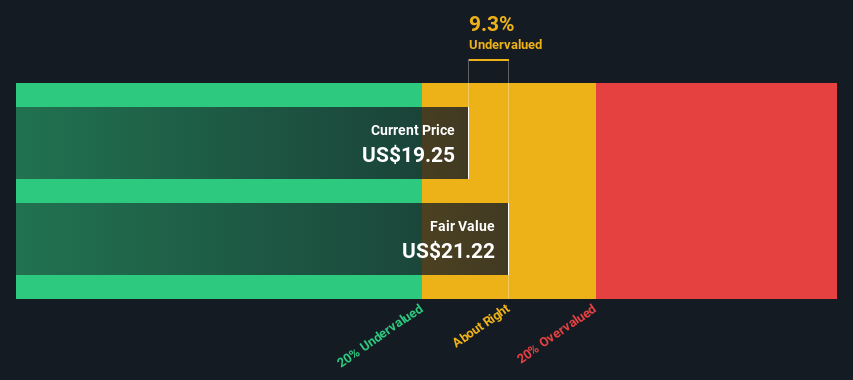

Montrose Environmental Group (MEG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Montrose Environmental Group is a company that provides environmental services, including remediation and reuse, measurement and analysis, and assessment, permitting, and response solutions, with a market cap of approximately $1.58 billion.

Operations: The company's revenue streams are primarily derived from Remediation and Reuse, Measurement and Analysis, and Assessment, Permitting and Response. Gross profit margin has shown a rising trend over recent periods, reaching 40.18% by mid-2025. Operating expenses have consistently increased alongside revenue growth, with general and administrative expenses forming a significant portion of these costs.

PE: -9.4x

Montrose Environmental Group, known for its environmental solutions, faces challenges yet holds promise. Despite being unprofitable with reliance on higher-risk funding sources, they continue to expand their services globally. Recently added to the Russell 3000 Value Index, Montrose reaffirmed a revenue target of US$735 million to US$785 million for 2025 and announced a share repurchase program worth up to US$40 million. Their innovative PFAS treatment solutions highlight their commitment to addressing environmental concerns effectively.

Make It Happen

- Reveal the 80 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal