Hammond Power Solutions Inc. (TSE:HPS.A) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Hammond Power Solutions Inc. (TSE:HPS.A) shares have been powering on, with a gain of 27% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

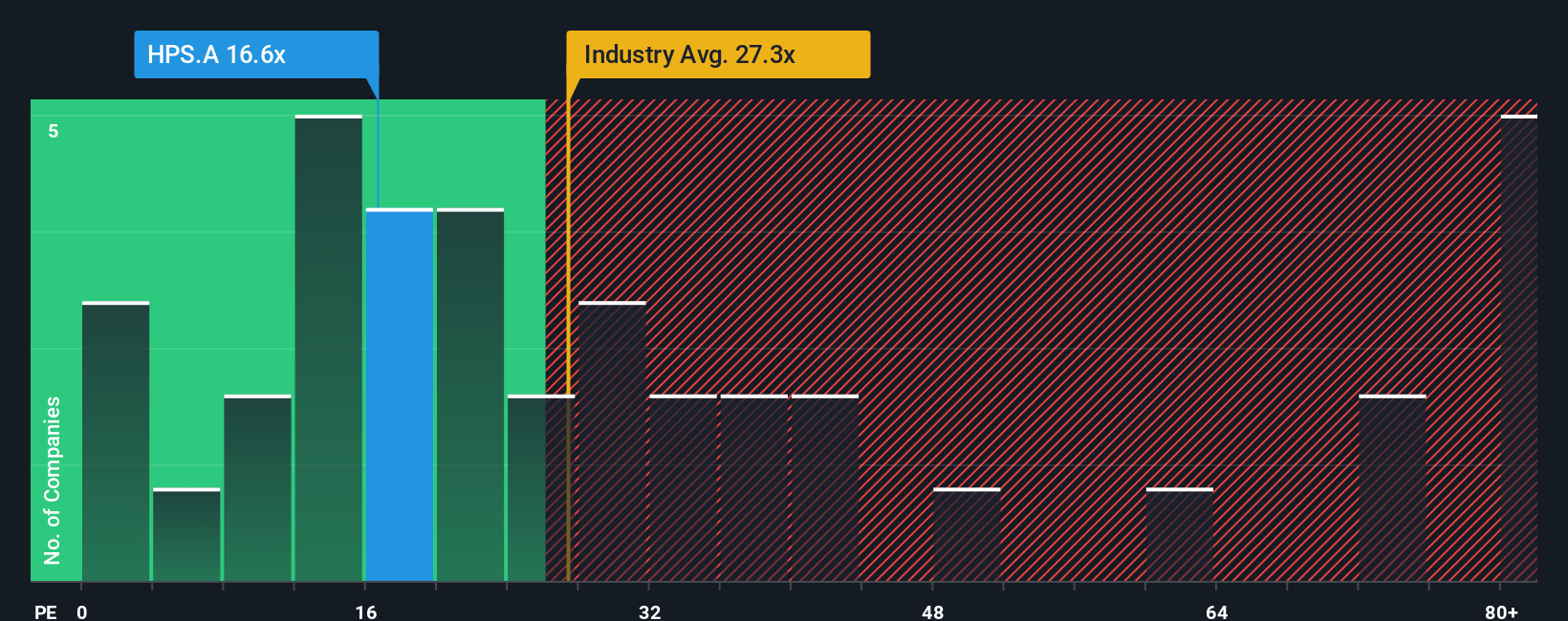

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Hammond Power Solutions' P/E ratio of 16.6x, since the median price-to-earnings (or "P/E") ratio in Canada is also close to 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Hammond Power Solutions has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Hammond Power Solutions

How Is Hammond Power Solutions' Growth Trending?

In order to justify its P/E ratio, Hammond Power Solutions would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 61%. The strong recent performance means it was also able to grow EPS by 313% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 1.1% per year over the next three years. Meanwhile, the broader market is forecast to expand by 11% each year, which paints a poor picture.

In light of this, it's somewhat alarming that Hammond Power Solutions' P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Hammond Power Solutions' P/E

Hammond Power Solutions appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hammond Power Solutions currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Hammond Power Solutions that you should be aware of.

If these risks are making you reconsider your opinion on Hammond Power Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal