3 Promising Penny Stocks With Market Caps Under $400M

The market is up 2.7% over the last week and has climbed 13% in the past year, with earnings expected to grow by 15% per annum in the coming years. The term 'penny stocks' might feel like a relic of past market eras, but these smaller or relatively new companies can offer affordability and growth potential when paired with strong financials. In this article, we explore three penny stocks that stand out for their financial strength amidst current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $488.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9265 | $148M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.66 | $376.5M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.50 | $55.08M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8339 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $86.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Marine Petroleum Trust (MARP.S) | $4.43 | $8.76M | ✅ 1 ⚠️ 4 View Analysis > |

| TETRA Technologies (TTI) | $3.46 | $441.8M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 450 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Vanda Pharmaceuticals (VNDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vanda Pharmaceuticals Inc. is a biopharmaceutical company that develops and commercializes therapies for high unmet medical needs globally, with a market cap of approximately $271.69 million.

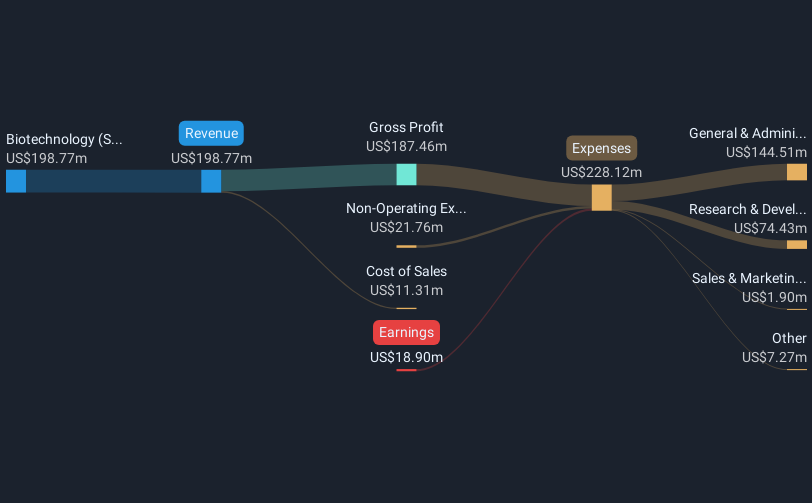

Operations: The company generates its revenue primarily from its Biotechnology (Startups) segment, which accounted for $201.35 million.

Market Cap: $271.69M

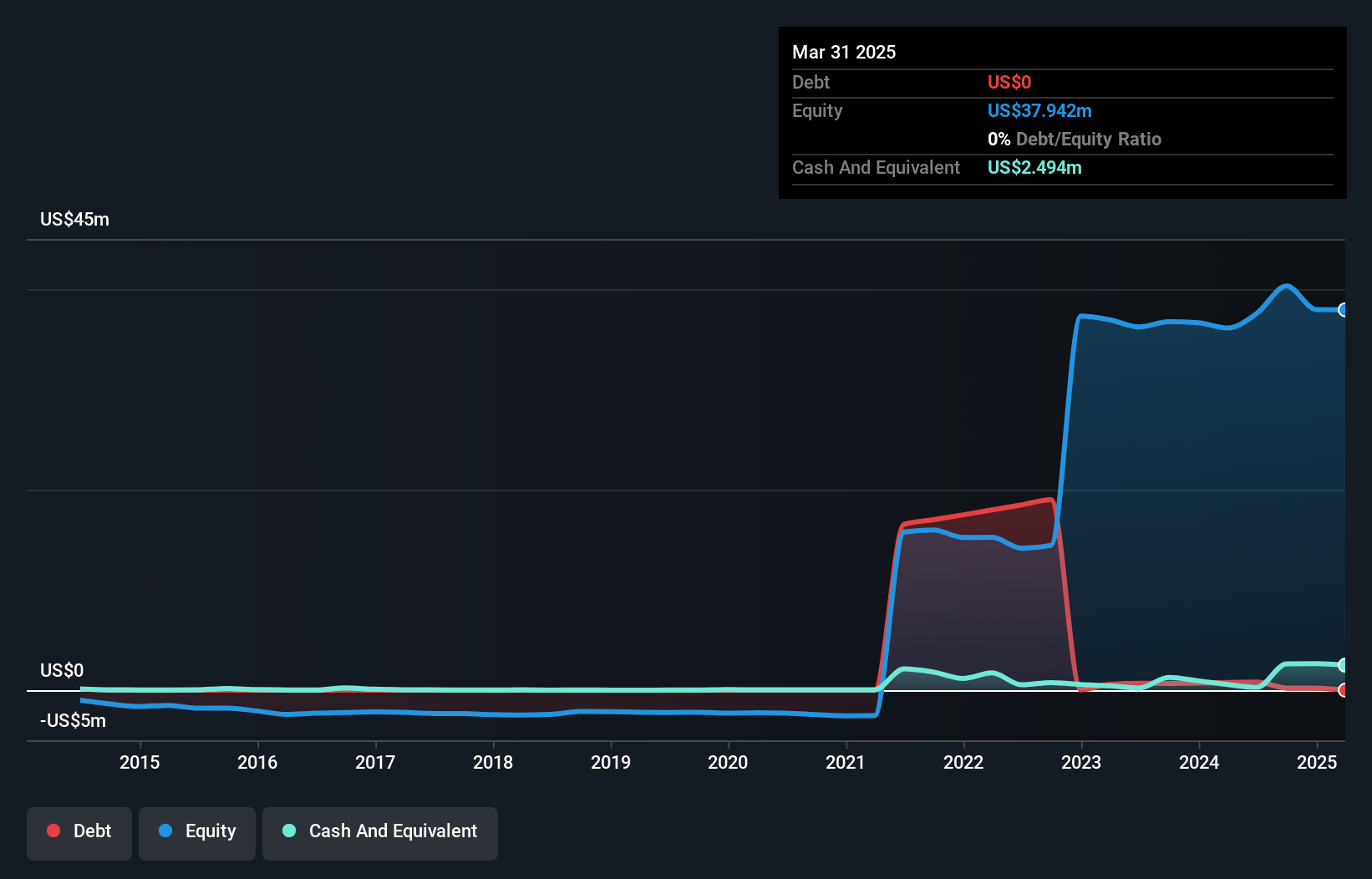

Vanda Pharmaceuticals, with a market cap of approximately US$271.69 million, is navigating the challenging landscape of penny stocks by focusing on innovative treatments for rare diseases and psychiatric conditions. Despite being unprofitable with increasing losses over the past five years, Vanda's financial stability is supported by its debt-free status and strong asset position relative to liabilities. Recent developments include the initiation of a clinical trial for a rare neuromuscular disorder treatment and FDA progress on Bysanti, an antipsychotic drug potentially offering long-term exclusivity if approved. Revenue guidance remains optimistic at US$210-250 million for 2025 despite recent net loss increases.

- Jump into the full analysis health report here for a deeper understanding of Vanda Pharmaceuticals.

- Understand Vanda Pharmaceuticals' earnings outlook by examining our growth report.

ChargePoint Holdings (CHPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ChargePoint Holdings, Inc., along with its subsidiaries, operates electric vehicle charging networks and solutions across North America and Europe, with a market cap of approximately $0.33 billion.

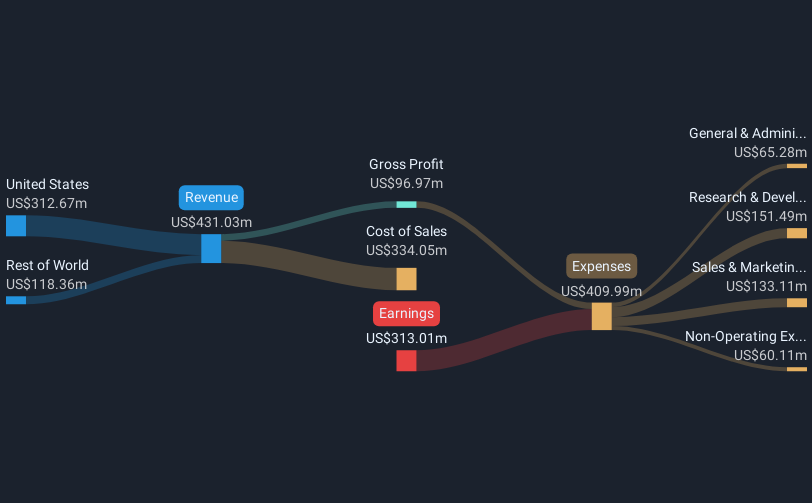

Operations: The company's revenue is primarily derived from its electric equipment segment, totaling $407.68 million.

Market Cap: $330.86M

ChargePoint Holdings, with a market cap of US$0.33 billion, is navigating the penny stock landscape by expanding its EV charging network across North America and Europe. Despite being unprofitable and experiencing increased losses over the past five years, the company's financial position shows short-term assets exceeding liabilities and a substantial cash runway. Recent collaborations with Eaton aim to streamline EV infrastructure deployment, enhancing ChargePoint's strategic role in the ecosystem. However, high net debt levels and significant insider selling present challenges. Revenue guidance for Q2 2025 indicates potential stabilization between US$90 million to US$100 million amidst ongoing volatility.

- Navigate through the intricacies of ChargePoint Holdings with our comprehensive balance sheet health report here.

- Explore ChargePoint Holdings' analyst forecasts in our growth report.

Verde Resources (VRDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verde Resources, Inc. operates through its subsidiaries in the production of biochar derived from waste materials in the dairy, palm, and other natural resource industries across the United States and Malaysia, with a market cap of $115.83 million.

Operations: The company's revenue is generated from the production of biochar in the United States and Malaysia, focusing on waste materials from industries such as dairy and palm.

Market Cap: $115.83M

Verde Resources, with a market cap of US$115.83 million, is pre-revenue and faces challenges typical of penny stocks, such as high volatility and limited cash runway. Despite these hurdles, the company is making strides in sustainable infrastructure through a 10-year partnership with C-Tw twelve Pty Ltd., focusing on low carbon asphalt technology. This collaboration has led to the issuance of biochar-based Carbon Removal Credits, marking an innovative step in climate solutions. Recent executive changes bring experienced leadership to navigate expansion and regulatory compliance as Verde aims for commercialization success amidst financial constraints.

- Click here to discover the nuances of Verde Resources with our detailed analytical financial health report.

- Learn about Verde Resources' historical performance here.

Seize The Opportunity

- Click this link to deep-dive into the 450 companies within our US Penny Stocks screener.

- Seeking Other Investments? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal