Undiscovered Gems US Market Highlights 3 Promising Small Caps

The United States market has shown robust performance recently, with a 2.7% increase over the last week and a 13% rise over the past year, while earnings are projected to grow by 15% annually. In such an environment, identifying promising small-cap stocks can be key to capturing potential growth opportunities that may not yet be fully recognized by mainstream investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Willdan Group (WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States with a market capitalization of approximately $867.20 million.

Operations: Willdan generates revenue primarily from its Energy segment, contributing $498.81 million, and its Engineering & Consulting segment, adding $96.88 million. The company's focus on these segments highlights its diversified service offerings within the professional and technical consulting industry in the U.S.

Willdan Group, a player in the professional services sector, has seen its earnings grow by 84% over the past year, outpacing the industry's 15.3%. The company's debt to equity ratio has significantly improved from 78.5% to a more manageable 35.5% over five years, reflecting effective financial management. With high-quality earnings and positive free cash flow, Willdan is well-positioned for future growth. Recent developments include expanded borrowing capacity up to $200 million and raised fiscal year guidance with expected net revenue between US$325 million and US$335 million, signaling confidence in ongoing projects and strategic initiatives.

Ituran Location and Control (ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally, with a market capitalization of approximately $730.29 million.

Operations: The company's revenue primarily comes from telematics services, contributing $243.74 million, and telematics products, contributing $93.95 million.

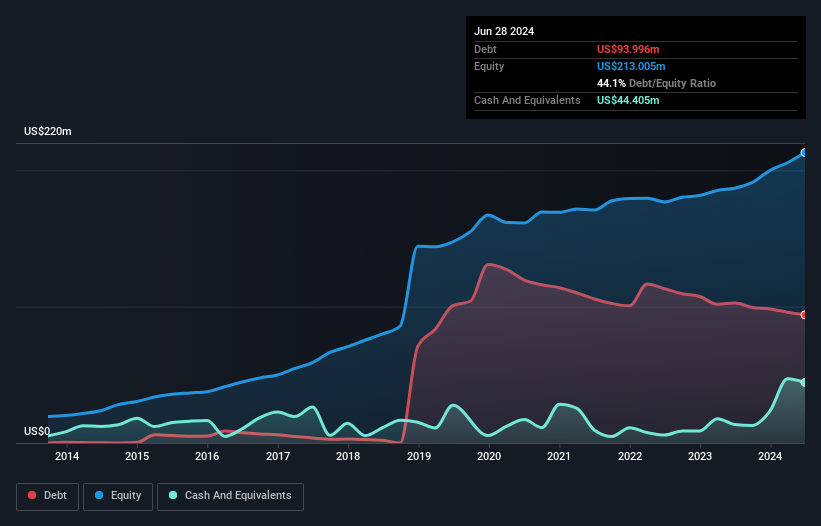

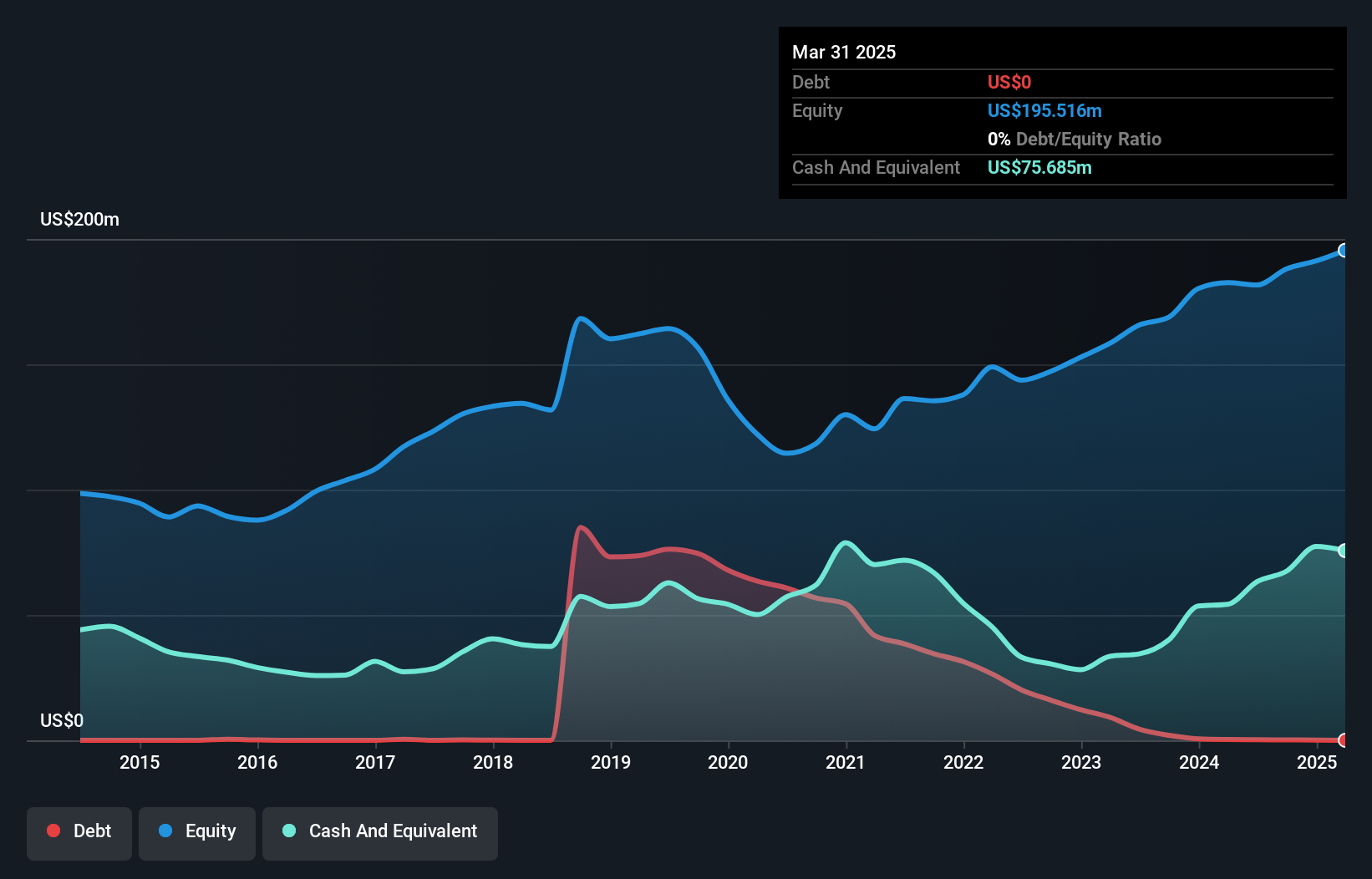

Ituran Location and Control, a nimble player in the telematics sector, has shown resilience with earnings growing at 31.6% annually over five years, despite trailing the broader communications industry's recent growth. The company is debt-free, having reduced its debt-to-equity ratio from 52% five years ago to zero today. Trading at 31.7% below estimated fair value suggests potential for upside. Recent strategic moves include partnerships with BMW Motorrad Brazil and Stellantis in South America, enhancing their service offerings and market reach. A dividend of $0.50 per share was announced, reflecting steady shareholder returns amidst ongoing expansion efforts.

Northpointe Bancshares (NPB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Northpointe Bancshares, Inc. is a bank holding company for Northpointe Bank, offering a range of banking products and services across the United States with a market capitalization of approximately $463.92 million.

Operations: Northpointe Bancshares generates revenue primarily from its Retail Banking and Mortgage Warehouse segments, with the former contributing $148.55 million and the latter $46.68 million.

Northpointe Bancshares, with assets totaling US$5.9 billion and equity of US$586.5 million, stands out in the financial sector due to its impressive earnings growth of 83.2% over the past year, surpassing industry averages. The bank's total deposits amount to US$3.8 billion against loans of US$5.1 billion, while maintaining a net interest margin of 2.3%. Despite having a lower allowance for bad loans at 14%, Northpointe benefits from primarily low-risk funding sources comprising 72% customer deposits. Recent strategic changes include appointing Gary Dykstra as principal accounting officer and expanding its mortgage warehouse lending division under Patrick Collins' leadership.

- Navigate through the intricacies of Northpointe Bancshares with our comprehensive health report here.

Evaluate Northpointe Bancshares' historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 284 US Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal