LTC Co.,Ltd (KOSDAQ:170920) Soars 32% But It's A Story Of Risk Vs Reward

The LTC Co.,Ltd (KOSDAQ:170920) share price has done very well over the last month, posting an excellent gain of 32%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

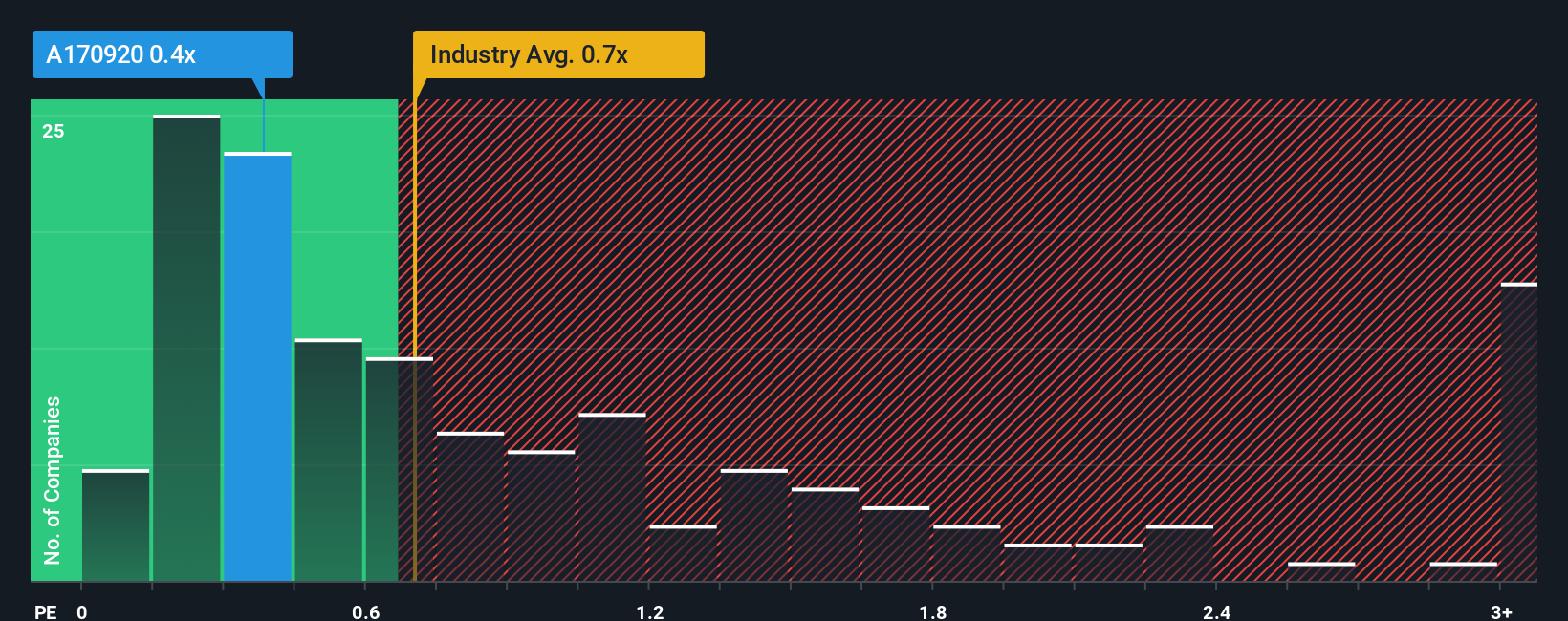

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about LTCLtd's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in Korea is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for LTCLtd

What Does LTCLtd's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, LTCLtd has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for LTCLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For LTCLtd?

LTCLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 124% last year. The latest three year period has also seen an excellent 241% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 9.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that LTCLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does LTCLtd's P/S Mean For Investors?

LTCLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that LTCLtd currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for LTCLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal