Global Penny Stocks: Suning UniversalLtd And 2 More Promising Picks

Global markets have been navigating a complex landscape, with U.S. stocks closing mixed amid geopolitical tensions and economic uncertainties, while smaller-cap indexes showed resilience. For investors exploring opportunities beyond major indices, penny stocks represent an intriguing segment of the market. Despite being an older term, these often smaller or newer companies can offer surprising value and potential for growth when they possess strong financial foundations.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.25 | HK$801.31M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.22 | £474.08M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.415 | SGD168.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$3.60 | A$881.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.19 | SGD8.62B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.42 | SEK2.32B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.47 | A$155.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,914 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Suning UniversalLtd (SZSE:000718)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suning Universal Co., Ltd is a real estate development company operating in China with a market cap of CN¥6.55 billion.

Operations: Suning Universal Co., Ltd does not report distinct revenue segments.

Market Cap: CN¥6.55B

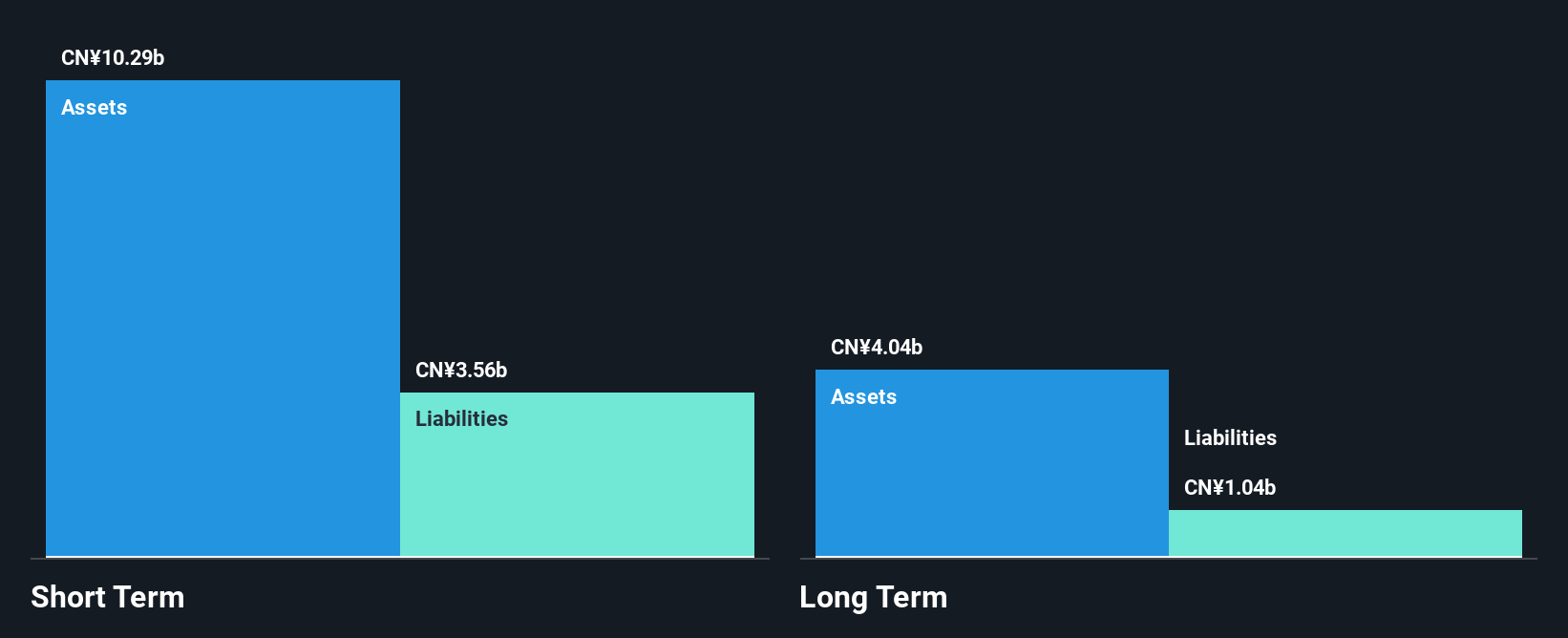

Suning Universal Co., Ltd, with a market cap of CN¥6.55 billion, has faced challenges in recent years. Its net debt to equity ratio is satisfactory at 10.1%, and its short-term assets exceed both short and long-term liabilities, indicating solid balance sheet management. However, the company has experienced declining earnings over the past five years and reported lower revenues for Q1 2025 compared to the previous year. Despite these setbacks, Suning Universal maintains high-quality earnings and continues to distribute dividends, although current dividends are not well covered by earnings due to profitability pressures.

- Dive into the specifics of Suning UniversalLtd here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Suning UniversalLtd's track record.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. operates in China, focusing on the design and construction of interior decoration, curtain walls, furniture, and landscape projects, with a market cap of CN¥9.08 billion.

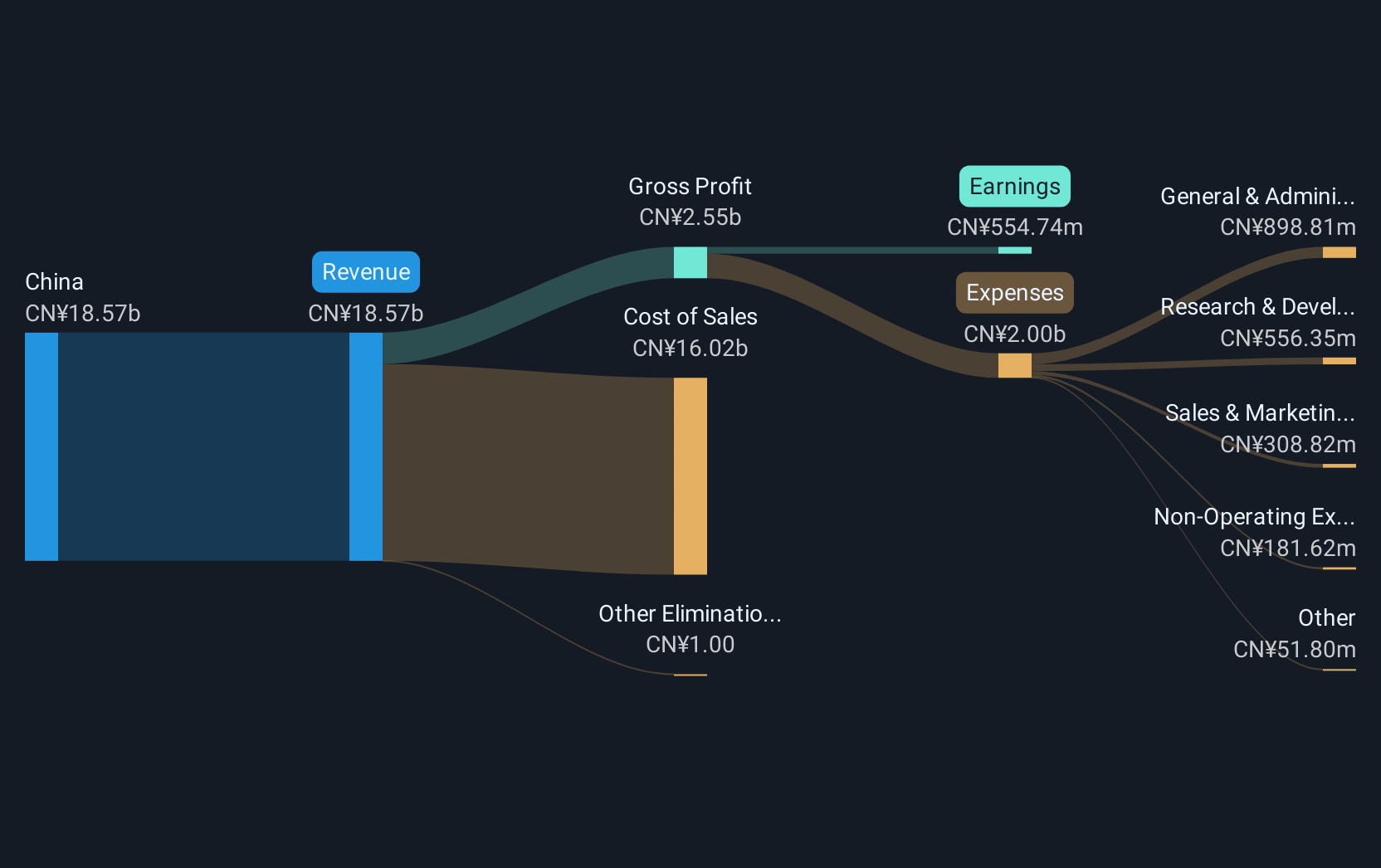

Operations: The company generates CN¥18.57 billion in revenue from its operations within China.

Market Cap: CN¥9.08B

Suzhou Gold Mantis Construction Decoration Co., Ltd. has a market cap of CN¥9.08 billion and generates significant revenue, but faces challenges with declining earnings, which fell 41.9% last year compared to the industry average decline of 5.4%. Despite trading at a discount to its estimated fair value and having more cash than debt, its Return on Equity is low at 4%, and profit margins have decreased from 4.9% to 3%. The company was recently removed from major indices, suggesting potential volatility concerns; however, it maintains high-quality earnings and stable short-term asset coverage over liabilities.

- Click here and access our complete financial health analysis report to understand the dynamics of Suzhou Gold Mantis Construction Decoration.

- Assess Suzhou Gold Mantis Construction Decoration's future earnings estimates with our detailed growth reports.

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. manufactures and sells LED lighting products both in China and internationally, with a market cap of CN¥3.38 billion.

Operations: The company generates its revenue primarily from the Semiconductor Lighting segment, which accounted for CN¥412.79 million.

Market Cap: CN¥3.38B

Dongguan Kingsun Optoelectronic Co., Ltd. has a market cap of CN¥3.38 billion and is experiencing growth in its Semiconductor Lighting segment, with recent quarterly revenue reaching CN¥149.63 million from CN¥115.26 million a year ago. Despite being debt-free and having short-term assets significantly exceeding liabilities, the company remains unprofitable, with net losses increasing to CN¥7.03 million for the quarter and CN¥249.36 million for 2024 compared to prior periods. While it benefits from a stable cash runway exceeding three years, its negative Return on Equity and inexperienced board may pose challenges moving forward amidst ongoing financial losses.

- Unlock comprehensive insights into our analysis of Dongguan Kingsun OptoelectronicLtd stock in this financial health report.

- Learn about Dongguan Kingsun OptoelectronicLtd's historical performance here.

Seize The Opportunity

- Click here to access our complete index of 3,914 Global Penny Stocks.

- Want To Explore Some Alternatives? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal