Faraday Copper And 2 Other TSX Penny Stocks To Watch

The Canadian market is navigating a period of economic resilience amid moderating growth, with the Bank of Canada further along in its easing cycle compared to its U.S. counterpart. As investors seek opportunities beyond established names, penny stocks—though an outdated term—remain a relevant investment area due to their potential for significant returns when backed by solid financials. In this article, we explore three TSX-listed penny stocks that offer intriguing prospects, combining robust balance sheets with the potential for hidden value and growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.64 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.79 | CA$453.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.98 | CA$19.42M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.96 | CA$150.23M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.92 | CA$184.07M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.91 | CA$5.2M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 459 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Faraday Copper (TSX:FDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Faraday Copper Corp. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in the United States, with a market cap of CA$174.69 million.

Operations: Faraday Copper does not currently report any revenue segments as it is an exploration stage company.

Market Cap: CA$174.69M

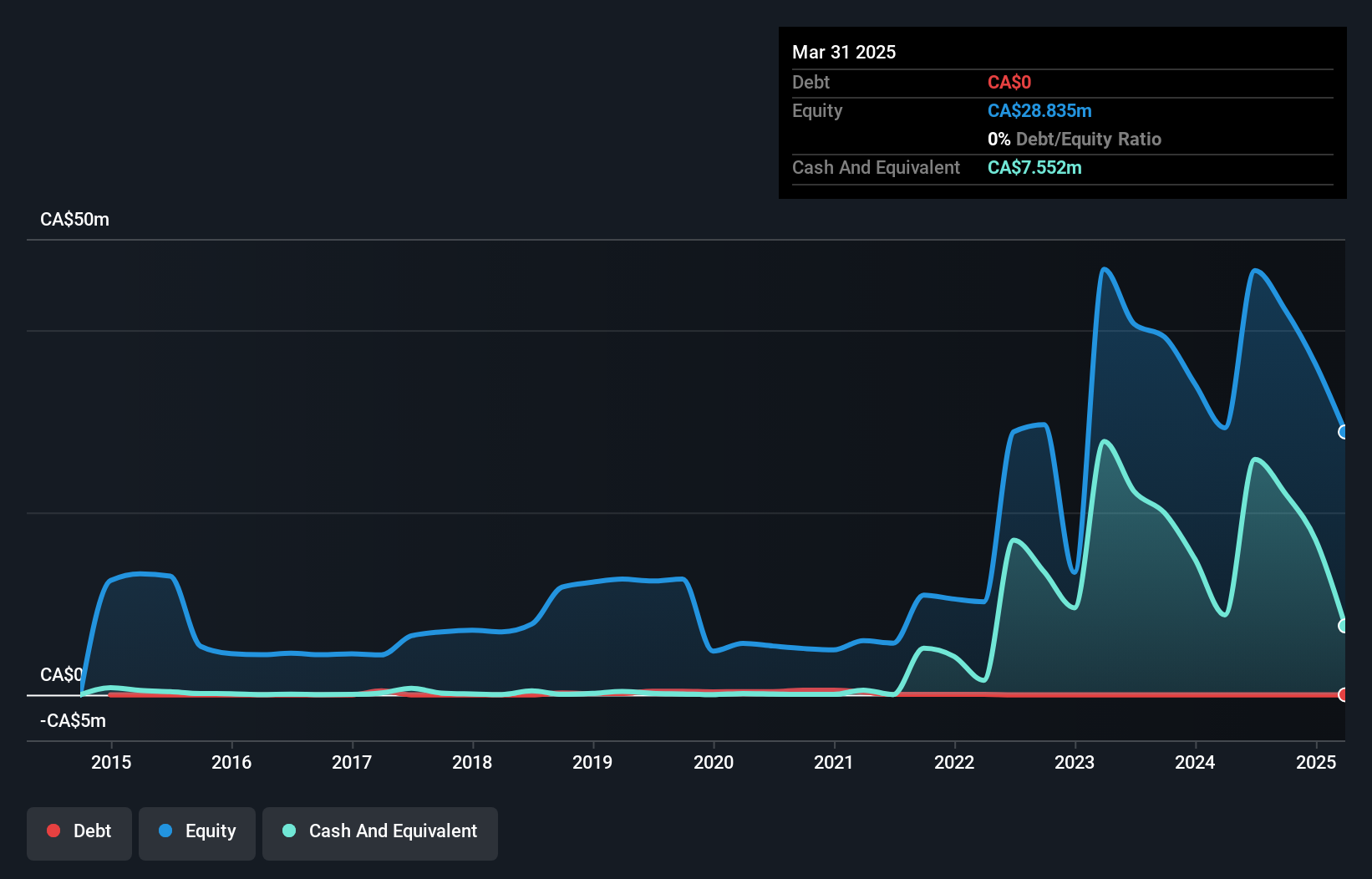

Faraday Copper Corp., with a market cap of CA$174.69 million, remains pre-revenue as it focuses on exploration and development at its Copper Creek Project in Arizona. Recent Phase III drilling results highlight significant near-surface copper mineralization, particularly in the American Eagle area, which could enhance future project value. The company plans to release an updated Mineral Resource Estimate (MRE) and Preliminary Economic Assessment (PEA) by the third quarter of 2025. Despite being debt-free and having no long-term liabilities, Faraday faces challenges with a limited cash runway and forecasted earnings decline over the next three years.

- Unlock comprehensive insights into our analysis of Faraday Copper stock in this financial health report.

- Evaluate Faraday Copper's prospects by accessing our earnings growth report.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform for online courses in Canada, the United States, and internationally with a market cap of CA$144.79 million.

Operations: The company's revenue is derived from the development, marketing, and support management of its cloud-based platform, totaling $68.82 million.

Market Cap: CA$144.79M

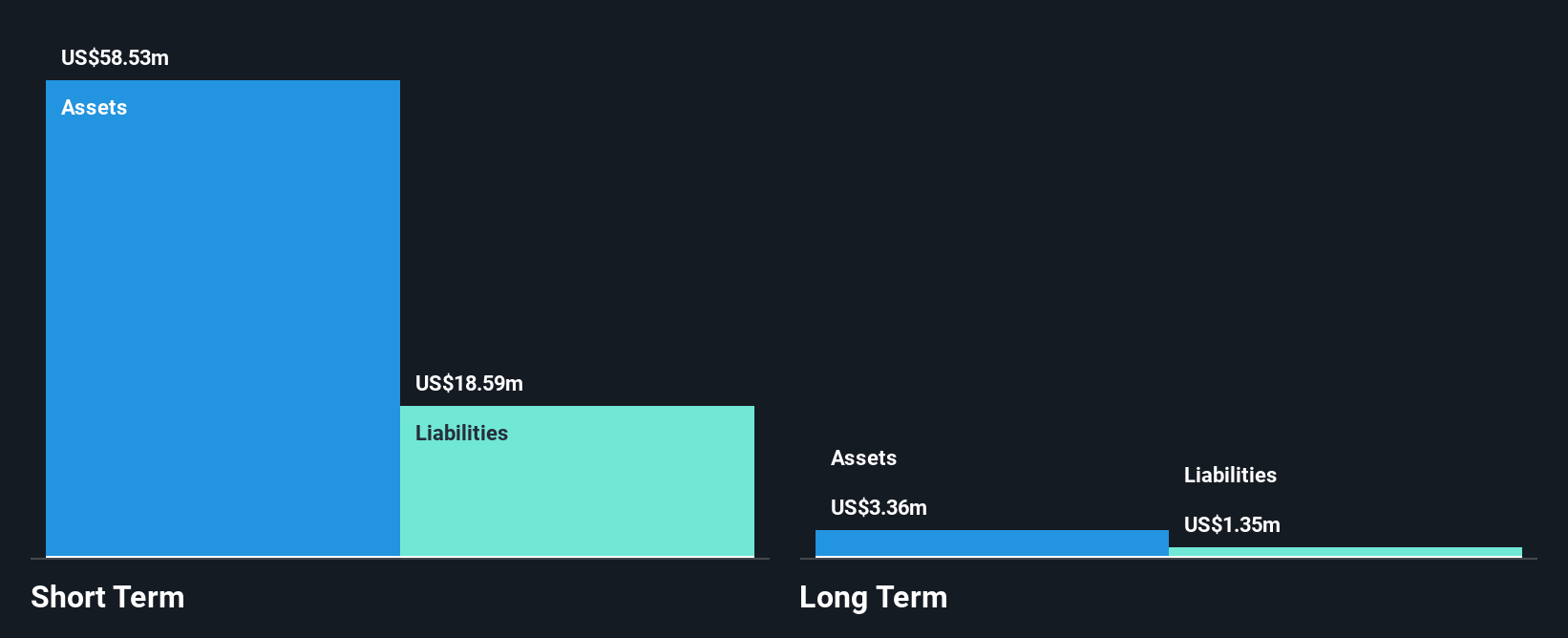

Thinkific Labs, with a market cap of CA$144.79 million, has recently completed a follow-on equity offering of CA$13 million, potentially strengthening its financial position. The company reported first-quarter revenue of US$17.84 million and achieved profitability with net income of US$0.401 million, marking an improvement from the previous year's loss. Although it is trading significantly below estimated fair value and remains debt-free, Thinkific faces challenges such as increased share price volatility and low return on equity at 2.9%. Revenue growth is forecasted at 8.94% annually; however, earnings are expected to decline in the coming years.

- Get an in-depth perspective on Thinkific Labs' performance by reading our balance sheet health report here.

- Understand Thinkific Labs' earnings outlook by examining our growth report.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lara Exploration Ltd. is involved in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile with a market cap of CA$87.68 million.

Operations: Lara Exploration Ltd. does not report specific revenue segments.

Market Cap: CA$87.68M

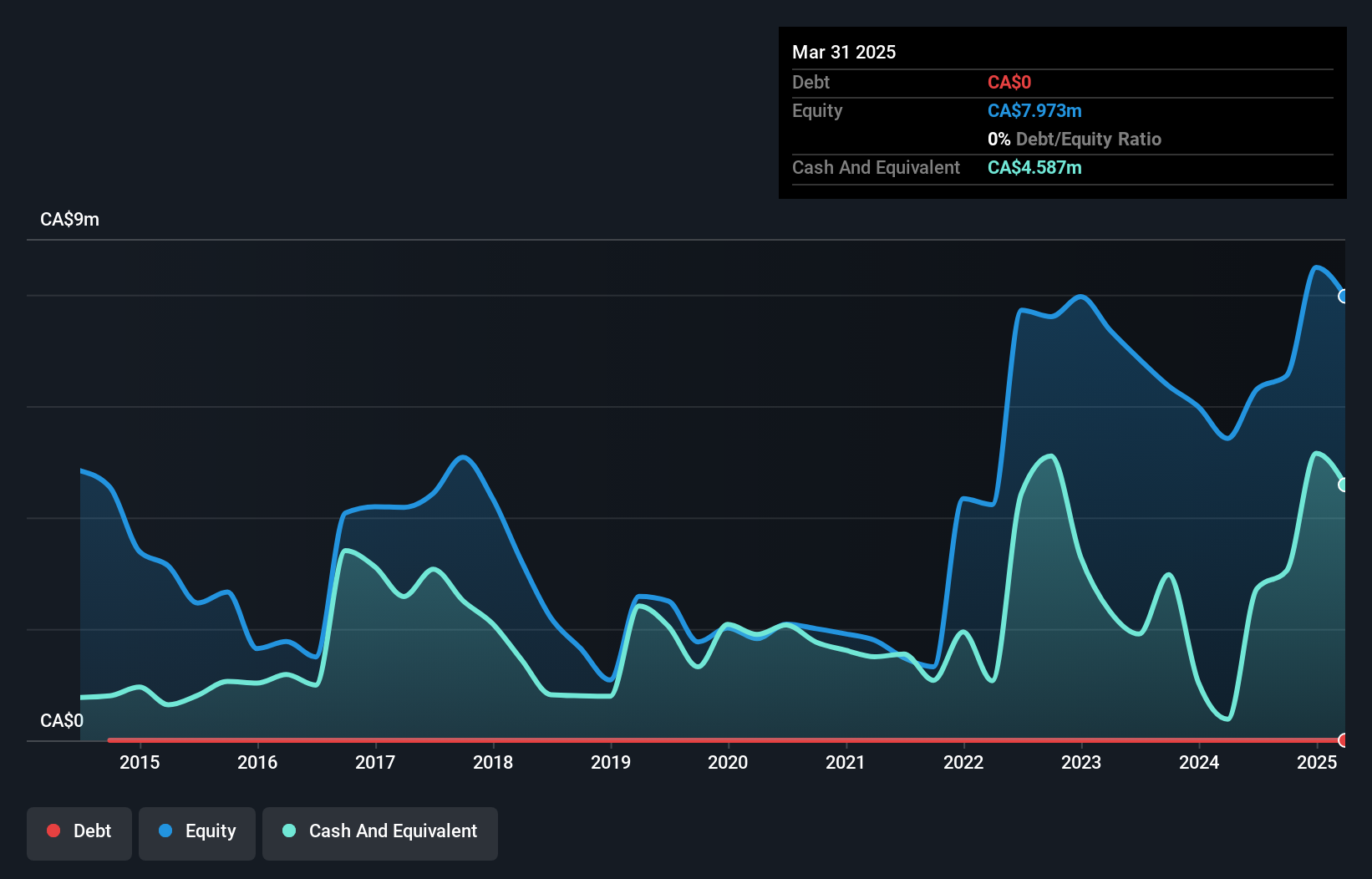

Lara Exploration Ltd., with a market cap of CA$87.68 million, is pre-revenue and currently unprofitable, having reported a net loss of CA$0.52 million for Q1 2025. Despite this, the company benefits from an experienced management team and board, with average tenures of 8.4 and 9.1 years respectively, which may provide stability in strategic direction. The company is debt-free and has sufficient cash runway for over two years if cash flow trends persist. However, its auditor has expressed doubts about its ability to continue as a going concern due to ongoing financial challenges.

- Dive into the specifics of Lara Exploration here with our thorough balance sheet health report.

- Learn about Lara Exploration's historical performance here.

Next Steps

- Unlock our comprehensive list of 459 TSX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal