3 Stocks Estimated To Be Trading Up To 48.7% Below Intrinsic Value

In the last week, the United States market has remained flat, although it has experienced an 11% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying stocks that are trading below their intrinsic value can offer investors potential opportunities for growth and value realization.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.41 | $48.06 | 49.2% |

| Roku (ROKU) | $80.90 | $160.46 | 49.6% |

| Rocket Lab (RKLB) | $32.78 | $64.25 | 49% |

| MAC Copper (MTAL) | $12.01 | $23.62 | 49.2% |

| Ligand Pharmaceuticals (LGND) | $114.975 | $225.70 | 49.1% |

| Insteel Industries (IIIN) | $36.03 | $72.02 | 50% |

| First Reliance Bancshares (FSRL) | $9.05 | $17.83 | 49.3% |

| First Busey (BUSE) | $22.96 | $45.56 | 49.6% |

| Brookline Bancorp (BRKL) | $10.31 | $20.54 | 49.8% |

| Berkshire Hills Bancorp (BHLB) | $24.62 | $48.78 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Coastal Financial (CCB)

Overview: Coastal Financial Corporation, with a market cap of $1.39 billion, is the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in Washington's Puget Sound region.

Operations: Coastal Financial's revenue is derived from three key segments: CCBX contributing $222.52 million, Community Bank generating $84.07 million, and Treasury & Administration adding $15.57 million.

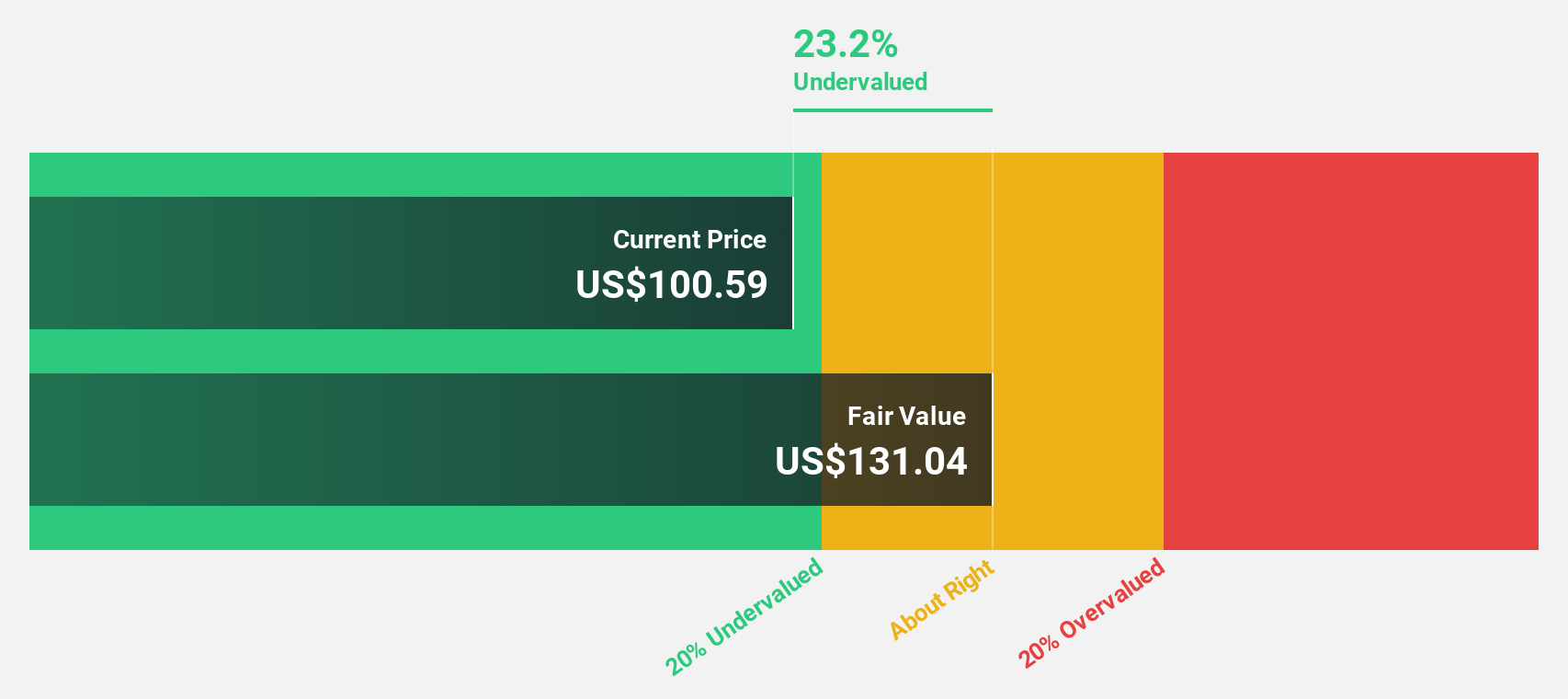

Estimated Discount To Fair Value: 29.6%

Coastal Financial is trading at US$92.26, significantly below its estimated fair value of US$131.04, indicating potential undervaluation based on cash flows. The company reported net interest income of US$76.06 million for Q1 2025, up from US$62.21 million a year ago, with net income rising to US$9.73 million from US$6.8 million. Despite recent insider selling and auditor changes, earnings are forecast to grow significantly over the next three years.

- The analysis detailed in our Coastal Financial growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Coastal Financial stock in this financial health report.

Valley National Bancorp (VLY)

Overview: Valley National Bancorp, with a market cap of approximately $4.96 billion, operates as the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services.

Operations: Valley National Bancorp generates revenue through its segments, including Consumer Banking ($321.94 million), Commercial Banking ($1.13 billion), and Treasury and Corporate Other ($96.22 million).

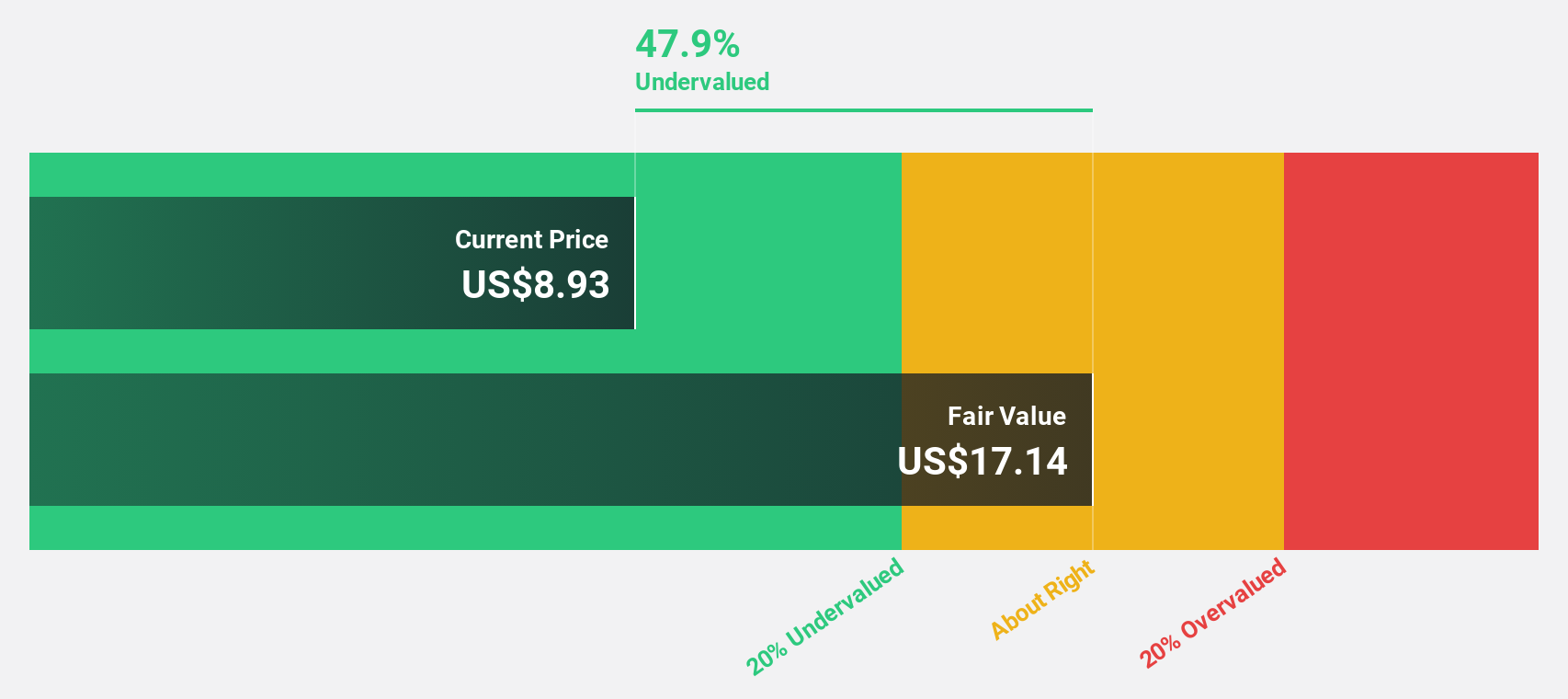

Estimated Discount To Fair Value: 48.7%

Valley National Bancorp is trading at US$8.85, well below its estimated fair value of US$17.24, highlighting its potential undervaluation based on cash flows. The company forecasts earnings growth of 25.8% annually, outpacing the broader US market's expected growth rate. Recent financials showed net interest income rising to US$420.11 million for Q1 2025 from a year ago, despite increased net charge-offs of $41.95 million compared to the previous year's $23.56 million.

- Our growth report here indicates Valley National Bancorp may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Valley National Bancorp.

On Holding (ONON)

Overview: On Holding AG develops and distributes sports products globally, with a market cap of approximately $17.19 billion.

Operations: The company generates revenue primarily from its Athletic Footwear segment, which accounts for CHF 2.54 billion.

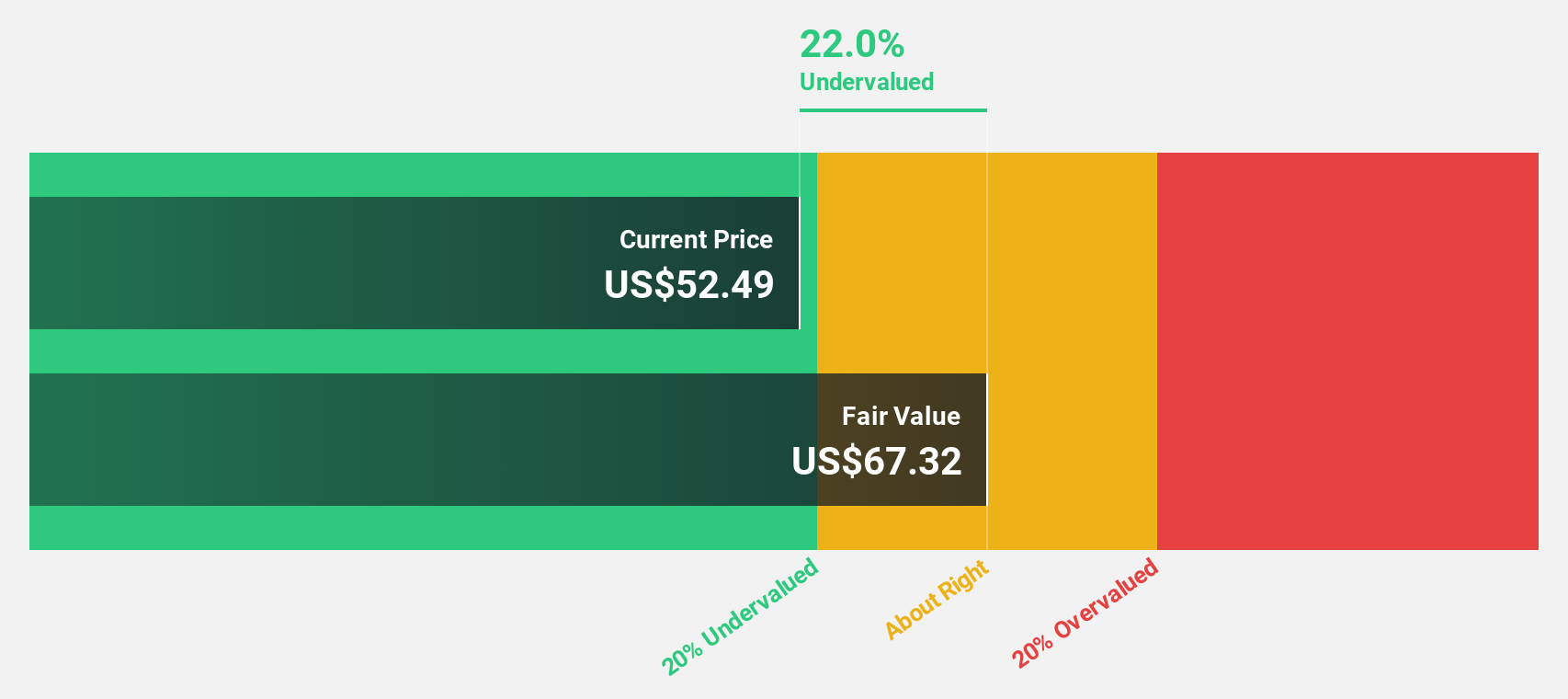

Estimated Discount To Fair Value: 20.3%

On Holding is trading at US$53.07, significantly below its estimated fair value of US$66.55, suggesting undervaluation based on cash flows. The company forecasts annual earnings growth of 22.8%, surpassing the US market's 14.6% projection, with revenue expected to grow faster than the market average at 17.9% per year. Recent strategic leadership changes and raised earnings guidance for 2025 further support On Holding's potential for sustained growth and profitability in the sportswear sector.

- Our comprehensive growth report raises the possibility that On Holding is poised for substantial financial growth.

- Navigate through the intricacies of On Holding with our comprehensive financial health report here.

Seize The Opportunity

- Access the full spectrum of 169 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal