US Undiscovered Gems 3 Small Caps to Watch

The United States market has experienced a flat week, yet it boasts an impressive 11% increase over the past year with earnings projected to grow by 15% annually. In this environment, identifying small-cap stocks that possess strong growth potential can be key to uncovering hidden opportunities for investors seeking to capitalize on these promising trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Interface (TILE)

Simply Wall St Value Rating: ★★★★★★

Overview: Interface, Inc. designs, produces, and sells modular carpet products across various regions including the United States, Canada, Latin America, Europe, Africa, Asia, and Australia with a market cap of approximately $1.22 billion.

Operations: Interface generates revenue primarily from the Americas, contributing $810.83 million, and from Europe, Africa, Asia, and Australia with $512.50 million in revenue.

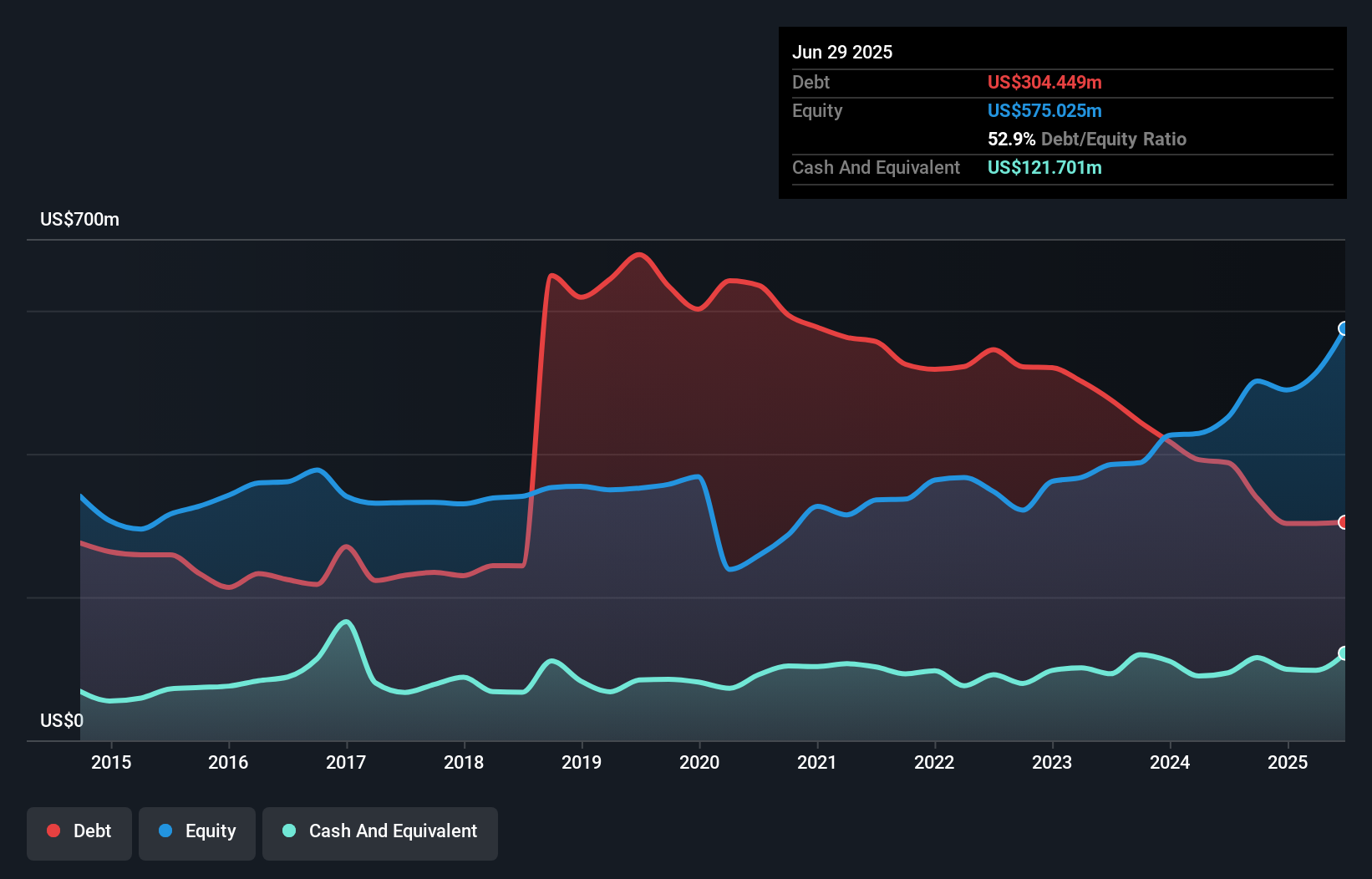

Interface seems to be navigating its path with a strategic focus on innovation and sustainability, aiming for carbon negativity by 2040. The company's debt to equity ratio has impressively reduced from 259% to 59% over five years, while earnings grew by 45.6% last year, outpacing the industry average of 7.6%. Despite these strengths, significant insider selling in recent months raises questions about internal confidence. Interface's new product lines like Dressed Lines™ and Lasting Impressions™ reflect their commitment to design excellence and sustainability, potentially bolstering their market position amidst economic uncertainties in Europe and Australia.

Horace Mann Educators (HMN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Horace Mann Educators Corporation operates as an insurance holding company in the United States, with a market capitalization of approximately $1.72 billion.

Operations: Horace Mann Educators generates revenue primarily from its Property & Casualty segment at $804.30 million, followed by Life & Retirement at $542.40 million, and Supplemental & Group Benefits at $294.80 million. The Corporate and Other segment contributes a smaller portion with $6.90 million in revenue.

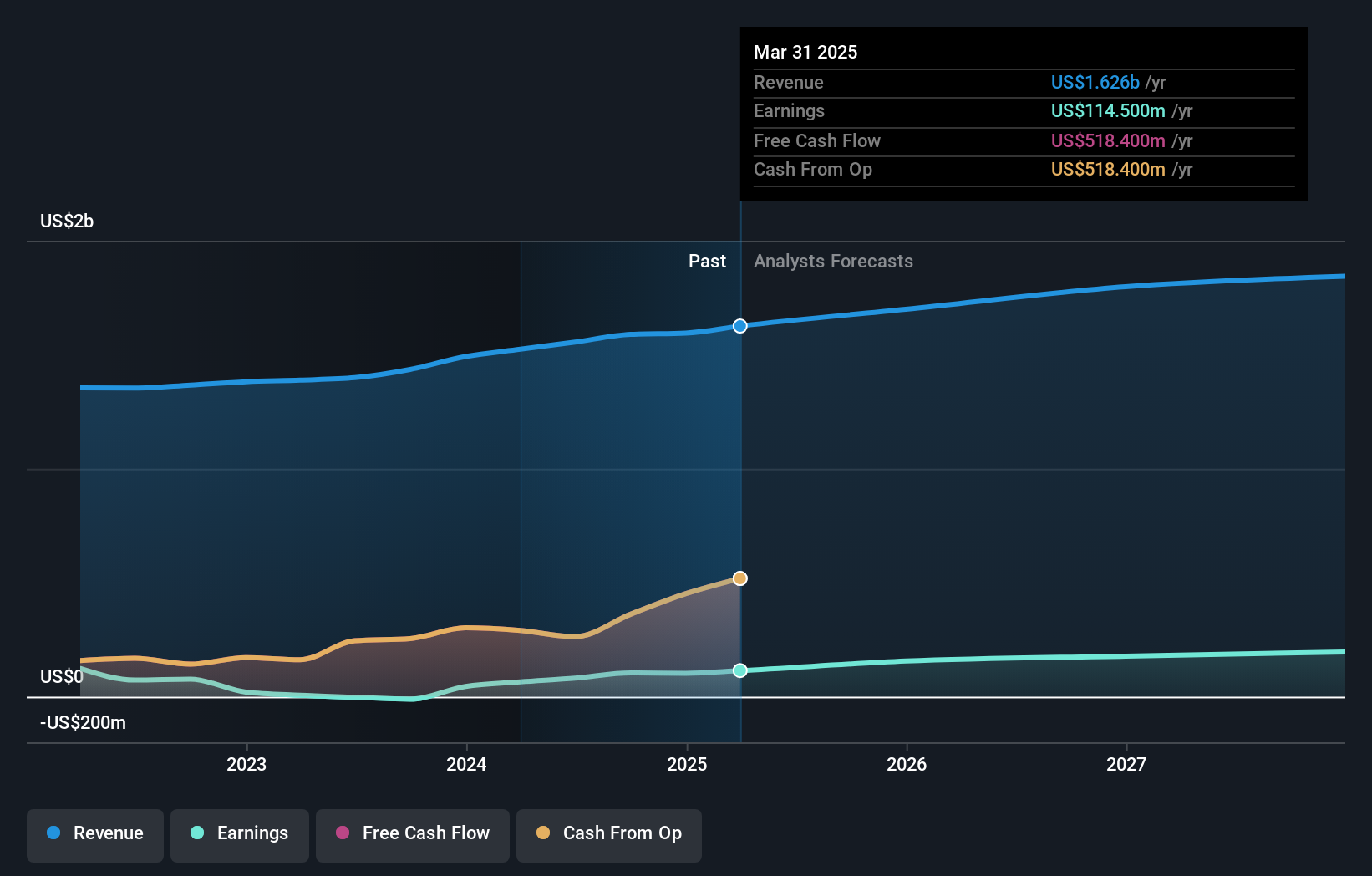

Horace Mann Educators, a niche player in the insurance sector, has shown impressive earnings growth of 76% over the past year, outpacing the industry average of 7%. The company's net debt to equity ratio stands at a satisfactory 29%, indicating prudent financial management. With a price-to-earnings ratio of 15.4x, it offers value below the US market average of 17.7x. Recent strategic moves include a partnership with Crayola and an ongoing share repurchase program worth $50 million, reflecting its commitment to shareholder value enhancement and market positioning through innovative collaborations and financial strategies.

National Presto Industries (NPK)

Simply Wall St Value Rating: ★★★★★★

Overview: National Presto Industries, Inc. operates in North America, offering a diverse range of products including housewares and small appliances, defense equipment, and safety products with a market capitalization of approximately $691.86 million.

Operations: NPK generates revenue primarily from its defense segment, which contributes $309.92 million, followed by housewares and small appliances at $103.46 million, and safety products at $1.83 million.

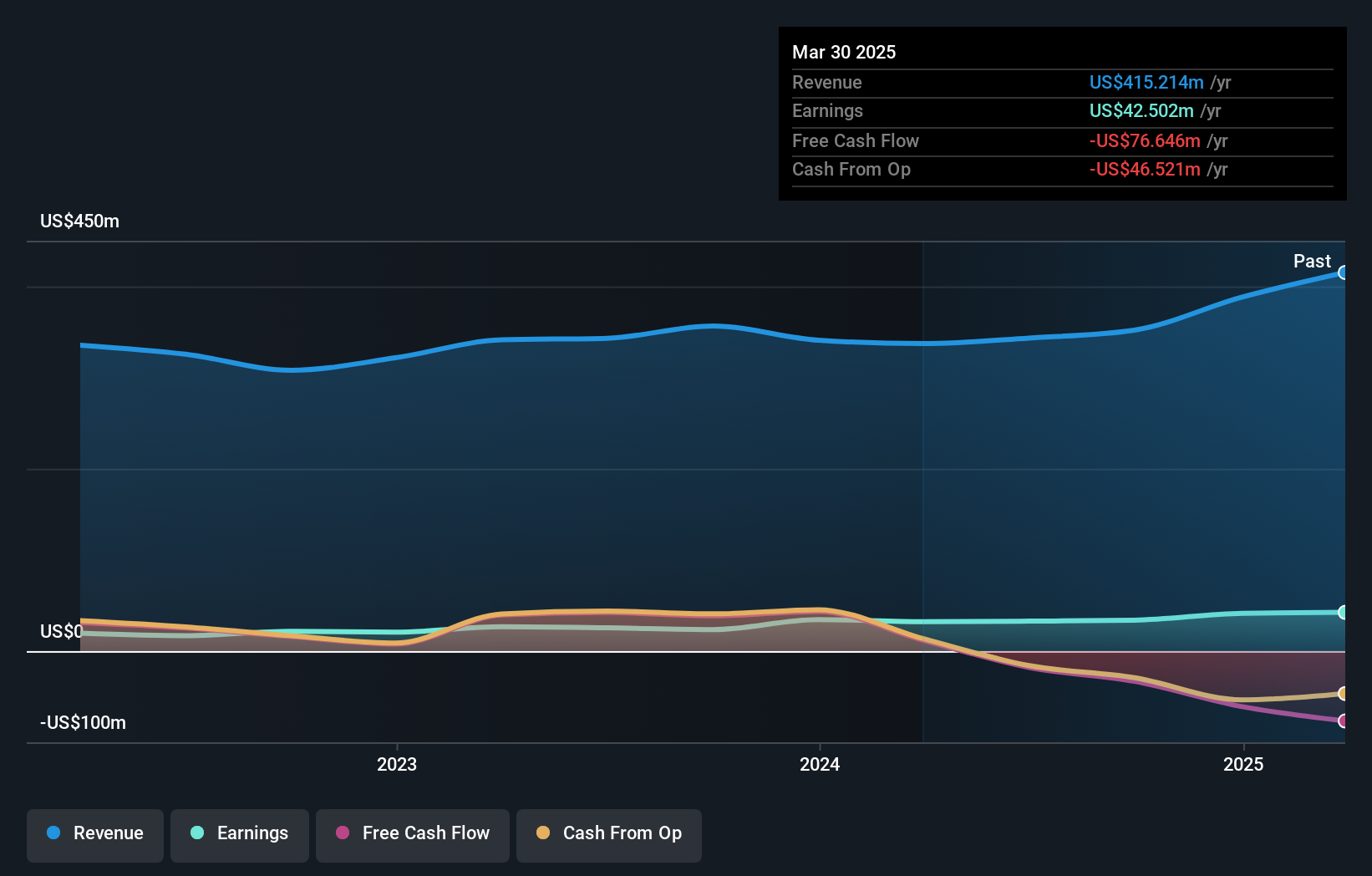

National Presto Industries, a nimble player in the Aerospace & Defense sector, has showcased impressive growth with earnings surging 31.7% over the past year, outpacing the industry's 25.6%. This debt-free company offers value with a price-to-earnings ratio of 16.3x, below the US market average of 17.7x. Despite a historical earnings dip of 6.4% annually over five years, recent results are promising; first-quarter sales rose to US$103.64 million from last year's US$76.65 million, and net income increased to US$7.61 million from US$6.57 million, signaling potential for future gains in this space.

- Dive into the specifics of National Presto Industries here with our thorough health report.

Gain insights into National Presto Industries' past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 284 US Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal