Risks To Shareholder Returns Are Elevated At These Prices For Madison Square Garden Sports Corp. (NYSE:MSGS)

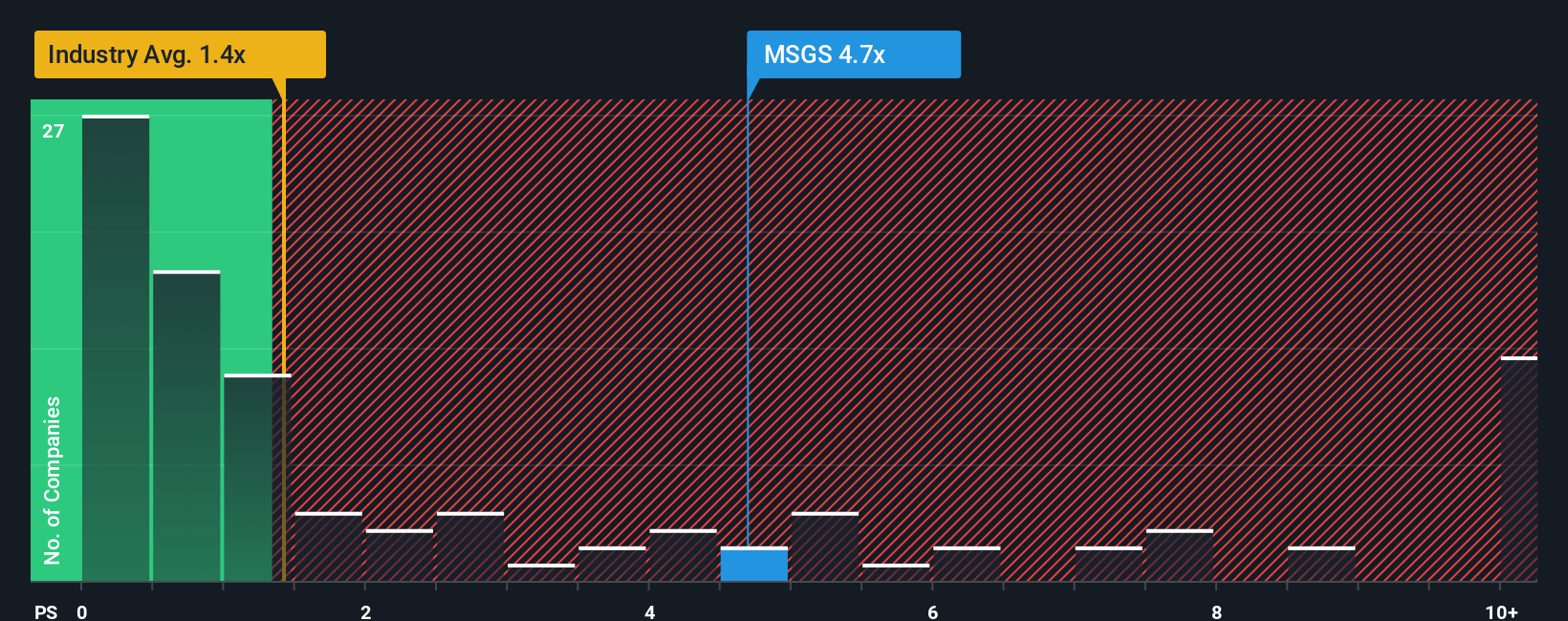

Madison Square Garden Sports Corp.'s (NYSE:MSGS) price-to-sales (or "P/S") ratio of 4.7x may look like a poor investment opportunity when you consider close to half the companies in the Entertainment industry in the United States have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Madison Square Garden Sports

How Madison Square Garden Sports Has Been Performing

Madison Square Garden Sports' revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Madison Square Garden Sports' future stacks up against the industry? In that case, our free report is a great place to start.How Is Madison Square Garden Sports' Revenue Growth Trending?

In order to justify its P/S ratio, Madison Square Garden Sports would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. This was backed up an excellent period prior to see revenue up by 34% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 3.4% per annum during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 12% per year growth forecast for the broader industry.

With this information, we find it concerning that Madison Square Garden Sports is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Madison Square Garden Sports' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Madison Square Garden Sports, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 3 warning signs for Madison Square Garden Sports (1 is a bit concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal