3 Growth Companies With High Insider Ownership And 17% Revenue Growth

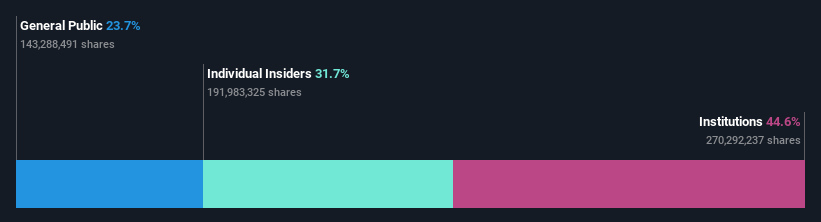

In the last week, the U.S. market has been flat, but over the past 12 months, it has seen an 11% rise with expectations of a 15% annual earnings growth in the coming years. In this context, identifying growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 39.1% |

| Similarweb (SMWB) | 14.9% | 69.7% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| Prairie Operating (PROP) | 34.6% | 75.7% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 60.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

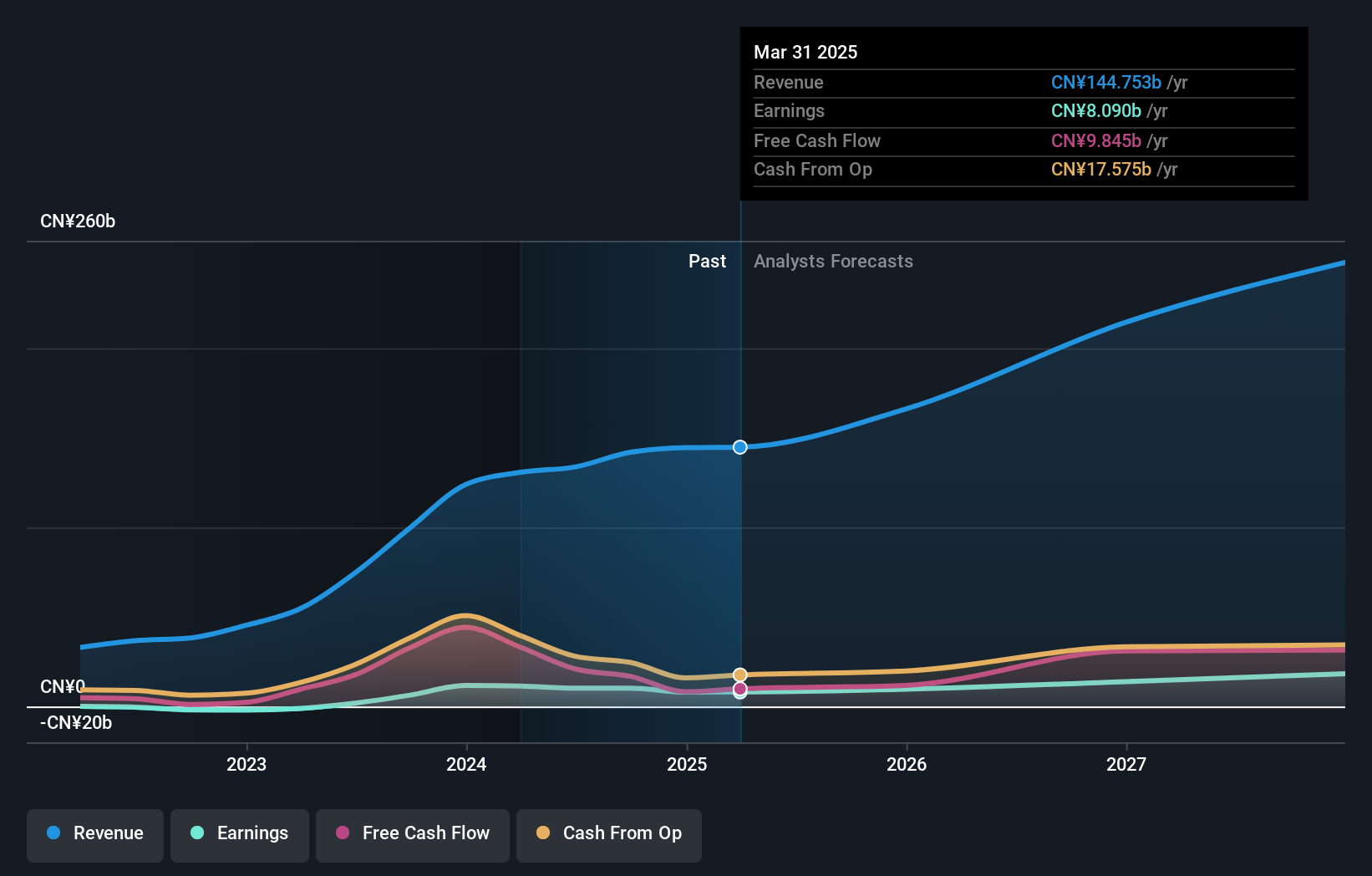

Li Auto (LI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China, with a market cap of approximately $28.45 billion.

Operations: The company's revenue segment primarily consists of its Auto Manufacturers division, generating CN¥144.75 billion.

Insider Ownership: 29.1%

Revenue Growth Forecast: 16.7% p.a.

Li Auto, a growth-oriented company with substantial insider ownership, is poised for significant earnings growth, forecasted at over 23% annually. The company's revenue is expected to outpace the US market's growth rate. Despite facing legal challenges related to alleged misstatements in SEC filings, Li Auto continues to report strong vehicle delivery numbers and strategic partnerships. Recent sales updates indicate robust year-over-year increases in deliveries and revenue projections reaching up to US$4.7 billion for Q2 2025.

- Unlock comprehensive insights into our analysis of Li Auto stock in this growth report.

- Our valuation report unveils the possibility Li Auto's shares may be trading at a premium.

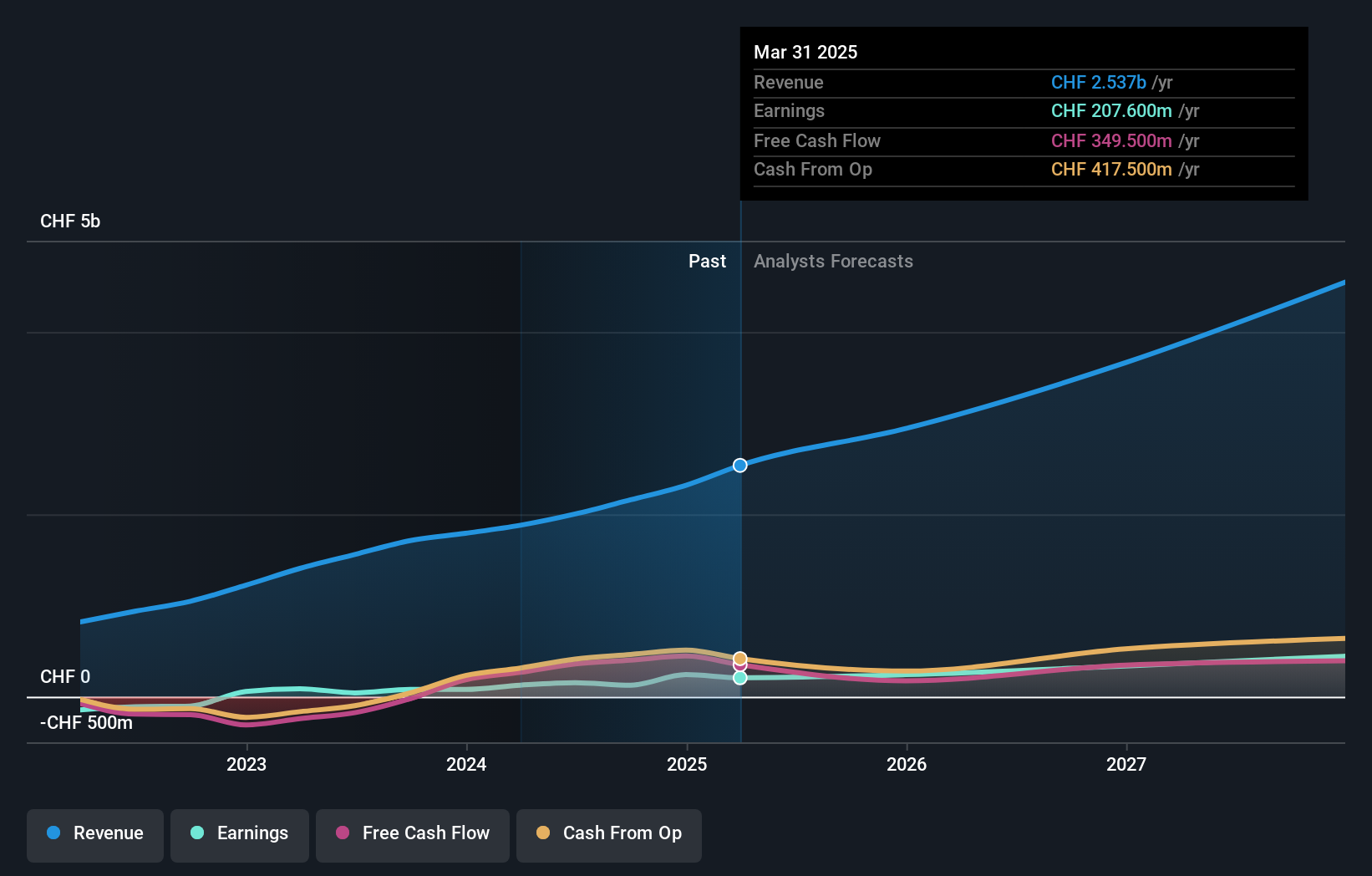

On Holding (ONON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: On Holding AG develops and distributes sports products globally, with a market cap of approximately $17.19 billion.

Operations: The company generates revenue primarily from its Athletic Footwear segment, which accounts for CHF 2.54 billion.

Insider Ownership: 17.4%

Revenue Growth Forecast: 17.9% p.a.

On Holding is experiencing robust growth, with earnings expected to increase significantly at 22.8% annually, outpacing the US market. The company's revenue growth forecast of 17.9% per year reflects strong demand for its brand globally. Recent leadership changes include Martin Hoffmann becoming sole CEO in July 2025, and Helena Helmersson joining the board. On has raised its full-year net sales guidance to a projected CHF 2.86 billion, reflecting continued momentum in sales performance.

- Delve into the full analysis future growth report here for a deeper understanding of On Holding.

- The analysis detailed in our On Holding valuation report hints at an deflated share price compared to its estimated value.

TAL Education Group (TAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TAL Education Group offers K-12 after-school tutoring services in the People’s Republic of China and has a market cap of approximately $6.42 billion.

Operations: The company generates revenue of approximately $2.25 billion from its K-12 after-school tutoring services in China.

Insider Ownership: 31.6%

Revenue Growth Forecast: 18% p.a.

TAL Education Group's earnings are forecast to grow significantly at 28.2% annually, surpassing the US market average. Despite a recent quarterly net loss of US$7.31 million, the company achieved full-year profitability with US$84.59 million in net income and strong revenue growth to US$2.25 billion from last year’s figures. Leadership changes include Yi Wang joining as an independent director, enhancing governance amid expanding educational initiatives in China and extended buyback plans through April 2026 bolster investor confidence.

- Click to explore a detailed breakdown of our findings in TAL Education Group's earnings growth report.

- Upon reviewing our latest valuation report, TAL Education Group's share price might be too optimistic.

Make It Happen

- Click through to start exploring the rest of the 190 Fast Growing US Companies With High Insider Ownership now.

- Want To Explore Some Alternatives? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal