The 2025 New Wealth Creation List is released: Zhang Yiming wins the richest man, Zhong Yuyi falls to second place

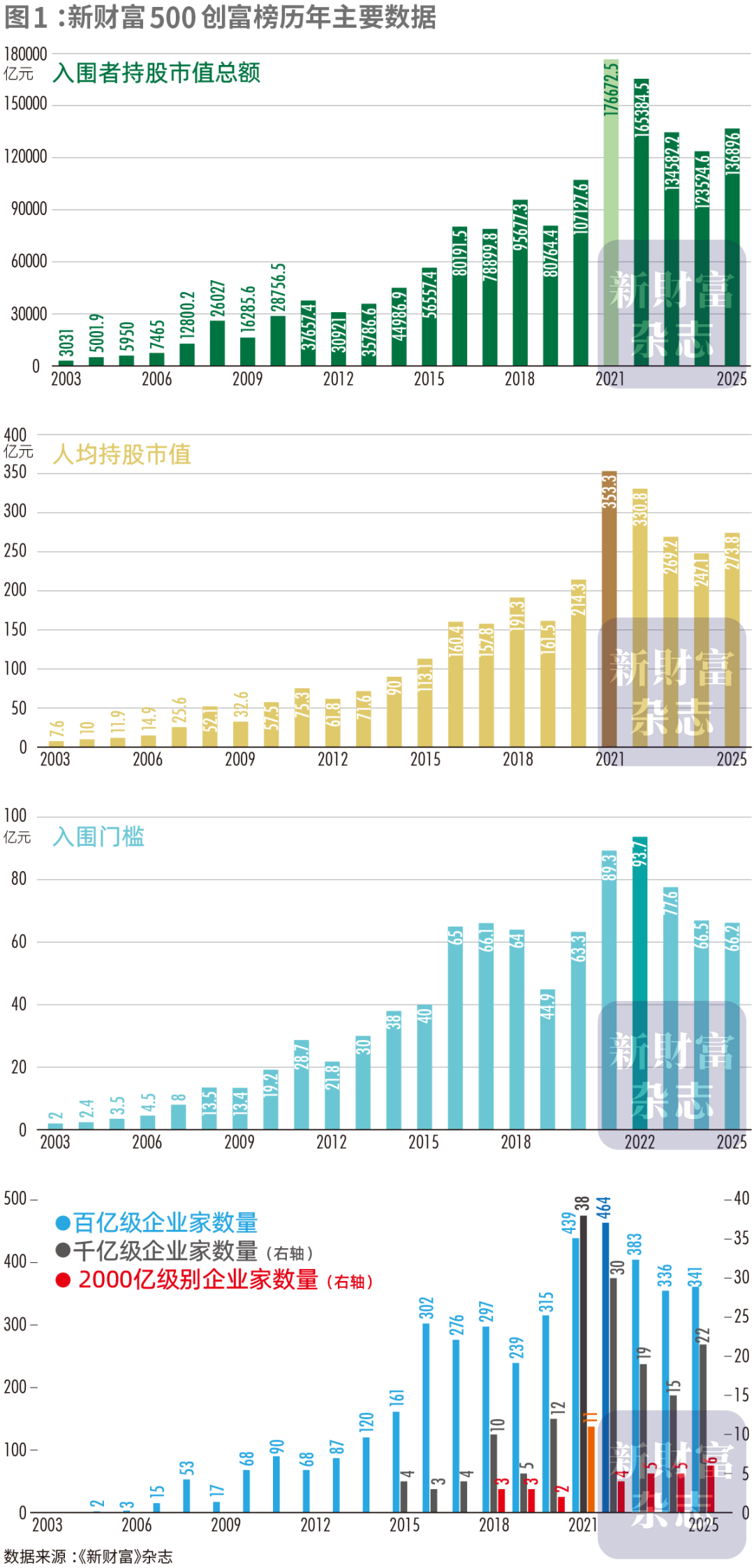

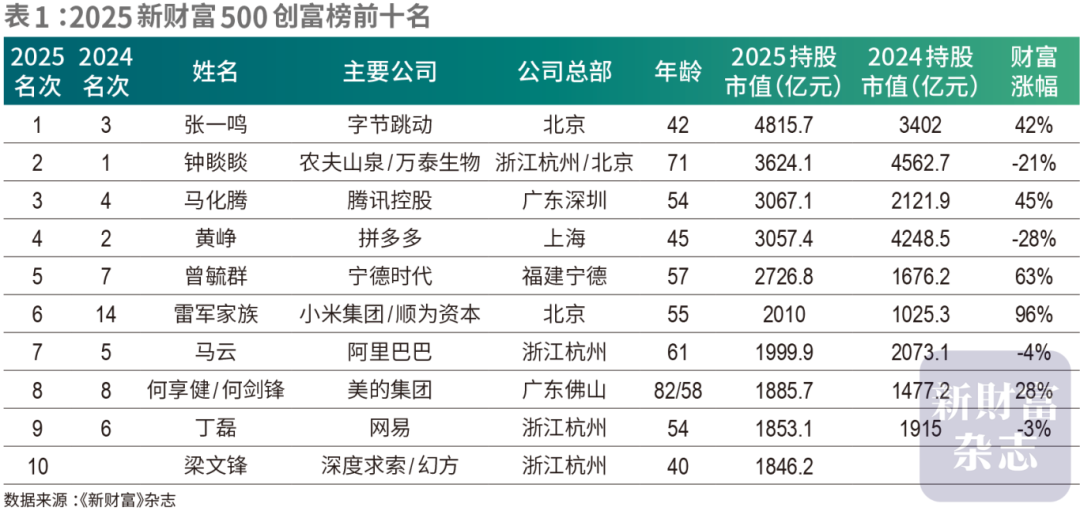

The Zhitong Finance App learned that on June 24, “New Fortune” magazine published the 500 Wealth Creation List for the 23rd time. Overall, the total market value of the 500 entrepreneurs (or families) on the list this year was 13.7 trillion yuan, up 11% from the previous year. The average market value of shares held was 27.38 billion yuan, the entry threshold was 6.62 billion yuan, and the number of entrepreneurs with a market value of 10 billion yuan or more reached 341. In terms of rankings, in 2025, 42-year-old Zhang Yiming became the richest man for the first time with a shareholding valuation of 481.57 billion yuan, which is 120 billion yuan higher than the second-place Zhong Yuyi.

Driven by innovation and going overseas, the value creation capabilities of Chinese private enterprises have been unleashed at an accelerated pace, and a new wave of wealth creation is surging. The total market value of shares held by the 500 entrepreneurs or families on the list this year reached 13.7 trillion yuan, up 11% from the previous year, with an average value of 27.38 billion yuan. The entry threshold is 6.62 billion yuan, and 341 people have a net worth over 10 billion yuan.

AI dominated the transformation of the top ten places on the list. 42-year-old Zhang Yiming reached the top for the first time with a shareholding valuation of 481.57 billion yuan. Monthly active users surpassed 180 million DeepSeek, driving Liang Wenfeng to rank in the top ten with a shareholding valuation of 184.6 billion yuan. The AI concept also caused Tencent (00700), Alibaba (09988), and Xiaomi (01810) to revalue, and Ma Huateng, Ma Yun, and Lei Jun gathered in the top ten. Zhong Yuyi's assets have been reduced by nearly 100 billion dollars, and he has lost the position of the richest man in four consecutive terms. Of this year's top ten, 4 are already from Hangzhou, Zhejiang.

TMT, pharmaceutics, and daily consumption became the top three tracks for wealth creation, contributing 110 people, 54 people, and 53 people respectively. TMT's dominance stems from the penetration of intelligence and the Internet of Things into all walks of life, bringing dividends to industries such as chips, AI, robotics, and consumer electronics. In the face of suppression and blockade, China's chip and AI industries defended each other, while the “veterans” of the consumer electronics industry chain such as mobile phones gradually migrated their manufacturing advantages to industrial chains such as smart cars, low-altitude economy, and humanoid robots, demonstrating China's complete supply chain and ecological collaboration, which is the foundation for the success of new industries.

In the restructuring of the wealth map, the trend of uneven levels of wealth creation between regions has been rewritten. With Sichuan as the lead, more people have appeared on the list in western regions such as Tibet, Xinjiang, Inner Mongolia, and Gansu. Zhejiang, Shanghai, and Jiangsu each added a net increase of 10, 7, and 8 new people, highlighting that the Yangtze River Delta has set the pace for the conversion of old and new kinetic energy.

The Chinese industry's advanced path from following to originality has benefited from the joint efforts of all parties, including private enterprises. Among them, the first tier led innovative breakthroughs “from 0 to 1”, and the backbone forces achieved “1 to 100” roots in competition, while new regional richest people frequently emerged on consumer and pharmaceutical tracks, reflecting the vast vitality of the domestic demand market.

The annual New Fortune 500 Wealth Creation List has arrived as scheduled to measure the warmth and warmth of the business world and the sentiment of the capital market through objective changes in the market value of stock holdings. This is also the 23rd time that “New Fortune” magazine has launched this list. The group of entrepreneurs who are on the list has shared their stories, clearly outlines the trajectory of the times, and also guides the future direction.

The total market value of the 500 entrepreneurs (or families) on the list this year was 13.7 trillion yuan, the average market value of shareholding was 27.38 billion yuan, the entry threshold was 6.62 billion yuan, and the number of entrepreneurs with a market value of 10 billion yuan or more was 341 (Figure 1).

In 2024, in the face of a complex and severe external environment, China's economy surged and progressed steadily. The continued positive trend is also reflected in the wealth creation list. After four years of continuous adjustments, the total wealth of those on the list in 2025 showed an upward curve, up 11% from the previous year. This increase is also in line with the increase in the Shanghai and Shenzhen 300 Index during the year. This shows that a new wave of wealth creation is surging.

Amidst the rapid release of private enterprises' ability to create value, the structure is still fragmented. On the one hand, the net worth of the top players in the real estate and photovoltaic industries continued to adjust, and there were not a few that fell to the list; on the other hand, entrepreneurs with 100 billion assets expanded drastically, rising from 15 to 22 in 2024, an increase of 50%, mainly benefiting from a sharp rise in the valuations of leading private enterprises such as the Internet, consumer electronics, automobiles, and finance.

This means that the core assets of private enterprises are re-forging market consensus and taking the lead in breaking out of the valuation slump. Currently, there is still a gap of about 20% to 30% between the various indicators of the wealth creation list and the historical high in 2021. What kind of momentum will the list use and when will it cross the historical high, everything needs to return to the roots of the industry.

AI dominates the top ten: Zhang Yiming reached the top for the first time, and Liang Wenfeng ranked in the top ten

In 2025, 42-year-old Zhang Yiming became the richest man for the first time with a shareholding valuation of 481.57 billion yuan, which is 120 billion yuan higher than the second-place Zhong Yuyi (Table 1).

Zhang Yiming's shareholding valuation mainly comes from his shares in ByteDance. ByteDance has revealed that Zhang Yiming holds 21% of the shares, employees hold 21% of the shares, and institutions hold 58% of the shares.

In 2018, Zhang Yiming was on the list for the first time, with a net worth of only 12 billion yuan. Rocket's average share appreciation rate stems from the “time killer” user stickiness of products such as today's headlines, Douyin, and TikTok, and is also empowered by AI.

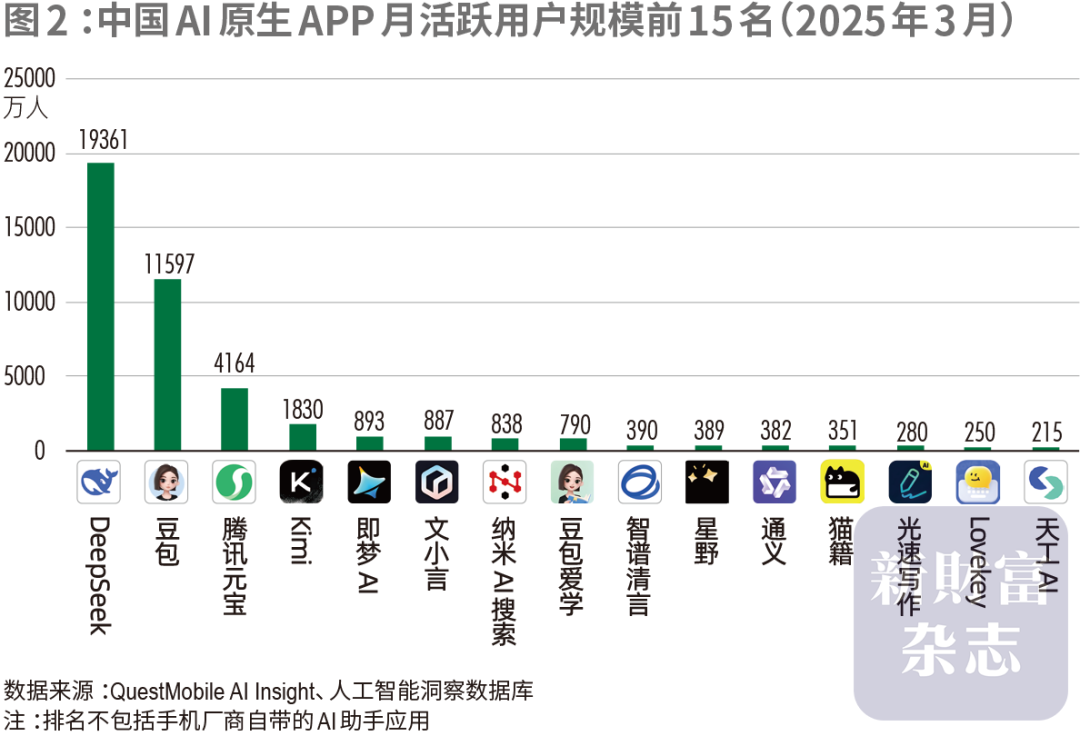

Among the top ten AI native apps for monthly active users in China, ByteDance has three seats: Doubao, Dream AI, and Doubao AiXue. Among them, Doubao has 116 million active users, second only to DeepSeek, which made ByteDance revalued (Figure 2).

According to reports, SoftBank Vision Fund, Fidelity Investments, and Cushin Group have raised ByteDance's valuations to 400 billion US dollars, 41 billion US dollars, and 450 billion US dollars, respectively. According to another report, ByteDance launched a stock repurchase program for US employees in March 2025. The price is US$189.9 per share, and its valuation is approximately US$315 billion.

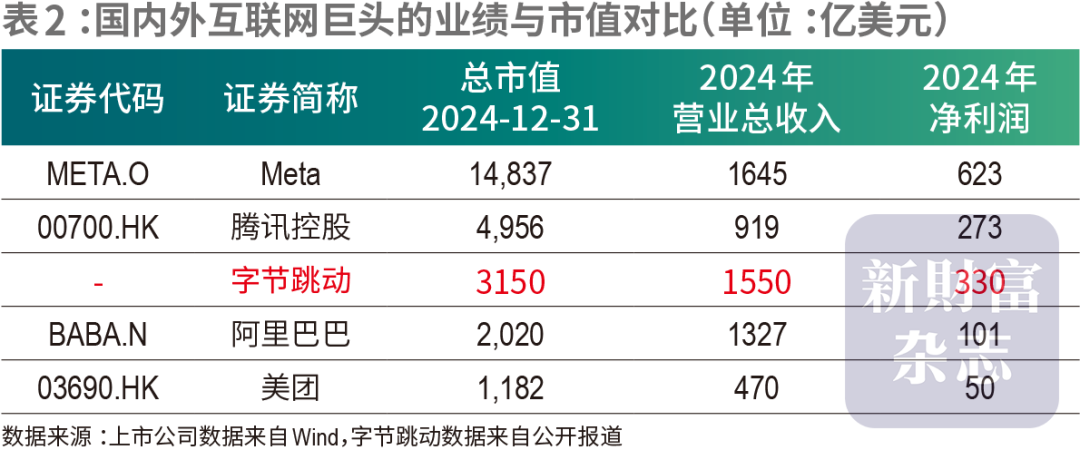

According to other reports, in 2024, ByteDance's revenue reached 155 billion US dollars (equivalent to 1.13 trillion yuan), an increase of 29% over the previous year, and net profit reached 33 billion US dollars. Measured in this way, it can be promoted to No. 1 Internet technology company in China, surpassing Alibaba and Tencent, and its revenue scale is close to Facebook's parent company Meta. Meta's valuation reached 1.5 trillion US dollars, and Tencent's valuation was 500 billion US dollars. ByteDance may have a higher performance growth rate, but the valuation is still significantly lower than Meta, Tencent, etc. (Table 2). If TikTok breaks through restrictions and establishes a closed loop of “content+e-commerce” model, Zhang Yiming's net worth should still have room to improve.

AI not only helped Zhang Yiming; it changed the world with amazing efficiency, but also reshaped the wealth creation list with amazing efficiency.

Leung Man-fung, 40, was promoted to the top ten for the first time, with a shareholding valuation of 184.6 billion yuan.

Ten years ago, Liang Wenfeng and several Zhejiang University alumni co-founded Magic Square Quantification. Relying on quantitative investment, it quickly became a 10 billion private placement. In 2015, Liang Wenfeng also founded Jiuzhang Asset with his classmate Xu Jin. In 2023, Liang Wenfeng founded DeepSeek (DeepSeek) to focus on big models and general artificial intelligence research. In the DeepSeek main platform, Hangzhou Deep Search Artificial Intelligence Basic Research Company, Liang Wenfeng held 84% of the shares after penetrating.

In January 2025, DeepSeek became popular, rewriting the trend in the AI arena between China and the US. This disruptive innovation was described as a “national-level scientific achievement” by Feng Ji, founder of game science and producer of the online game “Black Myths: Goku”. It not only subverted the stereotype that China only acted as a “technology follower,” but also spilled over significantly to global capital markets, triggering a series of chain reactions.

According to Wang Ying, chief Chinese stock strategist at Morgan Stanley, in the past few years, overseas restrictions on Chinese technology have caused the market to worry, and China is likely to lag behind in the new round of technological revolution. However, the rise of DeepSeek has reversed this perception and strengthened global investors' confidence that new growth drivers will continue to emerge in the Chinese economy in the future. This is the biggest change in the revaluation of Chinese assets.

Compared with its peers, the closed, high capital expenditure, and high fee model, the DeepSEEK-R1 model has rapidly risen with the “low cost+high performance” strategy. This is due to its unique efficient sparse model architecture and dynamic adaptive training algorithm, which drastically reduces training and inference costs while maintaining high performance through intelligent allocation of computational resources and reducing redundant parameters; while its open source strategy accelerates global computing power parity and technology sharing. From Tencent and Baidu to mobile and telecommunications, many giants have announced access to DeepSeek to promote the inclusiveness of AI technology.

DeepSeek's valuation is currently facing major differences due to the lack of external financing. According to Bloomberg research, its valuation range is 1 billion to 150 billion US dollars, and the median value is 2 billion to 30 billion US dollars.

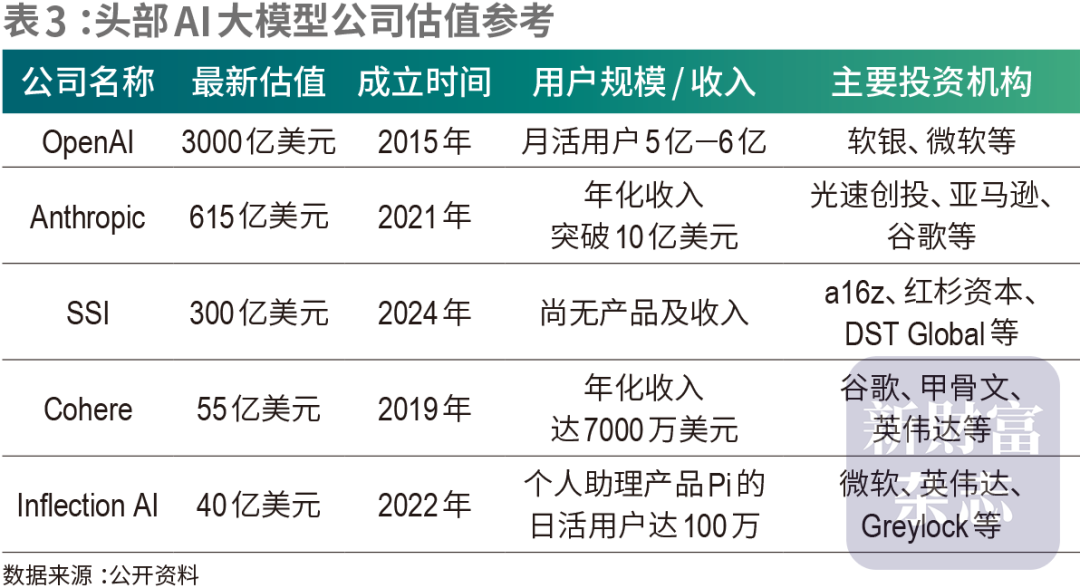

Comparing the latest valuations of large overseas AI models, OpenAI has just completed a new round of financing of 40 billion US dollars, and the post-financing valuation reached 300 billion US dollars. Safe Superintelligence (SSI), founded by former OpenAI chief scientist Ilya Sutskever (Ilya Sutskever) in 2024, has less than 20 team members, and the latest valuation reached US$30 billion. Anthropic, which launched the Claude chatbot, has just completed Series E financing of 3.5 billion US dollars, with a latest valuation of 61.5 billion US dollars.

From a domestic perspective, Kimi (the company is the dark side of the Moon), which has 18 million active users, has a relatively clear valuation path. Alibaba revealed in its 2024 earnings report that it received about 36% of the preferred shares in Dark Side of the Moon for 800 million US dollars. According to public reports, Dark Side of the Moon's financing round totaled 1 billion US dollars, and the post-financing valuation reached 2.5 billion US dollars. Since then, in a new round of investment led by Tencent, the valuation of Moon's dark side has risen to 3 billion US dollars.

Compared with this, the month after the launch of the R1 model, DeepSeek quickly surpassed 180 million monthly active users and received extensive government and enterprise cooperation. Currently, it is at the top of the domestic AI application list, and the number of active users is more than 10 times that of Kimi (Table 3). Bloomberg research gave it a median valuation of 30 billion US dollars, 10 times that of the dark side of the Moon.

Seen from a certain perspective, when innovation leaders who have achieved breakthroughs from 0 to 1 can quickly enter the top of the wealth creation list, such positive feedback will be a constant driving force for innovation and entrepreneurship in China.

The foundation of AI lies in algorithms and computing power, but when it comes to the application side, it relies on data, scenarios, and user accumulation. These are the strengths of traditional internet giants, and Tencent, Alibaba, Kuaishou, etc. all benefit from this.

Tencent, which connects 1.4 billion people, has full access to DeepSeek capabilities in WeChat. Tencent Yuanbao, a C-terminal AI assistant developed based on a self-developed mixed element model, currently has over 40 million active users. Tencent also said bluntly that its growth in performance directly benefited from the upgrading of AI-enabled advertising platforms. In 2024, Tencent's net profit surged 68% to 1940 billion yuan.

Next, Tencent will also reorganize the AI team, increase capital expenditure in the AI direction, and accelerate the popularization of personal AI applications.

Driven by AI narratives, Ma Huateng's net worth soared 45%, ranking 3rd in the list with 306.7 billion yuan.

Alibaba also clearly proposed “user-first, AI-driven”, and viewed AI as the strongest variable for business transformation and growth. On the one hand, it divested non-core assets such as Yintai and Gaoxin Retail to speed up cost reduction and efficiency; on the other hand, it focused on e-commerce and AI, invested in shares in many AI unicorns such as Kimi and Smart Spectrum, and announced that it plans to invest more than 380 billion yuan to increase AI infrastructure. This scale of capital expenditure has also become a new starting point for this round of internet narratives.

Doubao and Tencent Yuanbao mainly serve individual AI needs. Ali, who is good at the B-side battlefield, is also more biased towards the developer application ecosystem. Its Tongyi Qianwen Big Model has become the largest open source model group in the world. In open source communities at home and abroad, the number of derived models has exceeded 90,000, surpassing Facebook's Llama series open source models and ranking first in the world.

Currently, Alibaba's market capitalization has recovered to over 300 billion US dollars. In 2025, Ma Yun ranked 7th in the wealth creation list with a home worth nearly 200 billion yuan.

In addition to AI, Tencent and Ali, whose financial strength is at the forefront of the world, are also like Huawei, using platforms such as Tencent Quantum Labs and Pingtouge Semiconductor, respectively, to go deep into the uninhabited land of original innovation and accumulate technical energy from 0 to 1.

NetEase Ding Lei, who has been in the top ten all year round, has not missed the AI whirlwind. It has already deployed AI technology for audio and visual generation in games, and NetEase Youdao has also trained major educational language models.

AI phones and AI smart driving are also key concepts in the Xiaomi Group's stock price rise. Lei Jun, who has an excellent sense of the Internet, has more popular searches than his peers, but recently experienced several negative public opinion incidents, and the phrase “smart driving” for Xiaomi cars has also been corrected to “assisted driving.” According to the “New Fortune” calculation, Lei Jun's main wealth comes from holding 24.2% of the Xiaomi Group's shares, and his actual shareholding wealth in Jinshan Heshun Capital is not high. In 2025, Lei Jun ranked sixth with a net worth of 2010 billion yuan, a year-on-year increase of 96%.

Zhong Yuyi, who has been the richest man for four times, did not have much traction in the AI era and lost his status as the richest man this year. Its shareholding wealth evaporated by nearly 100 billion yuan, ranking second with 360 billion yuan.

He Xiangjian and Zeng Yuqun, who have been in the top ten all year round, have successively promoted the listing of H shares by their companies. Midea Group and Ningde Era also created the biggest IPOs for Hong Kong stocks in 2024 and 2025, respectively.

Currently, apart from Zhang Yiming and Liang Wenfeng, whose company is not yet listed, and Pinduoduo Huang Zheng, which is listed on the US stock market, 7 of the top ten richest people have already landed on Hong Kong stocks on their core platforms. As China's most open financial market to the outside world, Hong Kong stocks have gradually become a bridgehead for Chinese enterprises to globalization and the main base for global capital to invest in China's core assets.

Liang Wenfeng's ranking in the top ten also means that out of the top ten people with the highest shareholding valuation in China, four are from Hangzhou, Zhejiang (Zhong Yuyi, Ma Yun, Ding Lei, and Liang Wenfeng). Jiangnan has been a rich place since ancient times, and now it is back in charge of the Chinese economy. Beijing (Zhang Yiming, Lei Jun) and Guangdong (Ma Huateng, He Xiangjian) each have two seats, while Shanghai (Huang Zheng) and Fujian (Zeng Yuqun) each have one seat.

Eighteen years ago, six of the top ten in the 2007 list were from Guangdong (mainly real estate agents). Yang Hye-yeon, the richest man back then, has a net worth of 12.4 billion yuan, which has shrunk to 1/10 of its high rank. More wealthy people in real estate have disappeared into the long stream of value creation.

From real estate to the Internet to AI, changes in the main industries that create wealth have rewritten the focus of economic geography.

Another noteworthy dimension is age. On the wealth creation list, youth has become a new trend.

In this year's top ten, entrepreneurs under 55 already occupy six seats, including 3 post-80s (Zhang Yiming, Huang Zheng, and Liang Wenfeng), 2 post-70s (Ma Huateng, Ding Lei), and Lei Jun, born in December 1969. They all started from scratch and are mainly working in digital economy fields such as the Internet and AI.

With the participation of the previous ten representative entrepreneurs, China's AI industry has rapidly risen. According to the latest report released by the Stanford Institute of Artificial Intelligence, although the US still has an advantage in AI basic algorithm innovation and high-end AI chip design, the performance gap between the top AI models in China and the US has shrunk to 0.3%, compared to 20% in 2023.

What AI empowers and changes is not only the top ten seats, but also the entire industry.

Industry wealth creation list: TMT contributed new volume, and chips, AI, and robots became popular tracks

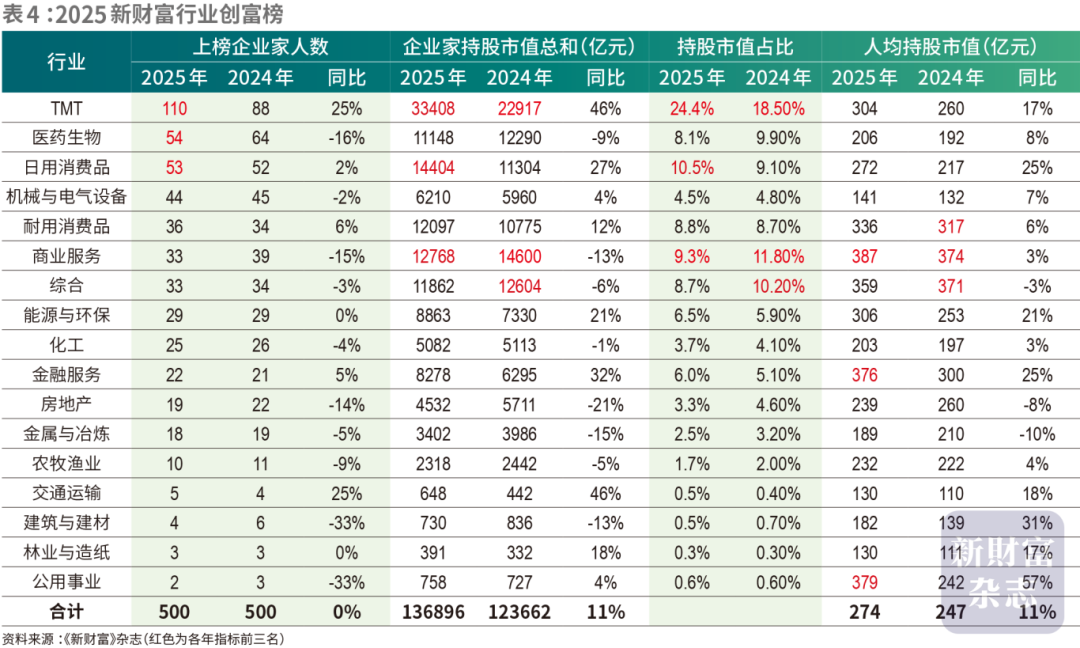

In 2025, according to industry statistics, the number of entrepreneurs on the list is still TMT, pharmaceutics, and consumer goods that occupy the top three tracks of wealth creation (Table 4).

However, only 54 people were on the list this year, which is 10 fewer than last year, indicating that the industry is still returning to the adjusted range of valuations, and there are almost no new entrepreneurs on the list. Innovative drugs have become a major highlight in the industry. In 2024, the participation of domestic innovative pharmaceutical companies in the global R&D system increased significantly. 31% of innovative drug candidates introduced by multinational pharmaceutical companies came from China. At the same time, AI technology accelerated penetration into the innovative drug development process, bringing significant changes to the industry. Entrepreneurs who stand out in the innovative drug business also have relatively superior wealth performance, including BeiGene Ou Leiqiang, Baili Tianheng Zhu Yi, and Wang Junmin, the richest man in Tibet.

The TMT circuit had a strong list of 110 people, a significant increase of 22 people over last year. The total wealth of the entrepreneurs on the list was as high as 3.34 trillion yuan, accounting for 1/4 of the wealth of all those on the list.

Of the 72 people newly added to the list this year, TMT occupied 36 seats, contributing half of the new volume. The main dividends of this circuit come from three major drivers: chips, artificial intelligence, and consumer electronics, and the three reinforce each other.

Currently, companies under the top ten, such as Zhang Yiming, Liang Wenfeng, Ma Huateng, and Ma Yun, are leading the big model technology innovation. When aiming for “0 to 1,” the backbone on the list is focused on breaking through the “1 to 100” landing level. This is also the best entry point for us to observe the competitiveness of the Chinese industry.

TMT takes 110 seats: chips and AI take the lead

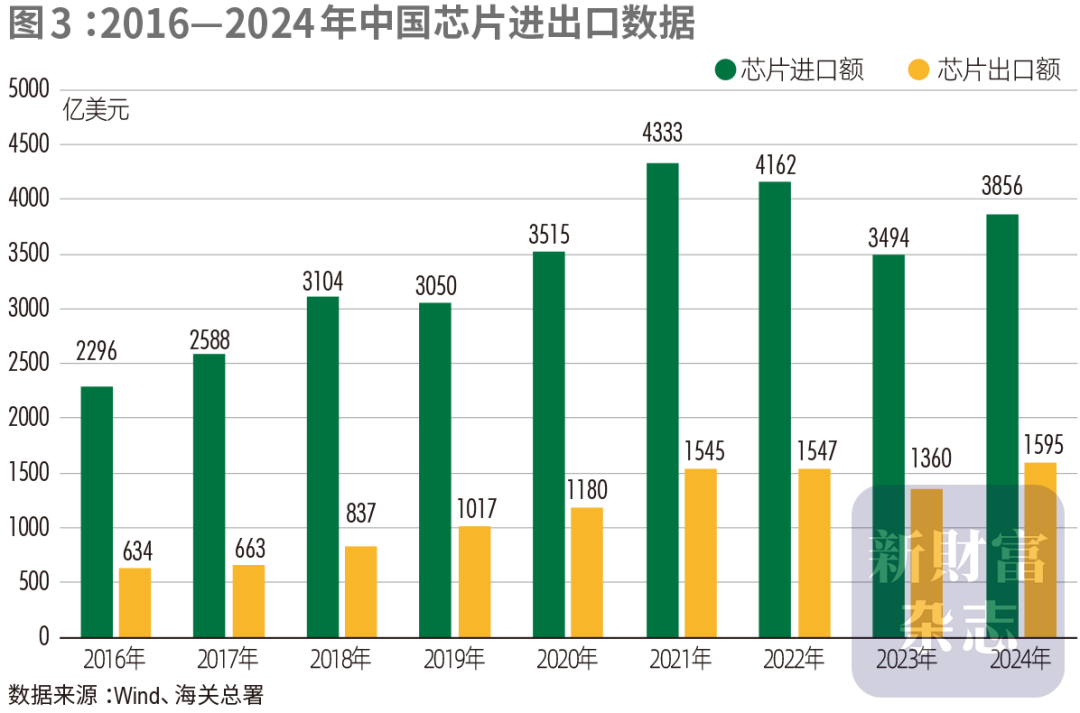

Chips are the main wealth creation pool in this round of the TMT circuit. External siege and interception have forced the strongest belief in localization. Performance and valuation have increased, and they have become the foundation for the chip industry's value revaluation. In 2024, the chip with the highest import value category in China began to “explode” globally. The export volume reached 298.1 billion units, and the export value reached 159.5 billion US dollars (about RMB 1.16 trillion). Not only did it break the 1 trillion yuan mark for the first time, but it also became the single product with the highest export value, surpassing traditional export strengths such as clothing, textiles, and mobile phones (Figure 3).

It is the rise of AI that is driving rapid development in fields such as intelligent driving, computing power, and high-speed network communication, injecting new momentum into the chip industry.

The Cambrian period, which had just reversed losses in the first quarter of 2025, stood on the cusp of AI chips. At one point, the stock price rose nearly 20 times from a low point. Last year's revenue was less than 1.2 billion yuan, and the market value has already surpassed 300 billion yuan. With the support of “Han Wang”, its young founder, Chen Tianshi, who graduated from the Chinese University of Science and Technology, held shares with a market value of 78.6 billion yuan, up 370% from the previous year. He has been at the top of the wealth growth list for two consecutive years.

This year, in the printed circuit board (PCB) segment alone, the Wu Ligan family of Shanghai Electric Power Co., Ltd., Chen Tao of Shenghong Technology, and Xiao Hongxing and Liu Jinchan of Guanghe Technology were added to the list. As a carrier and connection platform for chips, PCBs are known as the “mother of industrial electronics”. Previously, PCBs were mainly used in the communication electronics and consumer electronics markets. In recent years, the automotive electronics and industrial control fields relayed to provide incremental growth. In 2024, AI servers and high-speed network equipment in data centers became the main growth drivers for the PCB market.

According to “New Fortune” statistics, the number of chip industry chain entrepreneurs on the list this year reached 36, covering various segments such as chip design, EDA, SoC, PCB, GPU, storage, equipment, materials, etc., accounting for 1/3 of the TMT industry, accounting for 7% of the total list.

The AI circuit is in the infancy of the wealth creation universe. In addition to Liang Wenfeng breaking into the top ten this year, Yang Zhilin, founder of Dark Side of the Moon, also made the list for the first time with a net worth of 9.39 billion yuan. iFLYTEK took the lead in the intelligent voice recognition circuit and also laid out multiple “AI+” tracks such as smart education, smart medical care, and smart cities. Its head, Liu Qingfeng, appeared on the list with a net worth of 8.28 billion yuan.

AI computing power led to Zhou Chaonan of Runze Technology, the richest woman in Hebei last year. This year, Zhou Chaonan once again doubled the market value of shares held and reached the top 100 of the list with 41 billion yuan. In addition, Geng Diengen of Guangyuan New Network successfully made the list with the data center business and Robotco's Dai Jun with the Nvidia supplier concept.

Meanwhile, the development of the domestic chip industry can also feed back the progress of China's AI industry. Nvidia Wong In-hoon recently revealed that 4 years ago, Nvidia occupied 95% of the mainland AI chip market; today, it only accounts for half. Domestic large models are trying to reduce the performance requirements for chips, reducing the demand for overseas high-end chips to a certain extent; while domestic chips are also trying to adapt to the training ecology of large domestic models. As soon as DeepSeek was released, it received support and adaptation from 17 chip manufacturers including Huawei Ascend and Cambrian. Training and reasoning efficiency was greatly improved, helping the computing power ecosystem move steadily towards autonomy and control.

AI empowerment has also saved the consumer electronics circuit, which has been sluggish for two or three years. Entrepreneurs in the smart hardware manufacturing sector, such as the Wang Lichun family of Lixun Precision (002475.SZ), the Zhou Qunfei family of Lansi Technology (300433.SZ), Zeng Fangqin of Lingyi Intelligent Manufacturing (002600.SZ), and Qiu Wenshan of Huaqin Technology (603296.SH) have collectively rebounded in market value.

Meanwhile, China's manufacturing advantages in the field of consumer electronics have been further transformed into advantages in automobile intelligence and AI hardware equipment manufacturing. Last year, “New Fortune” magazine concluded that the collective entry of many foundry companies such as Lixun Precision and Lansi Technology into the automobile circuit is one of the key factors in the acceleration of China's automobile intelligence process. Xiaomi will transfer the supply chain advantage it has accumulated on mobile phones to the auto circuit, doubling its stock price in 2024, and 7 members of its startup team will rejoin the list. Among them, Lin Bin ranked 37th with 74.6 billion yuan.

The advantages of the industrial chain are reused, and new and old entrepreneurs gather in emerging fields such as the low-altitude economy and humanoid robots

This year, the advantages of industrial chain reuse have once again flourished. For example, in terms of technology, technology, and industrial chain, smart cars are highly homologous to low-altitude economy and embedded intelligent robots. The integrated components required in automobile production, such as joints, speed reducers, and screws, are an important part of the “body” of humanoid robots.

As a result, many automobile industry chain companies, such as Xiaopeng Motor, are speeding up the deployment of new tracks such as low-altitude economy and robotics. Lingyi Intelligent Manufacturing also proposed to accelerate the “human eye appeal” (humanoid robot, AI glasses, folding screen, and server) strategy. Tiangong Robotics, which won the championship in the world's first humanoid robot half marathon held in Yizhuang, Beijing in April 2025, partners include partners such as Lingyi Intelligent Manufacturing.

Junsheng Electronics, which is deeply involved in the auto parts circuit, has officially implemented the “car+robot Tier 1” dual-track strategy and is actively expanding robot software and hardware solutions. Its founder Wang Jianfeng's family has been on the list continuously for many years.

Ke Li Sensor's weighing force sensors were previously mainly used in household products such as health scales, fat scales, kitchen scales, etc., and had the highest market share in the country for 15 consecutive years. In the robot era, Coli Sensor has created a core product, a six-dimensional force sensor, which can simultaneously measure force and moment in three directions, provide high-precision mechanical feedback to robots, and is the foundation for flexible robot control, safe interaction, and intelligent decision-making. At present, it has sent samples to more than 50 domestic robot customers, and some customers have entered the batch order stage. Ke Jiandong, who went to the sea to start a business from the Political Research Department of the Ningbo Municipal Committee, was on the list for the first time this year with a net worth of 8.98 billion yuan.

Thanks to the joint efforts of China's supply chain, the core components (harmonic reducers and actuators) of humanoid robots have been localized 70%, and the cost advantage is remarkable. The number of companies involved in the production of humanoid robots in China ranks first in the world. In the past 5 years, mainland China has led the world in the number of patent applications related to humanoid robots, reaching 5,688.

Several startup founders appeared on the list, which became a coincidence and inevitable. At the Spring Festival Gala in the Year of the Snake, Yushu Tech robot caught fire. Wang Xingxing, who is only 35 years old, first appeared on the wealth creation list this year with a net worth of 6.7 billion yuan. Wu Bo, founder of Eston, which produces industrial robots, is also on the list with a net worth of 6.65 billion yuan.

Opportunities are not only left to young entrepreneurs like Wang Xingxing, entrepreneurial veterans who are painstakingly seeking incremental growth, but they are also trying to seize every opportunity to come to the table on the cusp of innovation.

Zongshen Power's main business was the production of motorcycle engines, but now it has broken into low-altitude aircraft and became an engine supplier for rainbow drones and pterosaur drones. After leaving the list for many years, its founder, Zuo Zongshen, returned with a net worth of 8.86 billion yuan at the age of 73. Chen Ailian, who was a female tractor when she was young, now the family owns three listed companies: Wanfeng Aowei, Rifa Seiki, and Paislin. In 2024, Wanfengwei's market value rose sharply. Three times, the Chen Ailian family made the list with a net worth of 13.2 billion yuan.

As can be seen, China's complete supply chain and ecological collaboration are the foundation for the success of new industries such as AI, chips, robotics, and the low-altitude economy. Suppliers in many segments can follow the context of industrial upgrading and jointly explore breakthrough solutions in cutting-edge fields in line with the R&D needs of chain owners and leaders. This ability to migrate across borders is a reflection of supply chain vitality, a key support from 0 to 1, and a true source of innovation and wealth.

As strategic emerging industries began to dominate economic growth, China's generous engineer dividends have been verified over and over again. Many undergraduate students trained in China have also developed extraordinary careers overseas.

The new Feita founders Xie Qing and Xie Hua brothers both graduated from Tsinghua University and are now ranked 22nd with a net worth of 102.1 billion yuan. Feita is a leading cybersecurity company, with a recent market capitalization of 600 billion yuan. Xie Qing was also previously rated as an academician of the US Academy of Engineering.

Wang Shuo, a 35-year-old girl from Northeast China, went to the US at the age of 16 and later practiced business skills at a flea market. In 2019, she founded DEEL with her college students to serve global companies such as Tesla and Boston Consulting, starting with “cross-currency salary payments.” DEEL's latest valuation reached 12 billion US dollars, and Wang Shuo made the list with a net worth of 8.6 billion yuan this year.

AI empowers the financial industry, and all four people are on the list

As a springboard for the next round of industrial revolution, AI business implementation is accelerating. In 2024, 78% of organizations reported using AI, up from 55% the previous year. AI has also become an important force empowering the financial industry. The financial services industry has 22 people on the list this year, and the market value of shares per capita reached 37.6 billion yuan, making it one of the top three tracks.

In 2024, Tonghuashun invested nearly 30% of its revenue in R&D, and focused on big models, computing power, and the introduction of high-end talents to form a full-scenario AI product matrix. At the end of the year, its market value exceeded 150 billion yuan, contributing 4 wealthy people to the list. Its founder, Yi Zheng, ranked 56th with a net worth of 55.8 billion yuan. Executives Ye Qiongjiu, Wang Jin, and Yu Haomiao were also on the list with a net worth of 23.1 billion yuan, 10.7 billion yuan, and 7.7 billion yuan respectively. The latter two were also on the list for the first time in many years.

In contrast, although the market value of Dongfang Wealth is as high as 400 billion yuan, in fact, the founders alone, Lu Lili and his wife are on the list with a net worth of 90.8 billion yuan. Having won a doctorate of literature from Fudan University, she actually has a wide range of interests. Currently, she is also the president of the Shanghai Whipped Egg Sports Association. It holds 21.72% of Oriental Wealth's shares, while Lu Lili directly holds 8.52% of Wanda Film's shares. Among A-share brokerage concept stocks, Dongfang Wealth is second only to CITIC Securities in market capitalization and ahead of brokerage firms such as Cathay Pacific Haitong and China Galaxy due to its broad internet user base, high stickiness and high gross profit.

Consumption has become a new highlight, and blind tea and coffee box sellers have successfully topped the list

Consumption is another major highlight. Insufficient domestic demand is a key problem in China's macroeconomy. Judging from the composition of GDP, Chinese consumption accounts for only about 40%, while Europe and the US have reached 60% to 70%. However, because of this, judging from the list, this track is booming and full of life.

In 2025, consumer goods for daily use were on the list with 53 people, ranking third; the market value of shares held per capita was also as high as 27.2 billion yuan, up 25% from the previous year, and the fastest growth rate in all industries. There were 36 people on the list for durable consumer goods, and a total of 89 people were on the consumer circuit, an increase of 3 places over last year.

Like the internet, consumption is also a “hero comes out as a teenager” racetrack. In 2025, out of 59 new entrants, 8 came from the consumer sector.

Previously, traditional types of wealth created by consumption were liquor and mineral water. The top water quality of Qiandao Lake nurtured two hundred billion fortunes, Zhong Yuyi of Nongfu Spring and Zong Fuli of Wahaha.

Now, with characteristics such as low prices, high frequency, repurchases, and chains, the coffee and milk tea circuit later took the lead. In 2025, they “summoned” five groups of people on the list, including Zhang Hongchao and Zhang Hongbo's brother, Nie Yunchen of Hi Tea, Zhang Junjie of Tea Master, Wang Xiaokun and Liu Weihong of Tea Baidao, and Wang Yunan of Gu Ming (Table 5).

In Henan, Zhang Hongchao and Zhang Hongbo started with a shaved ice stand. Today, they are at the helm of Michelle Ice City, which has more than 46,000 stores worldwide, surpassing Starbucks to rank first in the world in the world. With a net worth of 117.9 billion yuan, the brothers surpassed Qin Yinglin and his wife in Muyuan Co., Ltd., and were promoted to become the new richest people in Henan.

The hero didn't ask where it came from. Zhang Junjie, who was “illiterate before the age of 18,” went from being an orphan living on the street to working part-time at a milk tea shop, to founding Overlord Tea Princess and going public in the US, but it's only been about ten years. Of the 1.4 billion people, few had a lower starting point in life than him, but today there are no more than 300 people who are richer than him. Zhang Junjie, 30, is on the list for the first time with a net worth of 12.4 billion yuan.

Lucky Coffee came to a close. Revenue in 2024 reached 34.5 billion yuan, a tenfold increase from 5 years ago. The biggest beneficiaries were not the founder Lu Zhengyao, who was kicked out, or Guo Jin's first-class management at risk, but Lai Hui of Dazheng Capital, which lost 36% of the shares. This year, Li Hui made the list with a net worth of 15.08 billion yuan. He is also the husband of Zeng Zimo, the former star host of Phoenix TV.

However, the story is far from over. In the takeout war between JD and Meituan, Cudi Coffee sold 20 million orders a month, and the founder of Cudi was Lu Zhengyao. Will Lu Zhengyao, who was on the list, return one day?

“What LV sells is not a bag, it's an identity”. This successful logic can be applied perfectly to domestic consumer goods that have emerged in recent years — Haidilao sells not hot pot, but service; milk tea is not milk or tea, sweet sweet water that lasts a long time at work; old stores sell gold not gold, but Chinese luxury goods; Bubble Mart sells not toys, but “small luck” where young people can embrace the trend for tens of yuan.

Emotional value is embedded, which is also the intrinsic support for their high gross profit and high premium. This year, Xu Gaoming, and Xu Dongbo, a father and son from the old gold store, were listed with a market value of 23.3 billion yuan. Their stores were only able to line up to enter the market. The price of a single gram of gold jewelry reached 2.3 times the purchase price, highlighting the luxury position. In the gold jewellery industry, where homogenization is severe, the gross margin of Chow Tai Fook and Chow Sang Sang Sang Sang is only slightly over 20%, while the gross margin of old gold stores is as high as 40%.

In “Wu Zetian,” which was a hit 30 years ago, Mao Geping styled Liu Xiaoqing's makeup for ages 14 to 80, and became famous in World War I. Today, Mao Geping (01318), the domestic beauty brand it founded, has successfully landed on Hong Kong stocks, with a gross margin of 84%. Mao Geping, his wife Wang Liqun, and two sisters Mao Niping and Mao Huiping jointly own 64.5% of the company's shares. The family first appeared on the list with a net worth of 16.6 billion yuan.

Competition on the consumer durables circuit is more enduring and more intense. One sign worth paying attention to is that the momentum for wealth creation on auto racing tracks is beginning to lean towards traditional car companies. The market value of shares held by senior car industry experts such as BYD Wang Chuanfu, Geely Li Shufu, and Celis Zhang Xinghai all rose sharply. This year, the net worth of 43.5 billion yuan, 27.3 billion yuan, and 24.6 billion yuan respectively, while the net worth of Ideal Auto Car Li Xiang and Xiaopeng Motor's He Xiaopeng fell by 40% and 20%, respectively. What was further frustrated was NIO Li Bin. The market value of his stock holdings plummeted from 10.8 billion yuan last year to 4.8 billion yuan, falling down the list. What kind of future will NIO, which still hasn't reversed its losses, face?

Industry richest list: 17 major industries, 6 richest people benefit from the NEV wave

The ability of different industries to create wealth has migrated over time. The rotation of the richest people in the same industry can more intuitively reflect who is on top of the wave and who has received the dividends of the times (Table 6).

If, previously, real estate was a pillar industry, driving a long, three-dimensional industrial chain, then judging from this year, at least 6 of the 17 major industries are richest, directly or indirectly related to the rise of the NEV industry.

One is Zeng Yuqun, the richest man in the energy and environmental protection industry. It was founded by Ningde Era (03750), which is a leading company in the global power battery sector. In 2024, its market share reached 37.9%, which is 20 percentage points higher than the second place. Its performance and market value are directly linked to the competitiveness of China's new energy vehicles.

The second is Lu Xiangyang, the richest man in the financial services industry. With an angel investment of 10 million yuan 30 years ago, he successfully bet on his cousin Wang Chuanfu to support the latter in establishing BYD, which sells the most NEVs in the world today. What is even more invaluable is that after 30 years, Lu Xiangyang still holds 13.55% of BYD's shares, corresponding to a market capitalization of more than 110 billion yuan. In fact, many couples and business groups are putting pressure on Oriental Wealth, making him the richest person in finance.

The third is Pei Zhenhua and Rong Jianfen, the richest people in the machinery and electrical equipment industry. Their main wealth also comes from their holdings in the Ningde Era. In addition, the two also hold 32% of Tianhua Xinneng's shares. In 2024, the market value of Ningde Era surged by 400 billion yuan, driving Pei Zhenhua and his wife to surpass Liang Wengen of Sany Group and become the richest people in the industry.

Fourth is the Xiang Guangda family, the richest man in the metal and smelting industry. The Qingshan Holding Group, which it founded, controls about 30% of Indonesia's nickel ore resources. In 2025, the annual production of high-ice nickel is expected to increase to 1 million tons, accounting for more than 40% of the global supply. Among ternary batteries used in new energy vehicles, nickel is the key material, accounting for 30% to 40% of the cost. As a result, the Qingshan Group has attracted competition from Ningde Era and Tesla to invest in capital cooperation. In 2024, Qingshan Group's revenue reached 382.1 billion yuan, and the Xiang Guangda family continued to top the industry list with a net worth of 60.5 billion yuan this year, surpassing Shagang's Shen Bin family and Tianqi Lithium Jiang Weiping.

The fifth is the Chao Dewang family, the richest man in the construction and building materials industry. Also starting with engineered glass and household glass, Follett and Fuyao Glass chose different upgrade directions. In 2024, 90% of Follett's revenue comes from photovoltaic glass, while 90% of Fuyao Glass's revenue comes from automotive glass. Previously, Follett followed the sharp rise in PV expansion performance and market capitalization. In fact, the market value of the controller Ruan Hongliang's shares was as high as 64 billion yuan in 2021, but now it is impossible to escape the turbulent cycle. Follett's net profit fell 60% in 2024, and the stock price was only 30% off when it was high.

Following the explosion of automobile racetracks, Fuyao Glass promoted the development of high-value-added products such as smart panoramic roof glass, dimmable glass, and head-up display glass. The revenue growth rate has stabilized at 20% in recent years. With a market value of 365 billion yuan, the Cao Dewang family successfully regained the position of the richest person in the industry.

In addition to directly benefiting the five richest people in the industry, Yang Shaopeng, founder of Haifeng International, also benefited indirectly. It is China's massive exports of new energy vehicles, mobile phones, home appliances, and machinery, and shipping, which has relatively weak supply-side elasticity, that has become a lucrative booming industry.

More than 40 years ago, Yang Shaopeng was just an ordinary wharf porter at Qingdao Port. Today, Haifeng International, which he founded, has built a service system covering the entire industry chain, including international freight, shipping agency, warehousing, and customs declaration, and is more vigorously promoting the land and sea transportation collaboration model. The controlled capacity is ranked 13th in the world and 4th in the Asian market. The revenue in 2024 is 22 billion yuan, and the net profit is as high as 7.4 billion yuan. With a net worth of 21.3 billion yuan this year, Yang Shaopeng surpassed Li Jie, founder of Jitu, and became the new richest man in the transportation industry.

Being able to keep up with the pulse of the times and seize the dividends of the times is a leading internal skill that entrepreneurs need to practice to reach the top of the industry's richest people. In 2025, out of 17 major industries, 13 richest people in the industry successfully defended their title, and 4 richest people in the industry changed. In addition to the machinery and electrical equipment, construction materials, and transportation industries mentioned above, the richest man in the chemical industry has also changed. Resource endowments brought by different regions and strategic choices for the future are the keys to the entrepreneurial wealth sector.

Baofeng Energy, headquartered in Ningxia, made full use of the rich coal and green power resources in the Great Northwest, successfully implemented cost control, successfully weakened cyclical attributes and superimposed the green hydrogen strategic layout. Its 250,000 tons/year EVA project was officially put into operation in 2024; Inner Mongolia's 2.6 million tons/year coal-to-olefin project with 400,000 tons/year green hydrogen coupling to olefin progressed rapidly, and its performance bucked the trend. Its founder, Dang Yanbao, promoted to become the new richest person in the industry with 87 billion yuan of assets this year.

However, Rongsheng Petrochemical, controlled by the Li Shuirong family, the richest man in the industry last year, used crude oil as the main raw material, which is difficult to control on the cost side. The product structure is biased towards traditional industrial products, continuing the chemical industry's style of heavy assets and high liabilities. In recent years, its financial costs have been high and profitability has declined markedly. The family's shareholding wealth has declined from a high of 130 billion yuan in 2022 to 82.6 billion yuan this year.

It is worth mentioning that Wang Jianlin, the father and son of Wang Sicong, the richest man in the real estate industry, made it to the top ten last year, but due to the successive pledges of their shares in core companies, their shareholding wealth dropped sharply to 58.8 billion yuan this year, ranking fourth to last among the richest people in 17 major industries. This is also the lowest ranking in history for the first time in real estate.

Among the wealthy people on the real estate industry list, only Zhu Yan from Shell, Huang Chulong of Galaxy Group, Qi Jinxing of Binjiang Group, and Qi Jiaqi's father and son have clearly recovered, or indicate that real estate adjustments are not over yet.

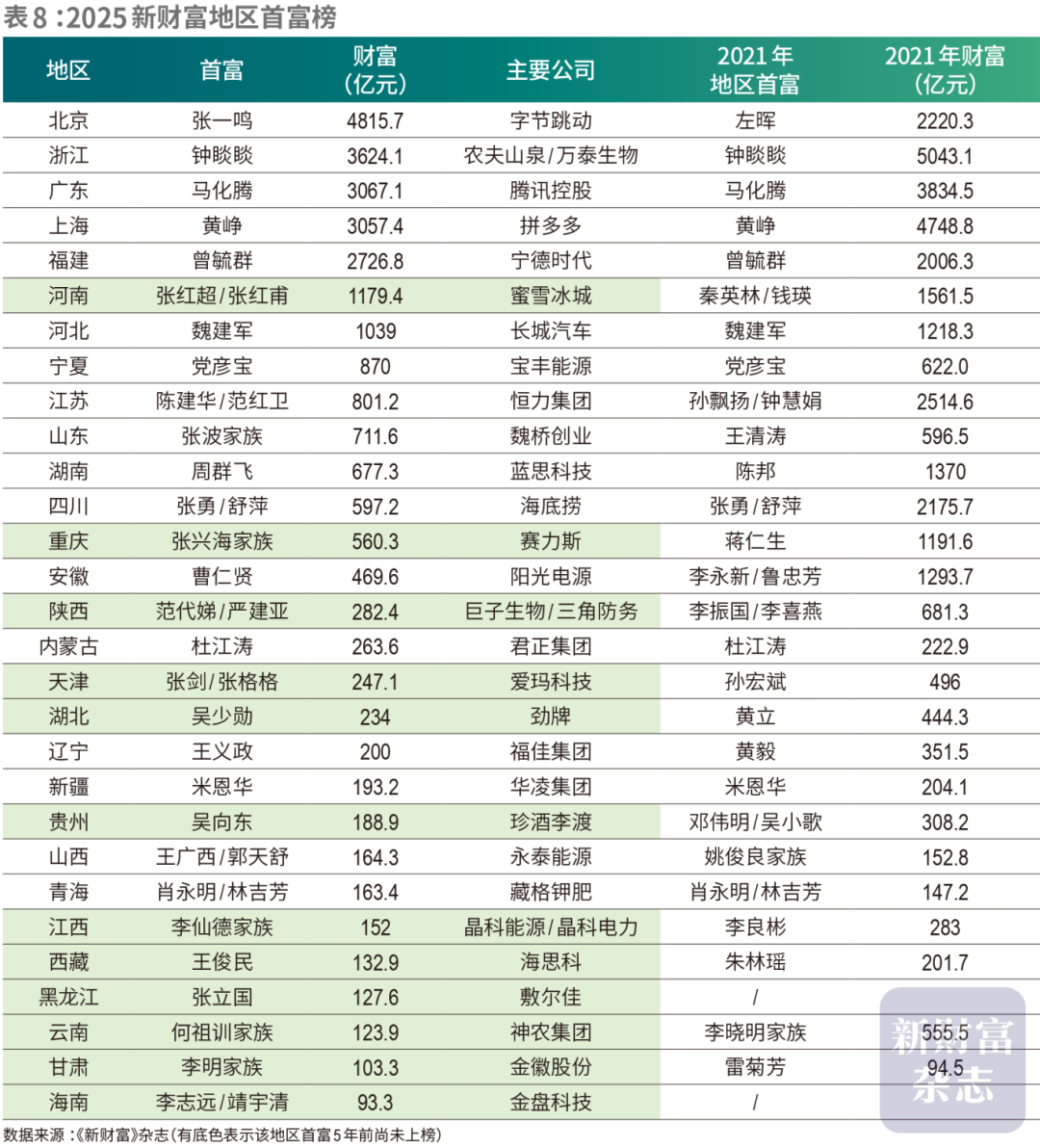

Regional wealth creation list: The Yangtze River Delta became the big winner, and the western wealth creation power jumped significantly

Looking at the number of people on the list in various regions, since 2021, Guangdong, Beijing, Anhui, and Liaoning have lost 16 seats, 13 seats, 7 seats, and 5 seats respectively. In contrast, the Yangtze River Delta has clearly risen, and Zhejiang, Shanghai, and Jiangsu have each added a net increase of 10, 7, and 8 new players. Interestingly, with Sichuan as the lead, economic catch-up regions such as Tibet, Xinjiang, Inner Mongolia, and Gansu have also sprung up more people on the list (Table 7).

Specifically, the industrial cycle is still the main baton of wealth creation. Looking back, 2021, when the stock market and real estate prices were high, was also the historical high for many data on the wealth creation list. It was also the historical high in Guangdong, where the headquarters of real estate companies gathered, on the list. This year, although the number of people on the list in Guangdong is still number one, it has slipped from 112 in 2021 to 96, and the total wealth of entrepreneurs on the list has also shrunk by 1/3 from 4.5 trillion yuan to 3 trillion yuan. The screening of losers is mainly focused on the real estate and upstream and downstream sectors. In 2021, the 21 entrepreneurs on the list in Guangdong came directly from the real estate industry. With the shift in the real estate cycle, Evergrande Xu Jiayin, Baoneng Yao Zhenhua, and “Bronze King” Wang Wenyin are now all mired in mud, and Guangdong's advantageous home appliance and home furnishing industries have also been adjusted.

The number of people on the list in Beijing also dropped from 83 in 2021 to 70, and the total wealth of listed entrepreneurs dropped from 3.2 trillion yuan to 2.2 trillion yuan. Whether in terms of numbers or wealth value, Beijing has been overtaken by Zhejiang and retreated to third place. In 2021, there were 15 entrepreneurs on the list in Beijing from the real estate line, 9 from the medical biology line, and 4 from the education line. These industries have all been adjusted in recent years, affecting Beijing's ranking.

However, most of the unicorns that have emerged in recent years come from hard technology fields such as artificial intelligence and humanoid robots. Whether it is Beijing, which gathers first-class science and innovation resources, or Guangdong, which is famous for hardware industrialization and technology commercialization, they all have plenty of momentum for innovation. According to the “China Unicorn Enterprise Development Report (2025)”, out of 409 unicorn companies in China, the number of them went north to Shenzhen, Hangzhou and Guangzhou, and the total valuation exceeded 70%. How can the founders of these unicorns continue to be transported to the wealth creation list? Beijing and Guangdong are already speeding up their layout.

Surprisingly, in the central star province of Anhui, there were 12 people on the list in 2021, but now only 5 people are on the list. The ranking has plummeted from 8th place to 14th place. The total wealth of those on the list has dropped from 320 billion yuan to more than 80 billion yuan, a drop of more than 70%. The reason for this is that in 2021, the richest man in Anhui was the mother and son of Li Yongxin of Chinese public education, with a net worth of 129.4 billion yuan. Today, the stock price of Chinese public education is only 7% of the high. Furthermore, the Wu Junbao family of Chinese Oriental Education, which was on the list at the time, and the Li Weiwei and Wu Xushun families of 37 Entertainment have now also disappeared from the list. Amid the wave of industrial transformation and upgrading, it is worth planning ahead for how Anhui, known as the master of state-owned venture capital, can quickly cultivate new private enterprise leaders and maintain its “Huaijun” advantage in the field of wealth creation.

This year, Zhejiang bucked the trend and added 10 seats, strengthening the return of the manufacturing industry and the rise of emerging industries. Of the 76 Zhejiang entrepreneurs on the list, 28 have been added to the list in the past 5 years, and 11 focus on the machinery and power equipment, metals and smelting, and chemical industries. They mainly serve the needs of the semiconductor and NEV industries.

As mentioned before, 4 of the top ten richest people are already from Hangzhou, Zhejiang. If DeepSeek was born in Hangzhou because Liang Wenfeng graduated from Zhejiang University, then Wang Xingxing, founder of Yushu Technology, was previously an employee of DJI (Shenzhen) and later went back to Hangzhou to start a business; Feng Ji, who created “Black Myths: Goku,” also moved this project to Hangzhou after founding Game Science in Shenzhen, showing that many entrepreneurs have made a choice between the two places. Why is this wave of burgeoning innovation concentrated in Hangzhou rather than Shenzhen, which has the title of “Innovation Capital”? This topic has already aroused heated discussions among various parties, and will the implications reshape the future wealth creation landscape?

Shanghai and Jiangsu also saw net increases of 7 and 8, respectively. One of Shanghai's advantages is the rise of the semiconductor industry, with many relevant entrepreneurs such as Gekowei Zhao Lixin, Shengmei Shanghai Wang Hui, Huaqin Technology Zhang Ruian, and Lexin Technology's Zhang Ruian on the list; second, in the mobile internet era, Miha Tour and Xiaohongshu became spiritual homes for a generation of young men and women, contributing 6 new riches; third, Shanghai, which is far ahead in terms of per capita disposable income, is more willing to invest in consumption. The growth in Jiangsu, on the other hand, is mainly due to the rise of the wind power and photovoltaic industry chain.

Remarkably, the number of people on the list in Sichuan rose from 9 in 2021 to 16 in 2025, surging by 7, but it is difficult to sum up the superior tracks in the region, such as automobile passenger transportation, specialty gases, tea, home furnishing stores, liquor, and prepared dishes. It is a track where new entrepreneurs from Sichuan have been working hard in recent years.

A more reasonable explanation might be that, as a leader in the West, the obvious rise in the number of people on the list in Sichuan is a reflection of the rise of the entire Great West.

From a macro perspective, since 2021, the wealth gap between the top players in various regions has narrowed markedly.

In 2021, one province in Guangdong accounted for 22% of the number of people on the list. At the same time, there were 15 provinces with fewer than 5 people on the list, and in total, only 27 people were on the list in these 15 provinces, accounting for only 5.4%. The momentum for wealth creation varies greatly between regions.

Today, the number of people on the list in these 15 provinces has reached 46, a marked increase. Among them, Inner Mongolia surged by 3 places on the list compared to 2021, while Hubei, Xinjiang, and Jiangxi each had a net increase of 2 places; Shaanxi, Guizhou, Shanxi, Tibet, Gansu, Heilongjiang, and Hainan each had a net increase of 1 place on the list. The provinces previously lagging behind in terms of wealth creation momentum have improved significantly by 2/3.

So, where exactly does the momentum for wealth creation come from in various regions? Let's take another look at the changes in the richest people in the region.

List of the richest people in the region: Consumption became the main track, Henan's “Snow King” replaced the “Pig King”, and the skincare and wine industry tracks each contributed two richest people

The richest championships in various provinces are very competitive.

In 2025, there were as many as 19 richest people. Unlike 2021, that is, over a period of 5 years, up to 2/3 of the richest people in the provinces changed (Table 8).

There are 12 richest people in the region. Five years ago, they had no names on the list. What's interesting is that they mostly come from the consumer industry. Compared to the Internet, manufacturing, and other industries, which are extremely easy to form a national monopoly advantage, the unique consumer circuit in various regions has instead surpassed the richest people in the region.

For example, as a major agricultural province, Henan doesn't seem to have an advantage in wealth creation in the industrialization and internet age, but in China where “people take food for heaven,” Henan used 1/16 of the country's arable land to contribute 1/2 of the country's ham sausage, 1/3 of instant noodles, 7/10 dumplings, and 4/5 of hot and sour powder. Following the trend, many food racetracks have become rich, such as Muyuan Qin Yinglin, Shuanghui Wanlong family, Weilong Liu Weiping, Sanquan Chen Zemin, etc.

Today, “Snow King” surpasses “Pig King,” and the new richest brother Zhang Hongchao also enjoys a convenient location. The base of Michelle Ice City in Wenxian County, Henan produces 500,000 tons of raw materials per year, with a self-supply rate of more than 60%, reducing its cost by more than 10%. Furthermore, Henan has a population of 100 million, second only to Guangdong and Shandong, and has a sufficiently declining market size, thus helping Michelle Ice City become the king of volume.

Fan Daidi and Yan Jianya, the actual controllers of Giants Biology, replaced Li Zhenguo of Longji Green Energy and others, and were promoted to become the new richest people in Shaanxi. Fan Daidi also currently holds the position of vice-chancellor of Northwestern University. Yang Xia from Jinbo Biotech, who is also deeply involved in the recombinant collagen circuit, is the richest woman in Shanxi.

Zhang Liguo of Shierjia also came from the medical and aesthetic skincare circuit. With a mask, he earned a net worth of 12.76 billion yuan and became the new richest person in Heilongjiang.

Furthermore, the new richest man in Hubei is Wu Shaoxun, founder of Jinpai Group, and Wu Xiangdong, founder of Zhenjiu Lidu. These two also come from the consumer circuit and rely on the local market.

Hubei, which has a culture of “drinking too early”, is a model for resisting famous sake from Sichuan and Guizhou and achieving provincial wine development. Over 70% of the market share in the province is still firmly occupied by local wine companies, while the “strong wine is good, don't be greedy” brand is currently still the highest grossing alcohol brand in Hubei, and is also the number one health wine brand in the country. With a net worth of 23.4 billion yuan this year, Wu Shaoxun became the new richest person in Hubei.

In 2009, Wu Xiangdong competed for the overall assets of Guizhou Zhen Distillery through a public auction. By 2024, the number of jobs created by Zhenjiu will increase 40 times, and the amount of tax paid will increase 340 times. Of the more than 4 billion yuan in sales of the fine wine brand, 3 billion yuan came from the Guizhou market. Wu Xiangdong also controlled two listed companies, Huazhi Liquor and Li Du, and became the richest person in Guizhou with a net worth of 18.89 billion yuan.

The collective decline in valuations of previously highly valued real estate, pharmaceutical, and new energy companies has also caused changes in the richest people in the region.

In Chongqing, Jiang Rensheng of Zhifei Biotech was the richest person in 2021. His net worth reached 110 billion yuan. At the time, Cyrus's Zhang Xinghai family was not on the list. In the past five years, the net worth of Canghai Sangtian, Jiang Rensheng's father and son dropped to 38 billion yuan, while Zhang Xinghai's family became the richest person in Chongqing with 56 billion yuan.

In Tianjin, Sun Hongbin, the richest man in the past, has fallen off the list. The new richest man also came from the consumer circuit. Emma Technology, which produces electric two-wheelers, later took the lead. Actual controllers Zhang Jian and Zhang Gege's father and daughter became the richest people in Tianjin with a net worth of 24.7 billion yuan.

Practice innovative internal skills and embrace the dividends of openness

DeepSeek Cyclone, dancing robots, power batteries with a battery life of minus 40 degrees, and overseas licensing collaborations for innovative Chinese drugs continue to explode... The original “from 0 to 1” made in China is becoming more and more popular, rebuilding the anchor of confidence for global institutions to embrace Chinese assets. This has benefited from the joint efforts of all parties, including private enterprises.

Looking at this year's wealth creation list, the first tier of the top ten players is pushing for an attack from 0 to 1 in original innovation fields such as AI, algorithms, quantum computing, and chips; the backbone of TMT is responsible for breaking through technical barriers in major strategic emerging industries such as AI, chips, robotics, smart cars, and low-altitude economy, promoting the implementation and improving the efficiency of thousands of industries; and whether it's tea, whether it's new consumption such as blind coffee boxes, or new richest people in various provinces are emerging from the consumer circuit, or hinting at a more sinking domestic demand market It will make a big difference in the future.

At the same time, China's high level of openness to the outside world has also brought broad space for a new wave of private enterprises to create wealth.

On the one hand, Chinese companies are speeding up their business overseas. According to statistics from “New Fortune” magazine, according to the Shenwan industry, 5,400 A-share listed companies, and listed companies in as many as 8 industries already account for more than 20% of overseas revenue. Among them, listed electronics and home appliances companies already account for 40% of overseas revenue. In absolute terms, the overseas revenue of listed electronics and automotive companies reached 1.45 trillion yuan and 1 trillion yuan respectively in 2024.

On the other hand, many entrepreneurs have promoted the listing of their core industries in Hong Kong stocks as a new starting point for globalization. Currently, there are as many as 101 companies in the top 200 Hong Kong stock market capitalization, which are under the ranks of this year's winners.

In the long run, this will also make it easier for overseas investors to invest in China's core assets, so that the overseas dividends of Chinese companies can be shared by global investors.

Driven by the Private Economy Promotion Law, what new enlightenment will next year's list bring to people?

Wall Street Journal

Wall Street Journal