Revenues Tell The Story For SKC Co., Ltd. (KRX:011790) As Its Stock Soars 30%

SKC Co., Ltd. (KRX:011790) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 37% over that time.

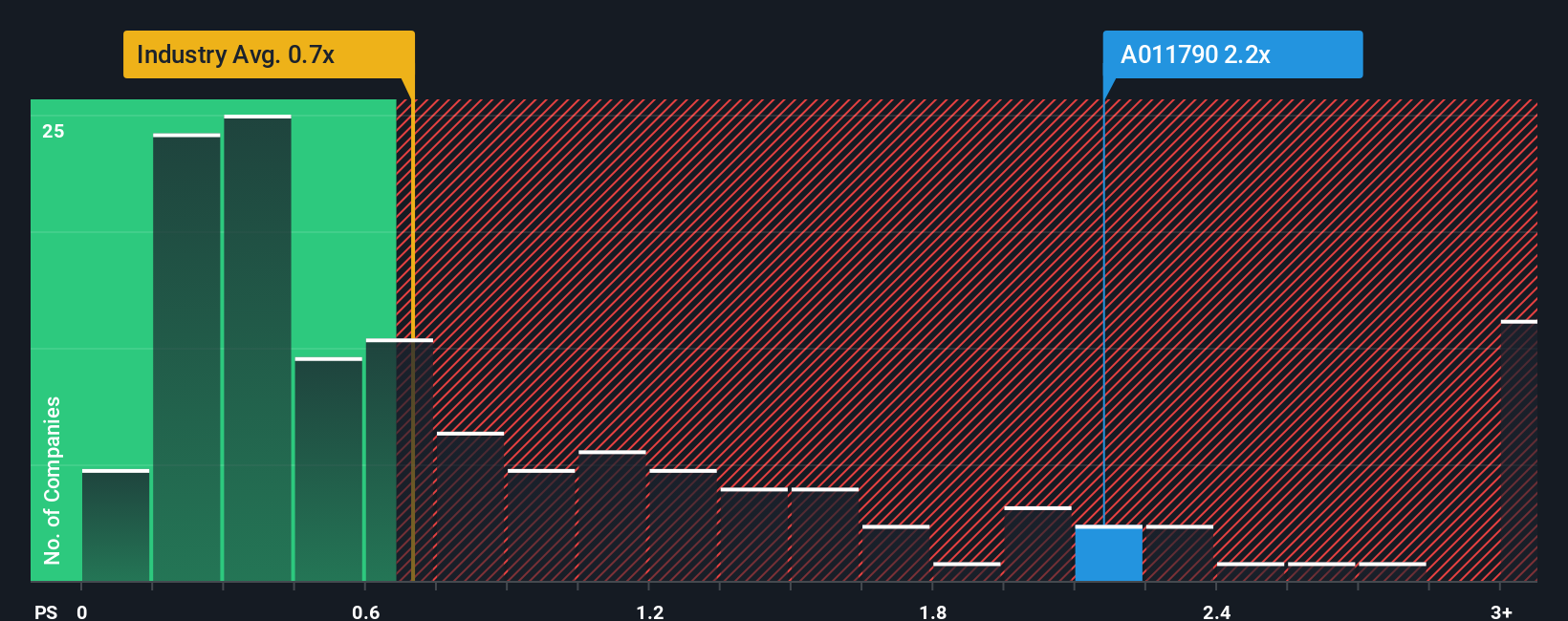

Following the firm bounce in price, you could be forgiven for thinking SKC is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Korea's Chemicals industry have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for SKC

What Does SKC's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, SKC has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think SKC's future stacks up against the industry? In that case, our free report is a great place to start.How Is SKC's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as SKC's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 23% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 31% during the coming year according to the eleven analysts following the company. That's shaping up to be materially higher than the 9.3% growth forecast for the broader industry.

With this in mind, it's not hard to understand why SKC's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

SKC shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of SKC's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for SKC (of which 1 is potentially serious!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal