Market Might Still Lack Some Conviction On GomSpace Group AB (publ) (STO:GOMX) Even After 37% Share Price Boost

GomSpace Group AB (publ) (STO:GOMX) shares have continued their recent momentum with a 37% gain in the last month alone. The annual gain comes to 174% following the latest surge, making investors sit up and take notice.

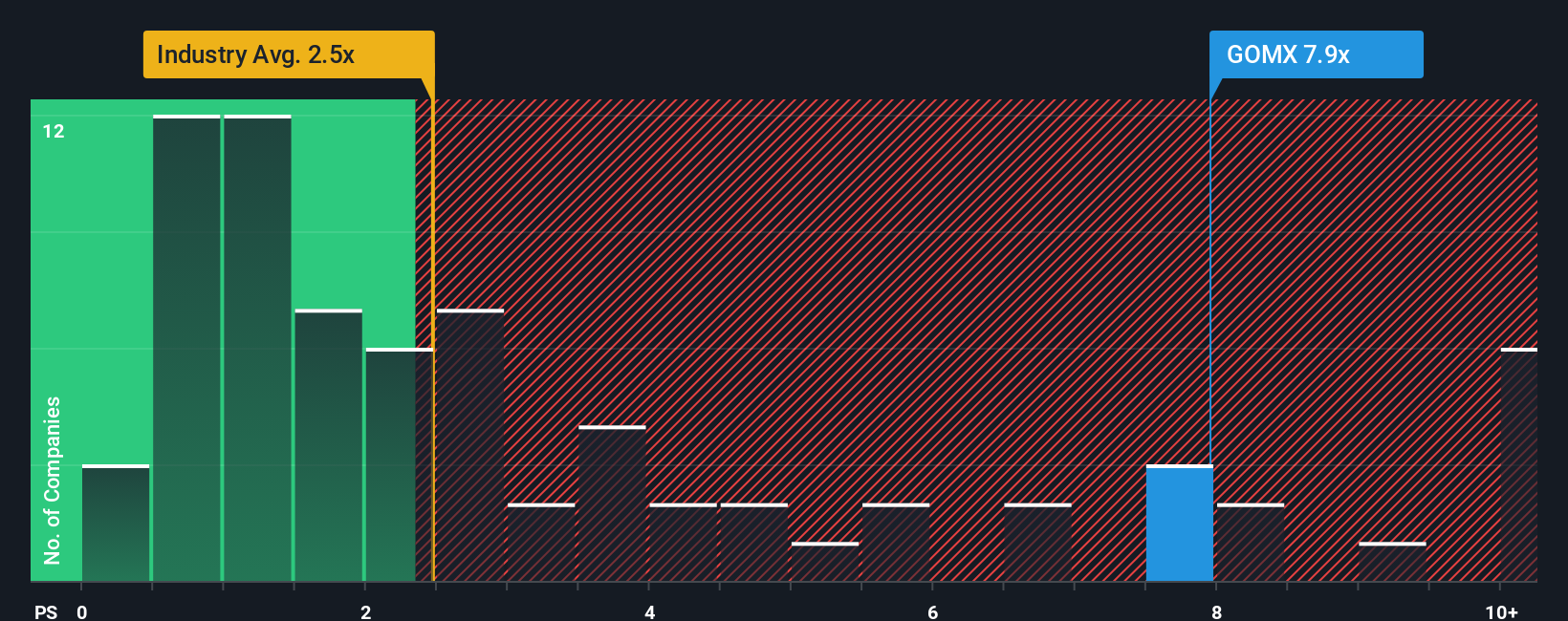

In spite of the firm bounce in price, there still wouldn't be many who think GomSpace Group's price-to-sales (or "P/S") ratio of 7.9x is worth a mention when the median P/S in Sweden's Aerospace & Defense industry is similar at about 6.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for GomSpace Group

How GomSpace Group Has Been Performing

Recent times haven't been great for GomSpace Group as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think GomSpace Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is GomSpace Group's Revenue Growth Trending?

In order to justify its P/S ratio, GomSpace Group would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.1%. The solid recent performance means it was also able to grow revenue by 20% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 41% over the next year. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

In light of this, it's curious that GomSpace Group's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now GomSpace Group's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that GomSpace Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for GomSpace Group that you should be aware of.

If these risks are making you reconsider your opinion on GomSpace Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal