Even after rising 35% this past week, Coreana CosmeticsLtd (KOSDAQ:027050) shareholders are still down 21% over the past five years

Coreana Cosmetics Co.,Ltd. (KOSDAQ:027050) shareholders will doubtless be very grateful to see the share price up 37% in the last month. But if you look at the last five years the returns have not been good. In fact, the share price is down 21%, which falls well short of the return you could get by buying an index fund.

While the last five years has been tough for Coreana CosmeticsLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

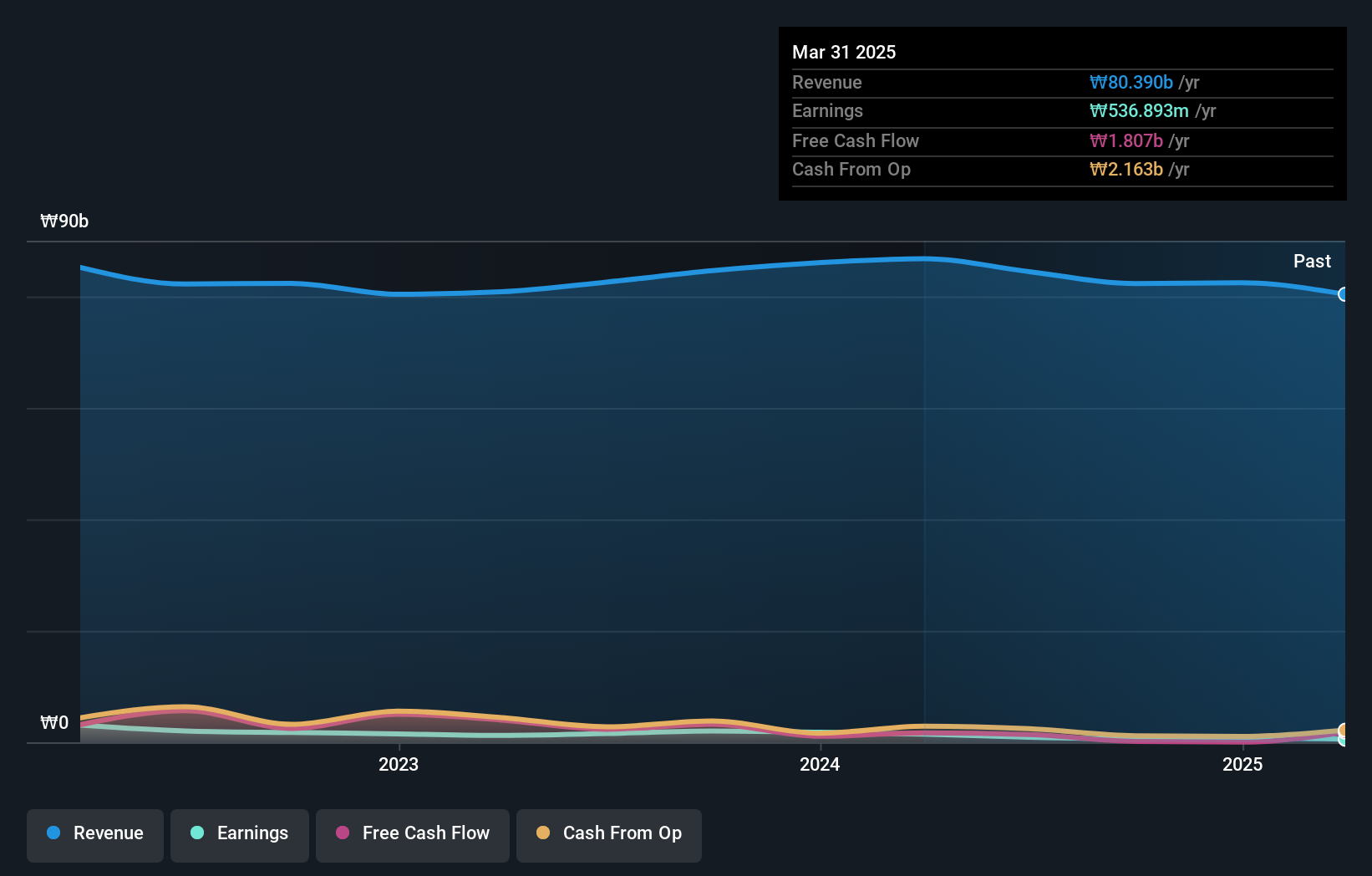

Given that Coreana CosmeticsLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years Coreana CosmeticsLtd saw its revenue shrink by 3.2% per year. While far from catastrophic that is not good. The share price decline at a rate of 4% per year is disappointing. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. Without profits, its hard to see how shareholders win if the revenue keeps falling.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Coreana CosmeticsLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 5.0% in the last year, Coreana CosmeticsLtd shareholders lost 2.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 4% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Coreana CosmeticsLtd better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Coreana CosmeticsLtd .

Of course Coreana CosmeticsLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal