Estée Lauder Companies (NYSE:EL) Climbs 17% Over Last Month

The Estée Lauder Companies (NYSE:EL) recently appointed Lisa Sequino as President of the Makeup Brand Cluster and amended its corporate bylaws, indicating a strategic focus on leadership and governance enhancement. These developments may have bolstered investor confidence, contributing to the company's 17% share price rise last month. This gain comes despite broader market fluctuations driven by geopolitical tensions and mixed economic signals, highlighting a distinct upward trajectory for Estée Lauder as compared to the general market, which remained relatively flat.

You should learn about the 2 risks we've spotted with Estée Lauder Companies.

The recent leadership change and amendments to Estée Lauder's corporate bylaws underscore the company's commitment to strengthening its operational foundation and governance. These developments may positively influence the company's ongoing transformation initiatives, which aim to enhance operational efficiency and stimulate revenue growth through digital expansion and market innovation. The appointment of Lisa Sequino could invigorate the Makeup Brand Cluster, aligning with Estée Lauder's strategic objectives to capture new market opportunities and improve earnings going forward.

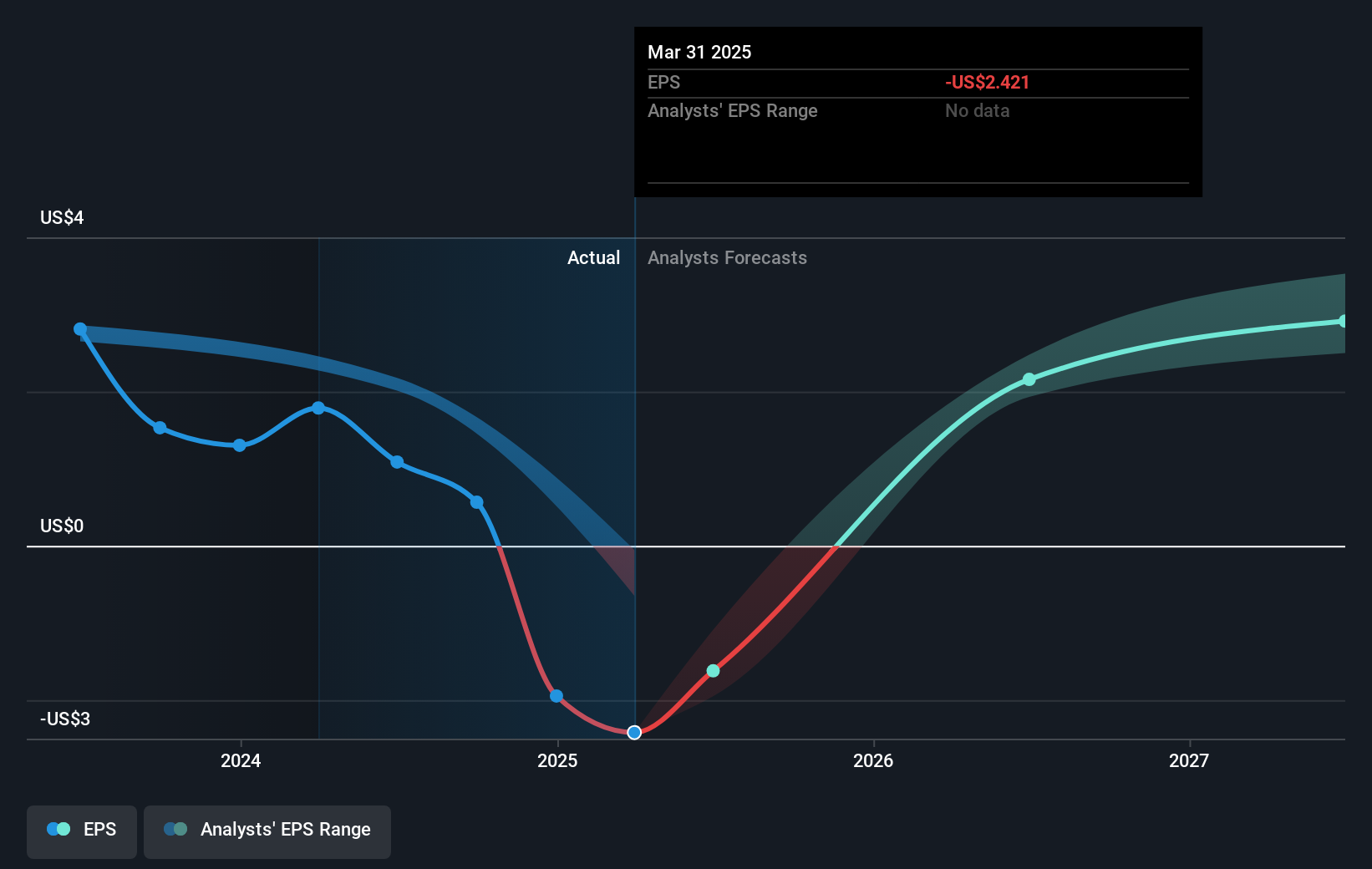

Over the past year, Estée Lauder has experienced a total shareholder return of a 32.91% decline, contrasting with the strong performance seen last month. In comparison, the company underperformed both the US Personal Products industry, which saw a 16.5% decline, and the broader US Market, which achieved a 10.4% return. This indicates a challenging period for the company over the longer term.

Looking forward, the news may have a mixed impact on revenue and earnings forecasts. While leadership enhancements could support the company's transformation goals, any potential benefits may take time to materialize given recent pressures such as declining sales and earnings challenges. The current share price of US$58.53 presents a discount to the consensus analyst price target of US$68.74, suggesting some optimism in future performance. However, the company will need to navigate ongoing headwinds, such as geopolitical tensions and weak consumer sentiment, to realize anticipated growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal