Dundee Leads The Way With 2 Other TSX Penny Stock Opportunities

As we head into the second half of 2025, the Canadian market is navigating through significant trade negotiations that could impact economic growth and inflation. Amidst this backdrop, investors are seeking opportunities in smaller companies that can offer potential value and growth. Penny stocks, despite their somewhat outdated moniker, remain a relevant investment area where financial strength and clear growth trajectories can uncover promising opportunities for those willing to explore beyond established giants.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.69 | CA$640.24M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.24 | CA$665.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.40 | CA$189.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.89 | CA$17.44M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.26 | CA$98.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.19 | CA$125.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.99M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.00 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 890 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation (TSX:DC.A) is a publicly owned investment manager with a market cap of CA$241.48 million.

Operations: The company's revenue is primarily derived from its Mining Services segment, which generated CA$1.65 million.

Market Cap: CA$241.48M

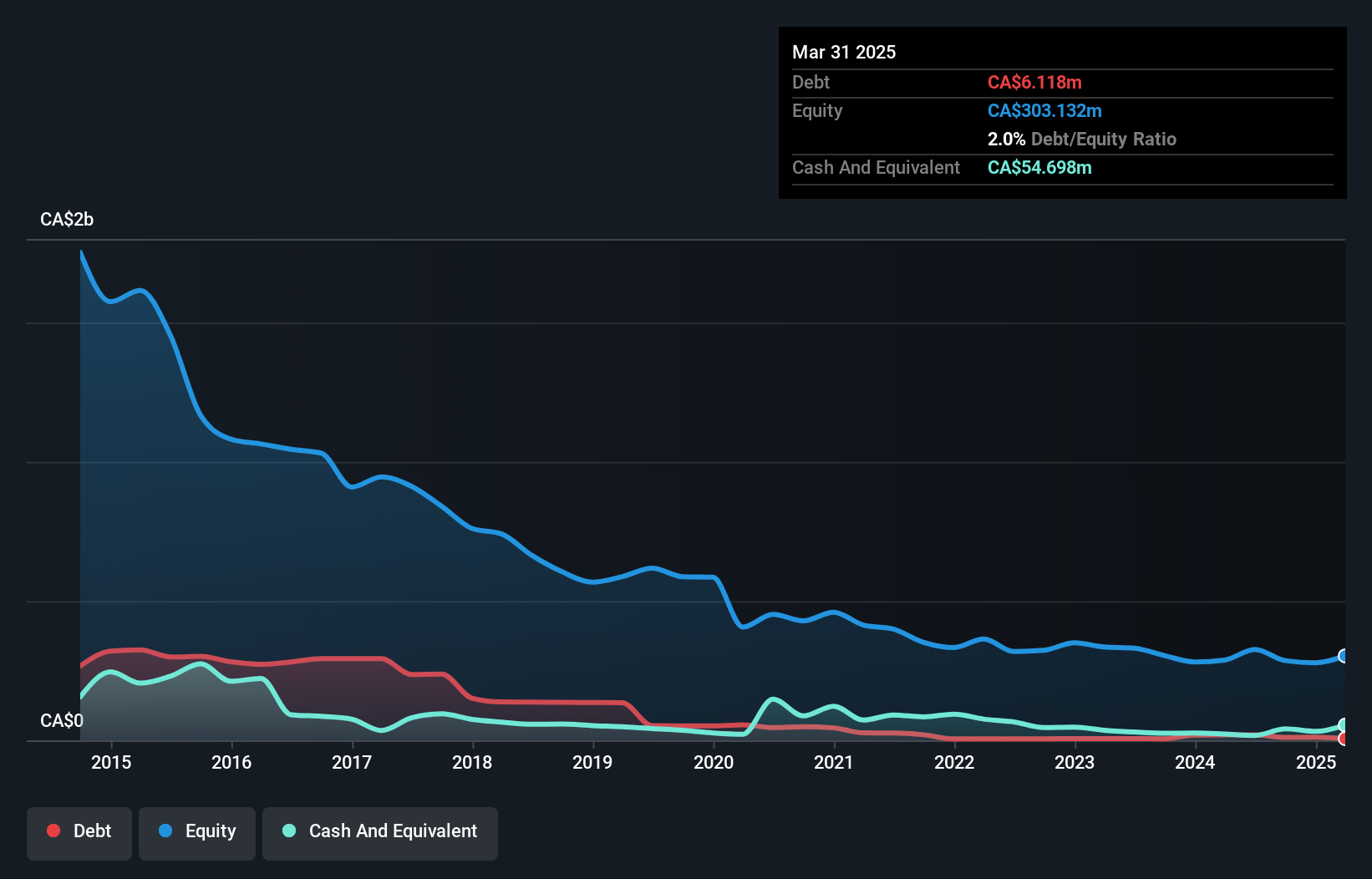

Dundee Corporation has transitioned to profitability, boasting a high return on equity of 24.6% and a price-to-earnings ratio of 3.3x, which is below the Canadian market average. Despite limited revenue from its mining services segment (CA$4 million), Dundee's financial position is strong with more cash than debt and short-term assets covering both short- and long-term liabilities. Recent strategic moves include an ongoing share repurchase program aimed at reducing outstanding shares by up to 7.46%. The company also reported significant net income growth in the first quarter of 2025, indicating robust earnings momentum.

- Jump into the full analysis health report here for a deeper understanding of Dundee.

- Learn about Dundee's historical performance here.

BeWhere Holdings (TSXV:BEW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BeWhere Holdings Inc. is an industrial Internet of Things (IIoT) solutions company that designs, manufactures, and sells hardware with sensors and software applications for tracking real-time information on equipment, tools, and inventory both in-transit and at facilities, with a market cap of CA$70.02 million.

Operations: The company generates revenue of CA$18.25 million from its Software & Programming segment.

Market Cap: CA$70.02M

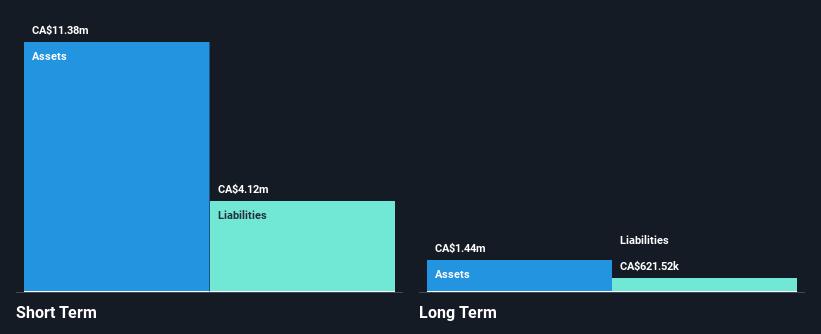

BeWhere Holdings, with a market cap of CA$70.02 million, has demonstrated steady revenue growth in its Software & Programming segment, reaching CA$18.25 million. Despite recent negative earnings growth and declining profit margins—3.2% compared to 6% last year—the company maintains a solid financial position with short-term assets exceeding liabilities and cash surpassing total debt. Its experienced management team and board bolster operational stability. The announcement of a potential share repurchase program could enhance shareholder value by reducing the number of outstanding shares, though regulatory approval is pending for this initiative set to commence on June 9, 2025.

- Click here to discover the nuances of BeWhere Holdings with our detailed analytical financial health report.

- Review our historical performance report to gain insights into BeWhere Holdings' track record.

Nickel 28 Capital (TSXV:NKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel 28 Capital Corp. is a base metals company with operations in Papua New Guinea, Quebec, British Columbia, Australia, and Yukon, and has a market cap of CA$66.28 million.

Operations: Nickel 28 Capital Corp. has not reported any specific revenue segments.

Market Cap: CA$66.28M

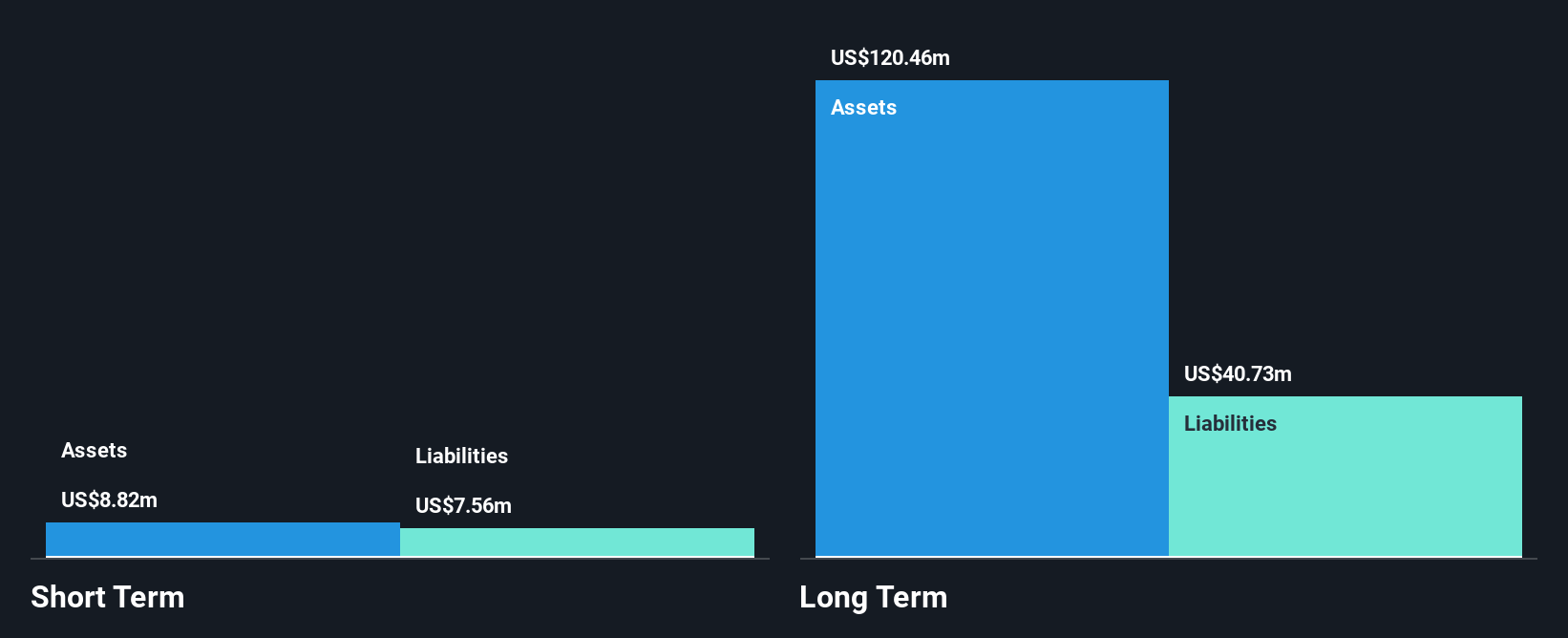

Nickel 28 Capital Corp., with a market cap of CA$66.28 million, operates in the base metals sector and remains pre-revenue, reporting a net loss of US$0.93 million for Q1 2025. Despite earnings challenges, the company has significantly reduced its debt-to-equity ratio from 170.9% to 45.7% over five years and maintains a satisfactory net debt to equity ratio of 35.1%. The Ramu Nickel-Cobalt operation shows promising resource expansion, with notable increases in reserves and resources due to successful exploration efforts in 2024. However, ongoing legal disputes involving former executives may impact future operations and investor sentiment.

- Click to explore a detailed breakdown of our findings in Nickel 28 Capital's financial health report.

- Explore historical data to track Nickel 28 Capital's performance over time in our past results report.

Make It Happen

- Unlock our comprehensive list of 890 TSX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal