Central banks around the world are mired in the “fog” of trade and politics, and the prospects for interest rate cuts are confusing

Central banks around the world are facing the problem of increased uncertainty about economic growth and inflation prospects, which complicates the decision-making process, especially for central banks trying to adjust their policies as they approach the end of the interest rate cut cycle. It also makes investment forecasting difficult. The Bank of Norway announced an interest rate cut on Thursday. This is the first time since 2020 that the bank has cut interest rates. This move came as a surprise to the market. Even the Federal Reserve warned not to rely too much on its policy predictions, which may change at any time.

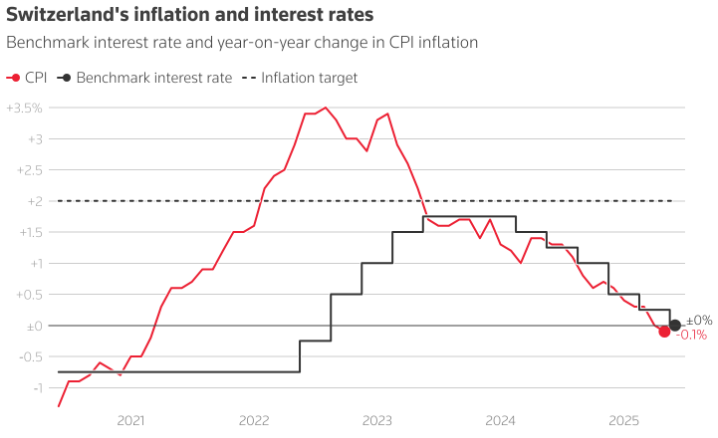

1. Switzerland

The SNB cut the benchmark interest rate to zero on Thursday. The bank said the move was due to considerations of falling inflation, the appreciation of the Swiss franc, and economic instability caused by uncertain US trade policies. The key question is whether the bank will lower interest rates to a negative range next time. The SNB is still considering various possibilities, but Chairman Martin Schlegel said that since interest rates have now been reduced to zero, it is more difficult to cut interest rates further.

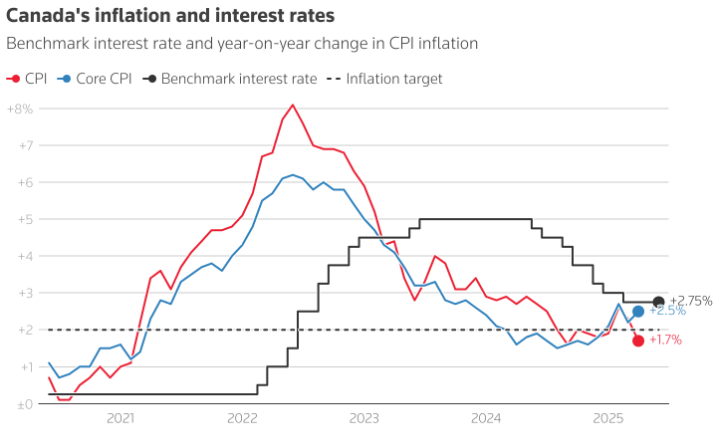

2. Canada

The Bank of Canada kept interest rates at 2.75% in early June and said that if the economy declines in the face of tariffs, further interest rate cuts may be needed. This suspension is the second time in a row that the Bank of Canada has suspended interest rate hikes. Previously, the bank had experienced a cycle of aggressive interest rate cuts, cutting interest rates by 225 basis points within nine months. The market expects to cut interest rates by another 25 basis points by the end of the year.

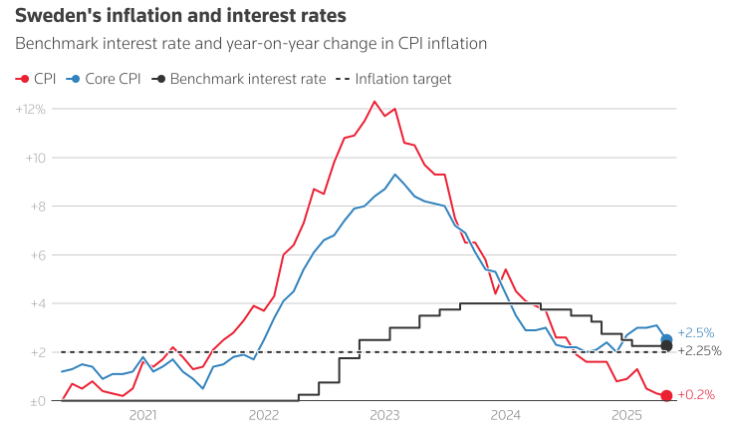

3. Sweden

The Riksbank lowered the benchmark interest rate from 2.25% to 2% on Wednesday and said that given less pressure on prices, the bank may further relax its policy before the end of the year to promote weak economic growth. The Riksbank has always been one of the more aggressive central banks, having cut a total of 200 basis points since May 2024.

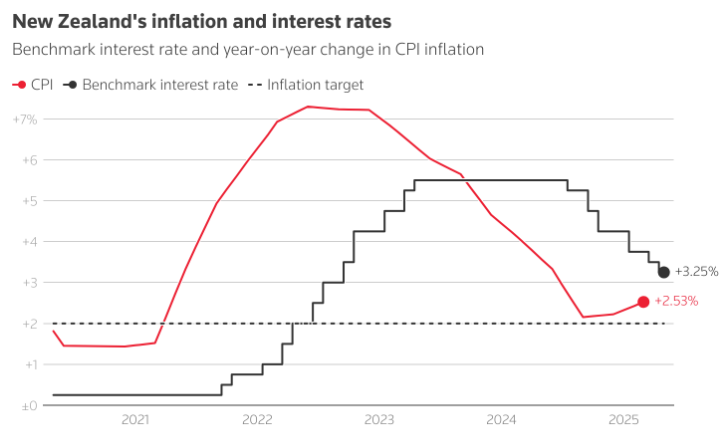

4. New Zealand

The market expects the New Zealand Federal Reserve to keep interest rates unchanged on July 9. The bank previously cut interest rates by 25 basis points to 3.25% in May to protect the economy. The New Zealand Federal Reserve also warned that uncertainty in global trade makes it difficult to predict future policy trends. The market expects another 25 basis point interest rate cut this year, and 225 basis points have already been cut during this cycle.

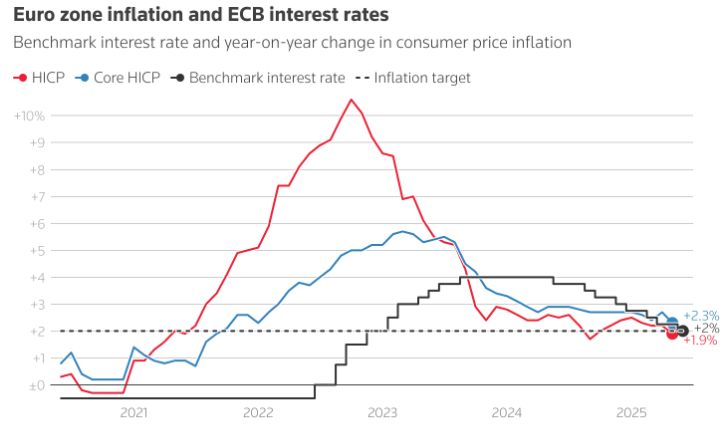

5. Eurozone

The ECB cut interest rates earlier this month, the eighth time since mid-2024, and left all possible policy options open until the next meeting. ECB President Lagarde said that the 2% inflation target set by the Eurozone central bank is attainable. For investors, the key question is whether the inflation rate will fall below this target, so further easing policies are needed. The market expects another rate cut by the end of the year.

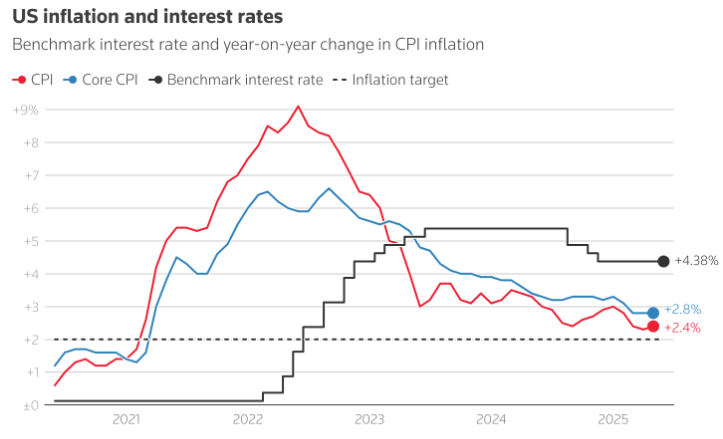

6. United States

The Federal Reserve kept interest rates unchanged on Wednesday and said that borrowing costs are likely to fall until 2025, but Federal Reserve Chairman Powell warned that we should not rely too much on this forecast. Powell said, “No one is going to have a firm belief in these... interest rate paths, and everyone will agree; these paths will all depend on data.”

He added that if it weren't for the tariff issue, and given that recent inflation data has been low, it might be time to consider lowering interest rates. The market anticipates that interest rates will still be cut about twice by 25 basis points each by the end of the year.

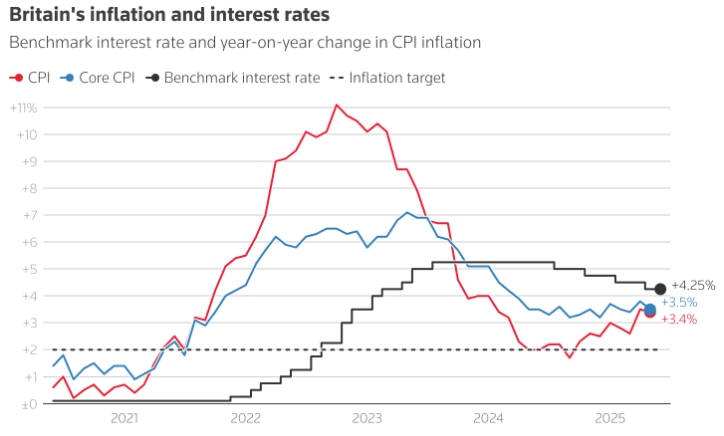

7. United Kingdom

The Bank of England's performance on Thursday unexpectedly met market expectations, keeping interest rates at 4.25%. Over the past year, the Bank of England has cut interest rates about once every quarter, and the market expects it to continue to maintain this pace, and it is expected that it will cut interest rates twice more by the end of the year.

Of the nine interest rate makers, three voted to lower interest rates on Thursday. Some investors speculate that weak labor data may prompt the Bank of England to cut interest rates faster, but others believe that due to the UK's high inflation rate, the interest rate cut process will be suppressed.

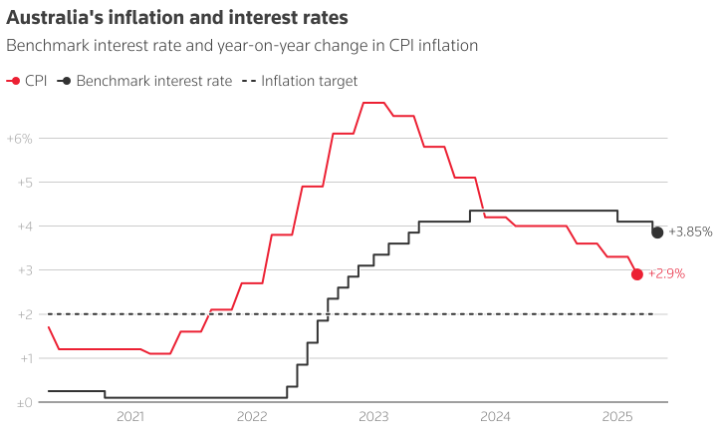

8. Australia

Australia's export-dependent economic growth data is weak, and people are worried that the trade dispute between the US and China will have an impact on commodity producers and miners, which means that the Reserve Bank of Australia is preparing to cut interest rates rapidly. The Reserve Bank of Australia cut interest rates by 25 basis points to 3.85% in May, and traders expect borrowing costs to drop to close to 3% by the end of the year.

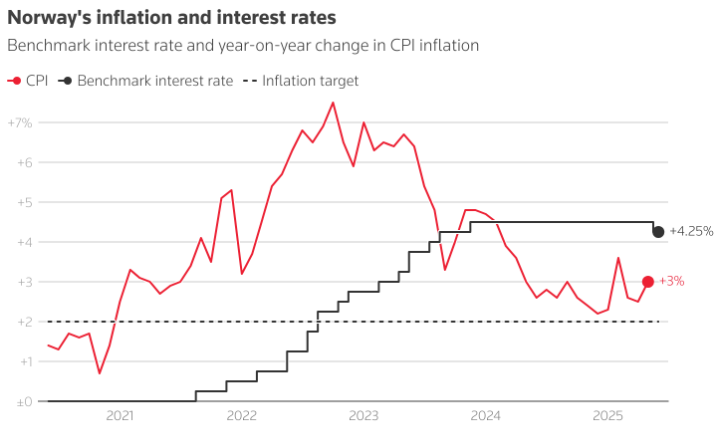

9. Norway

The Bank of Norway cut its policy interest rate by 25 basis points to 4.25% on Thursday, the first time the bank has cut interest rates since 2020. The decision went beyond most analysts' expectations and caused the local currency to depreciate. The Bank of Norway has always been one of the most cautious central banks in developed countries when it comes to cutting interest rates. Its governor Ida Bach said that it is expected to cut interest rates once or twice more this year.

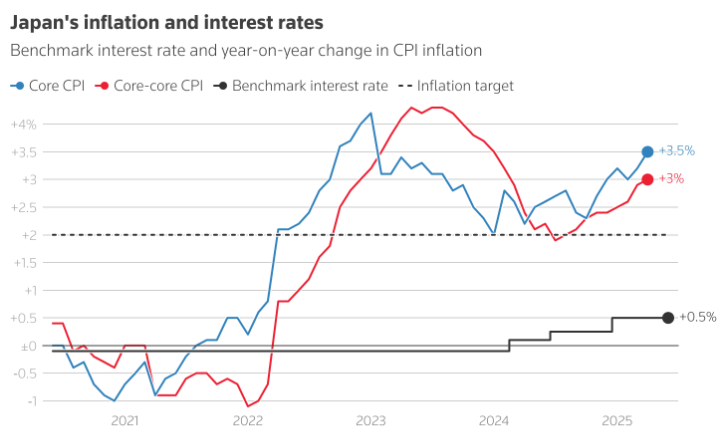

10. Japan

The Bank of Japan, as the only central bank to raise interest rates, kept interest rates unchanged on Tuesday, which was in line with investors' expectations.

The escalating situation in the Middle East and the US tariff policy have made it more difficult for the Bank of Japan to raise interest rates, which are still low, and reduce the scale of debt purchases. On Tuesday, the bank decided to slow the contraction of its balance sheet next year, indicating that it tends to be cautious about phasing out decade-long stimulus measures.

Wall Street Journal

Wall Street Journal