Oscar Health (NYSE:OSCR) Q1 2025 Revenue Surges 42% to US$3,046 Million

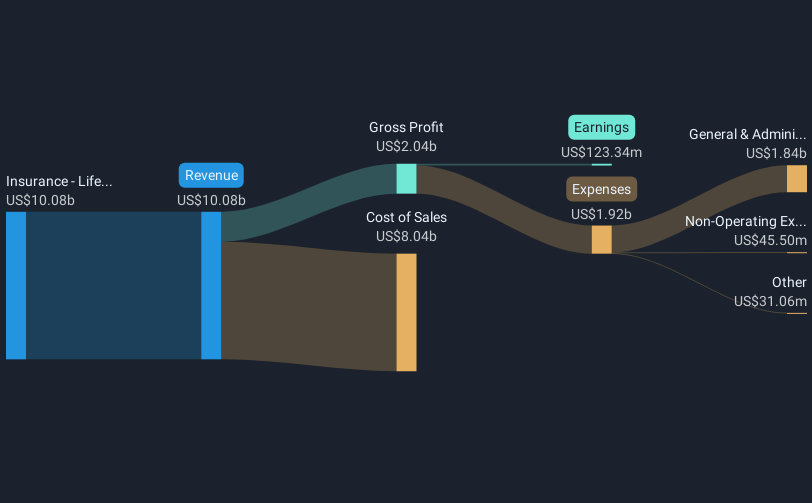

Oscar Health (NYSE:OSCR) recently announced a significant 45% price increase over the last quarter, attributed largely to robust Q1 2025 earnings. The company reported a 42% year-over-year revenue growth to USD 3,046 million, alongside a net income increase to USD 275 million. Basic earnings per share rose to USD 1.10, from USD 0.77, signaling strong performance. This growth contrasted with the broader market, which remained flat recently but showed a 9.9% annual increase. Upcoming events, like the scheduled Annual General Meeting, along with positive financial results, likely reinforced investor confidence amidst an environment of projected annual earnings growth.

The recent announcement from Oscar Health, demonstrating a significant 45% increase in share price due to robust Q1 2025 earnings, suggests a positive market perception of the company's current and future financial performance. This optimism aligns with the company's reported 42% year-over-year revenue growth and net income increase to US$275 million, underpinned by an earnings per share rise to US$1.10. The company's enhanced performance and strategic initiatives in AI integration and ICHRA enrollment are poised to elevate efficiency, potentially driving further revenue and earnings growth.

Looking at the longer-term context, Oscar Health's total shareholder return over a three-year period, including share price and dividends, reached 330.50%, reflecting substantial appreciation. However, over the past year, Oscar Health underperformed the US Insurance industry, which returned 14%. This performance contrast highlights potential volatility and investor sentiments influenced by broader industry trends.

Oscar Health's share price increase aligns closely with its fair value consensus analyst price target of US$19.36, which is 32.5% higher than the current share price of US$13.07. This target suggests potential upside, though analysts exhibit varying expectations, with the most bullish suggesting a price target of US$28.0. The positive sentiment bolstered by recent earnings reports may continue to impact future revenue and earnings forecasts, with expectations of US$13.5 billion in revenue and US$564.5 million in earnings by 2028. As Oscar Health navigates potential risks related to regulatory changes and market conditions, investors should weigh these against the optimistic forecasts.

Understand Oscar Health's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal