Alnylam Pharmaceuticals (NasdaqGS:ALNY) Appoints New R&D Chief to Drive Growth Phase

Alnylam Pharmaceuticals (NasdaqGS:ALNY) recently announced the appointment of Dr. Pushkal Garg as Executive Vice President and Chief Research and Development Officer to accelerate its R&D efforts. This leadership change, along with the European Commission's approval of AMVUTTRA for treating transthyretin amyloidosis with cardiomyopathy, contributed to a 23% price rise over the last quarter. While the market has risen 10% over the past year, Alnylam's focus on executive roles and drug approvals supports its trajectory. These events bolstered investor confidence amid broader flat market trends, potentially strengthening Alnylam's standing in the biotech arena.

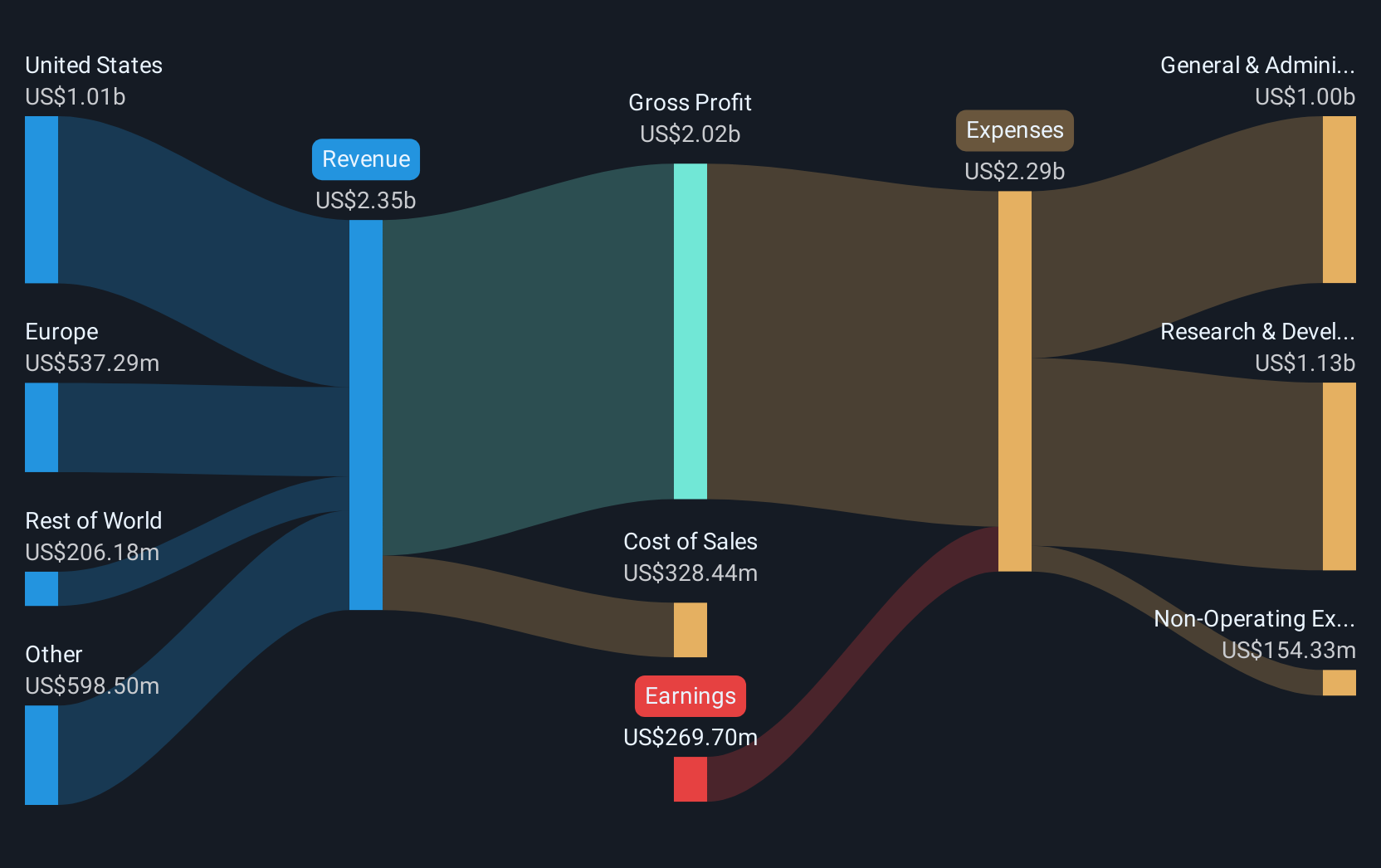

The recent leadership change at Alnylam Pharmaceuticals, with the appointment of Dr. Pushkal Garg, aligns with the company's efforts to enhance its R&D capabilities. This move, alongside the European approval of AMVUTTRA, underscores Alnylam's commitment to driving revenue growth through expanded treatment options. Over the past three years, Alnylam's total returns, including share price appreciation and dividends, have been remarkable at 120.63%. This growth stands out against last year's industry trend where the US biotech sector saw a decline of 9.9% while Alnylam posted a positive return, exceeding the broader market increases of 9.9% during the same period.

The recent developments support analysts' expectations for increased revenue and improved profit margins. The successful AMVUTTRA launch and a robust RNAi pipeline could significantly influence future earnings forecasts. With the current share price at US$269.81, the market exhibits confidence but remains undervalued relative to the consensus analyst price target of US$320.56. The approved drug indications and strengthened research efforts may propel Alnylam closer to the target, enhancing investor optimism about sustainable profitability and long-term growth. However, considering the broader market context and growth expectations, investors should continue to assess these projections critically.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal