J.P. Morgan warns that copper prices may drop to 9,100 US dollars in the second half of the year or now “hangover” in Q3!

The Zhitong Finance App learned that J.P. Morgan Chase released a report saying that in the second half of 2025, the slowdown in US copper tariffs and Chinese demand may cause copper prices to fall to around 9,100 US dollars/ton in the third quarter. Earlier, advance US import purchases and Chinese market demand tightened copper supply. As the tightening factors are reversed, the market will gain breathing room. Overall, however, copper supply growth is still facing challenges, so copper prices may find basic support at $9,000 per tonne or slightly above this level.

J.P. Morgan's main views are as follows:

Copper fundamentals were significantly tightened in the first half of 2025 due to two major early procurement factors: US imports before potential copper tariffs and the early release of Chinese demand. We believe that both major developments will occur in the second half of 2025, which makes us more cautious about copper prices for the rest of the year. Copper prices are expected to fall to around 9,100 US dollars/ton in the third quarter of 2025, and then stabilize at around 9,350 US dollars/ton in the fourth quarter of 2025.

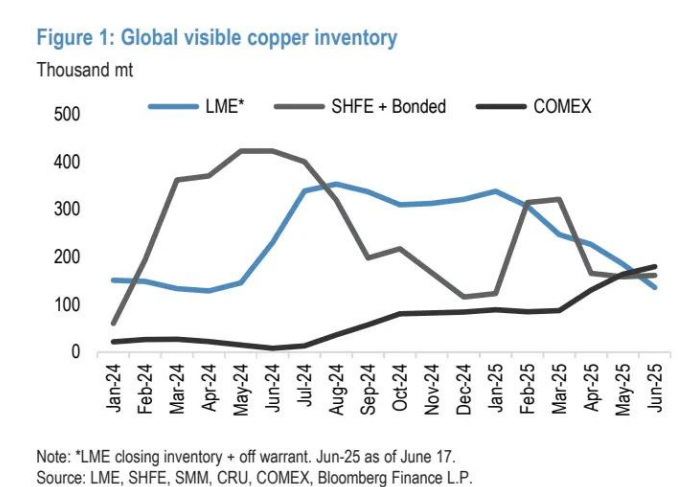

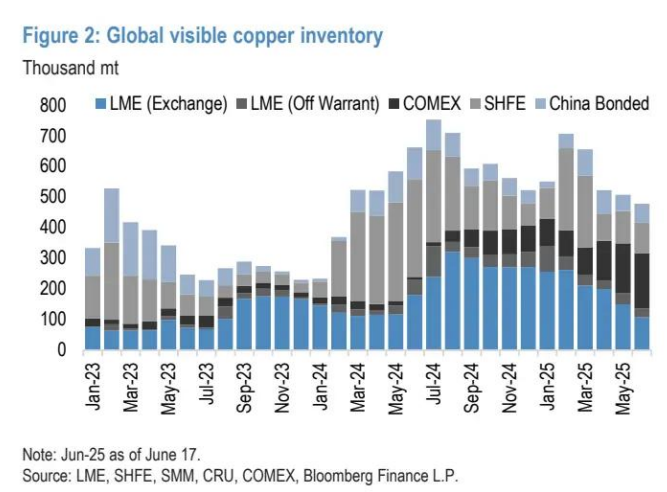

Global copper stocks are not extremely tight as a whole; rather, there are significant misalignment and imbalance. Before potential tariffs are implemented, the US is expected to import about 430,000 tons of surplus refined copper (higher than normal import demand) in the first half of 2025, which is equivalent to about six months' inventory of normal US copper import demand. As detailed in our report, our benchmark scenario still assumes that the US will announce a 25% tariff on imports of refined copper and copper products by the end of July.

When the certainty of copper tariffs comes, this situation of early import purchases will begin to reverse, and the US may experience a multi-month inventory removal cycle. During this period, US refined copper imports may drop to a very low level, thus shifting more supply to other parts of the world, especially Asia. The increase in supply flows to Asia is likely to coincide with a slowdown in Chinese demand in the second half of 2025. China's copper demand grew at a rate of about 7% year over year, but this growth trend has slowed since April.

Although demand for power grids is likely to remain strong, we expect the strong demand for air conditioning and white goods to be reversed in the second half of 2025 due to resistance faced by exports and domestic demand, while demand for solar energy will also fall sharply, which means that China's overall copper demand growth will remain flat or contract slightly in the second half of 2025.

We believe that as the tightening factors reverse, the market will gain more breathing room, but overall, copper supply growth is still facing challenges, so we believe copper prices will receive basic support at $9,000 per ton or slightly above this level, because in the absence of more serious negative changes in the overall macroeconomic environment, the price correction will continue to attract dips to buy (from investors, companies, and hoarders).

In the context of the escalating conflict in the Middle East, the impact of oil price stagflation is still a risk of weakening demand for basic metals, but this may have a more significant beneficial impact on the supply of aluminum. The Middle East region exports about 5 million tons of aluminum per year (about 7% of global supply), most of which is transported through the Strait of Hormuz. The potential disruption of this transportation flow, combined with the risk of rising energy prices, is still a positive risk for aluminum prices and premiums.

Global significant copper inventory:

Wall Street Journal

Wall Street Journal