Further weakness as PBG (BVMF:PTBL3) drops 10% this week, taking three-year losses to 24%

PBG S.A. (BVMF:PTBL3) shareholders will doubtless be very grateful to see the share price up 33% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 29% in the last three years, significantly under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Given that PBG didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, PBG saw its revenue grow by 4.9% per year, compound. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 9% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

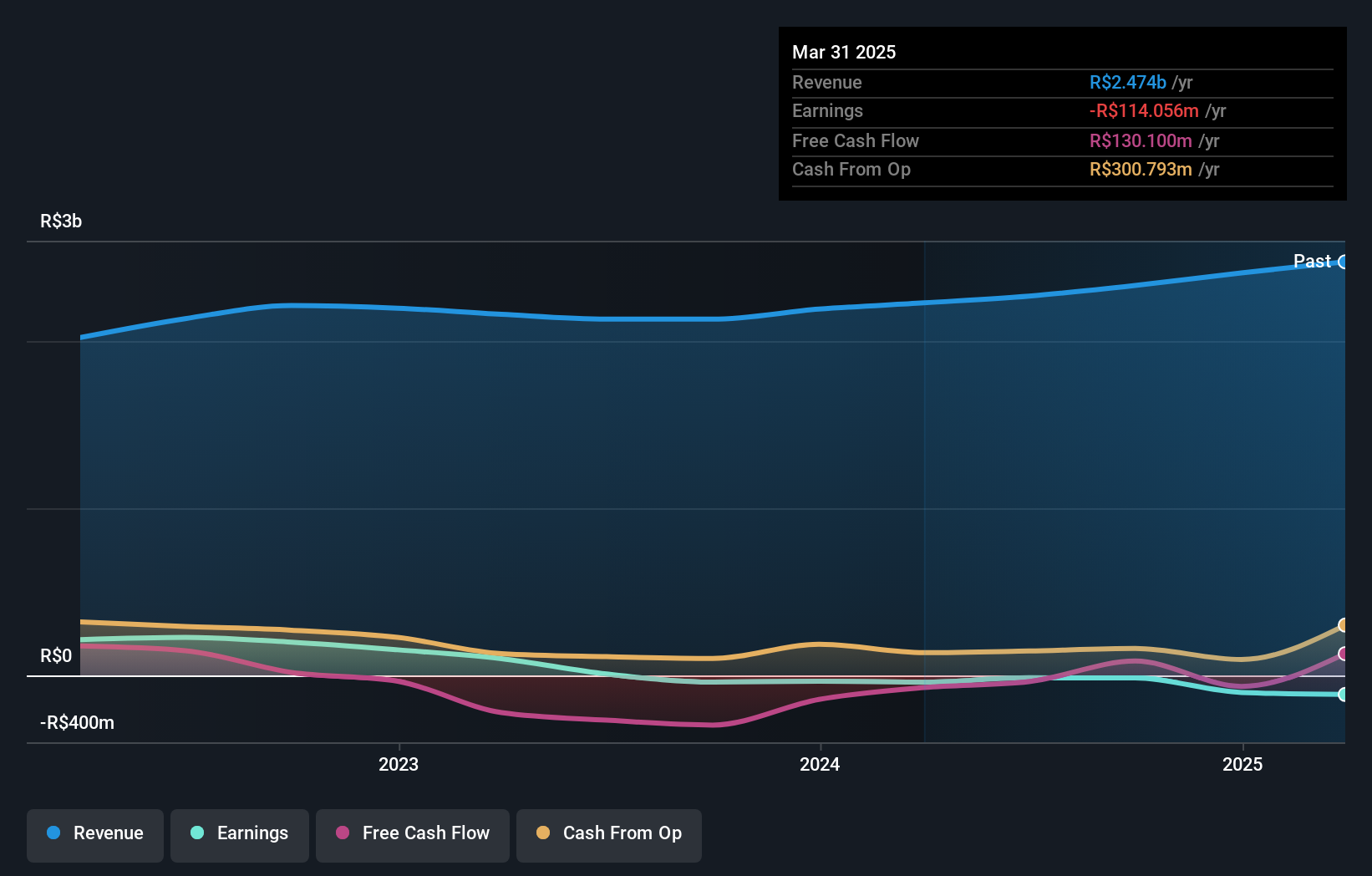

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between PBG's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for PBG shareholders, and that cash payout explains why its total shareholder loss of 24%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

PBG provided a TSR of 17% over the year. That's fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 7% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that PBG is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal