Carta Holdings, Inc.'s (TSE:3688) 38% Price Boost Is Out Of Tune With Revenues

Carta Holdings, Inc. (TSE:3688) shares have continued their recent momentum with a 38% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 26%.

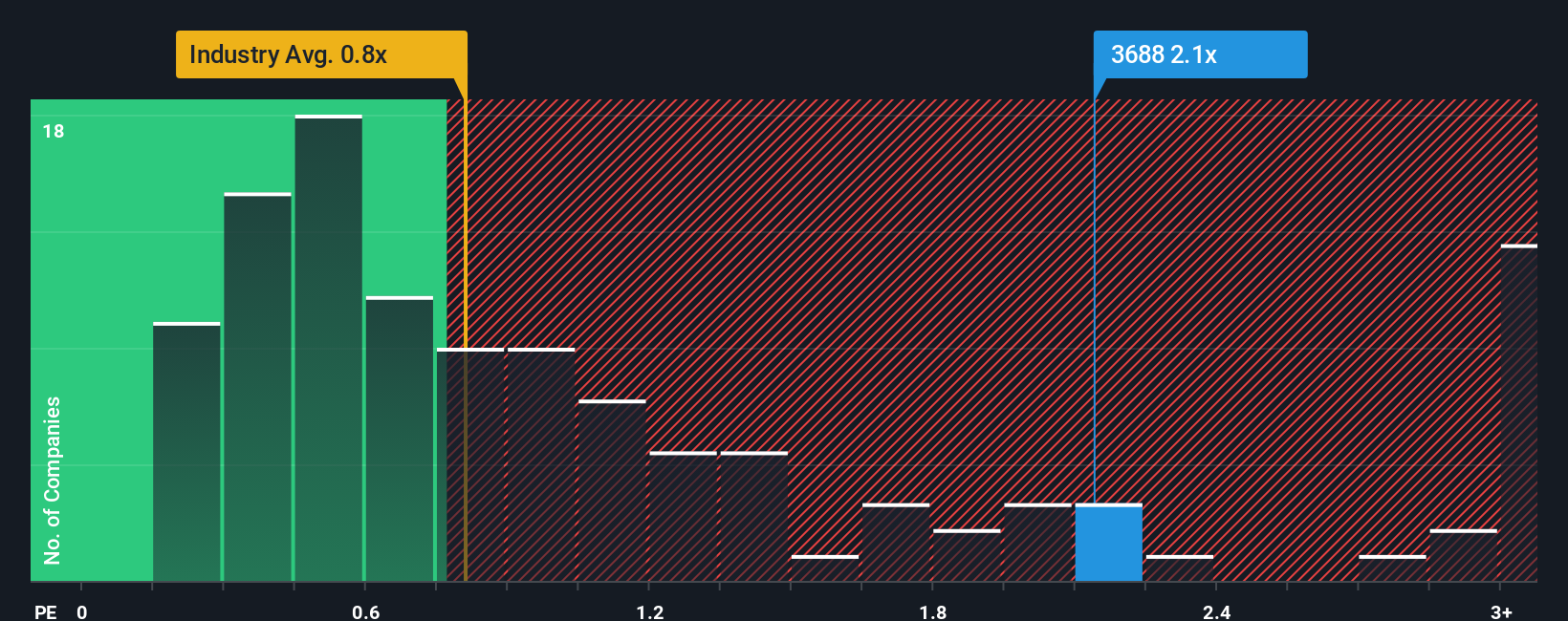

Since its price has surged higher, you could be forgiven for thinking Carta Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in Japan's Media industry have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Carta Holdings

How Has Carta Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, Carta Holdings has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Carta Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Carta Holdings' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.2%. Still, lamentably revenue has fallen 6.4% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 5.7% over the next year. With the industry predicted to deliver 23% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Carta Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Carta Holdings' P/S?

The large bounce in Carta Holdings' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Carta Holdings trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Carta Holdings you should be aware of.

If these risks are making you reconsider your opinion on Carta Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal