Warren Buffett's Real Estate Business Sounds Alarm: 'Overpriced' Homes Need Reductions

Warren Buffett‘s real estate business underscored the need for homeowners to reduce prices as the Home Builder Confidence index fell to a 30-month low in June 2025.

What Happened: Berkshire Hathaway Inc.‘s (NYSE:BRK) (NYSE:BRK) Home Services blog highlighted that if the sellers had few to no showings or offers, it's likely “overpriced” to homebuyers.

The blog post suggested accepting and understanding the current home market prices, upcycle homes for quicker sales, and reviewing the marketing by better staging and photography.

“A price reduction should send the right message to the marketplace—that your home is well worth its asking price,” it stated.

This comes as the Home Builder Confidence index fell to 32, which was the worst in nearly 30 months since December 2022's — 31 reading and April 2020's — 30 reading.

It was the third-worst figure since 2012 in June. “The weak retail report suggests that weak consumer demand helped hold down inflation in May,” said Bill Adams, the chief economist for Comerica Bank.

Reiterating the point from Berkshire Hathaway Home Services’ post, Charlie Bilello of Creative Planning highlighted that “37% of builders cut home prices to boost sales, the highest share on record.”

Why It Matters: The S&P 500 Real Estate Index is up 2.82% on a year-to-date basis and 8.78% over the last year. However, it has declined 1.30% over the last month.

Here are a few real-estate ETFs for investors to consider.

| ETFs | YTD Performance | One Year Performance |

| Vanguard Real Estate Index Fund ETF (NYSE:VNQ) | 1.46% | 6.64% |

| Schwab US REIT ETF (NYSE:SCHH) | 1.82% | 6.57% |

| Real Estate Select Sector SPDR Fund (NYSE:XLRE) | 3.65% | 8.52% |

| iShares US Real Estate ETF (NYSE:IYR) | 2.11% | 8.32% |

| iShares Core US REIT ETF (NYSE:USRT) | -0.04% | 7.13% |

| DFA Dimensional Global Real Estate ETF (NYSE:DFGR) | 5.75% | 8.14% |

| SPDR Dow Jones REIT ETF (NYSE:RWR) | -0.50% | 4.76% |

Buffett’s Berkshire Class B shares, on the other hand, have risen 7.18% on a year-to-date basis and 18.51% over a year.

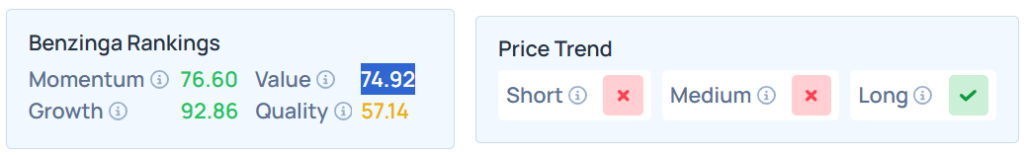

Benzinga Edge Stock Rankings shows that Berkshire had a weak price trend over the short and medium term but a strong price trend over the long term. Its momentum ranking was solid, and its value ranking was also sturdy at the 74.92th percentile. The details of other metrics are available here.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Tuesday. The SPY was down 0.85% at $597.53, while the QQQ declined 0.98% to $529.08, according to Benzinga Pro data.

On Wednesday, the future of the S&P 500, Dow Jones, and the Nasdaq 100 indices were trading higher.

Read Next:

Photo courtesy: mark reinstein / Shutterstock.com

Wall Street Journal

Wall Street Journal