3 UK Growth Companies With Insider Ownership Expecting 67% Earnings Growth

In recent weeks, the UK's FTSE 100 index has experienced downward pressure, influenced by weak trade data from China and declining commodity prices. Amid these challenging market conditions, investors often seek companies with robust growth potential and high insider ownership as they can indicate strong confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| QinetiQ Group (LSE:QQ.) | 13.2% | 70.7% |

| Petrofac (LSE:PFC) | 16.6% | 117% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.2% | 26.6% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 23.5% | 55.0% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 112.4% |

Underneath we present a selection of stocks filtered out by our screen.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

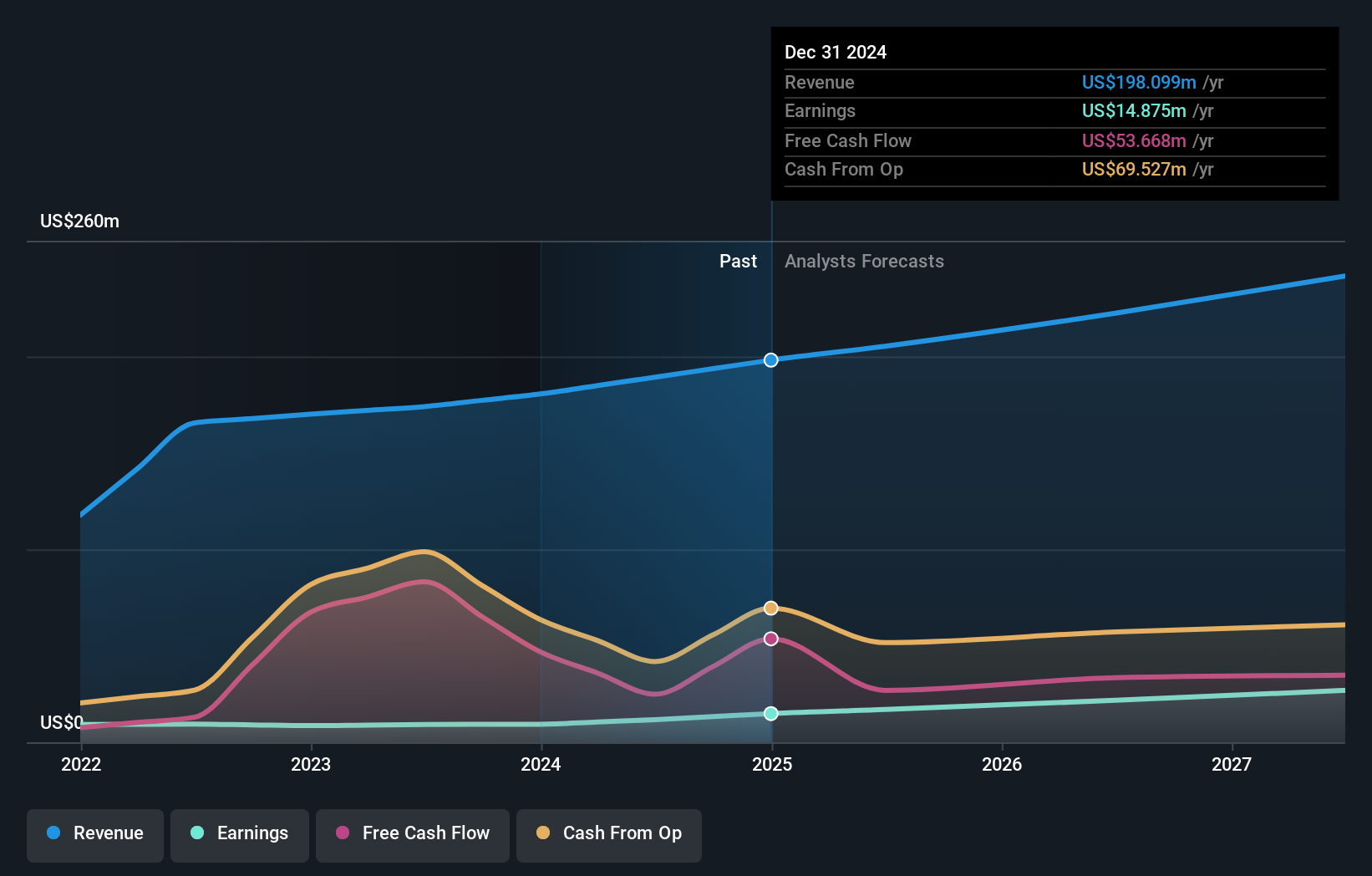

Overview: Craneware plc, with a market cap of £714.39 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: The company's revenue is primarily derived from its healthcare software segment, which generated $198.10 million.

Insider Ownership: 16.4%

Earnings Growth Forecast: 24% p.a.

Craneware shows potential as a growth company with insider ownership, evidenced by more shares bought than sold by insiders recently. Its earnings are forecast to grow at 24% annually, outpacing the UK market's 14.5%. However, revenue growth is slower at 8.1%, though still above the market average. Recent takeover interest from Bain Capital was rebuffed due to undervaluation concerns, highlighting confidence in Craneware's future prospects despite current share price underperformance.

- Get an in-depth perspective on Craneware's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Craneware implies its share price may be too high.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Growth Rating: ★★★★☆☆

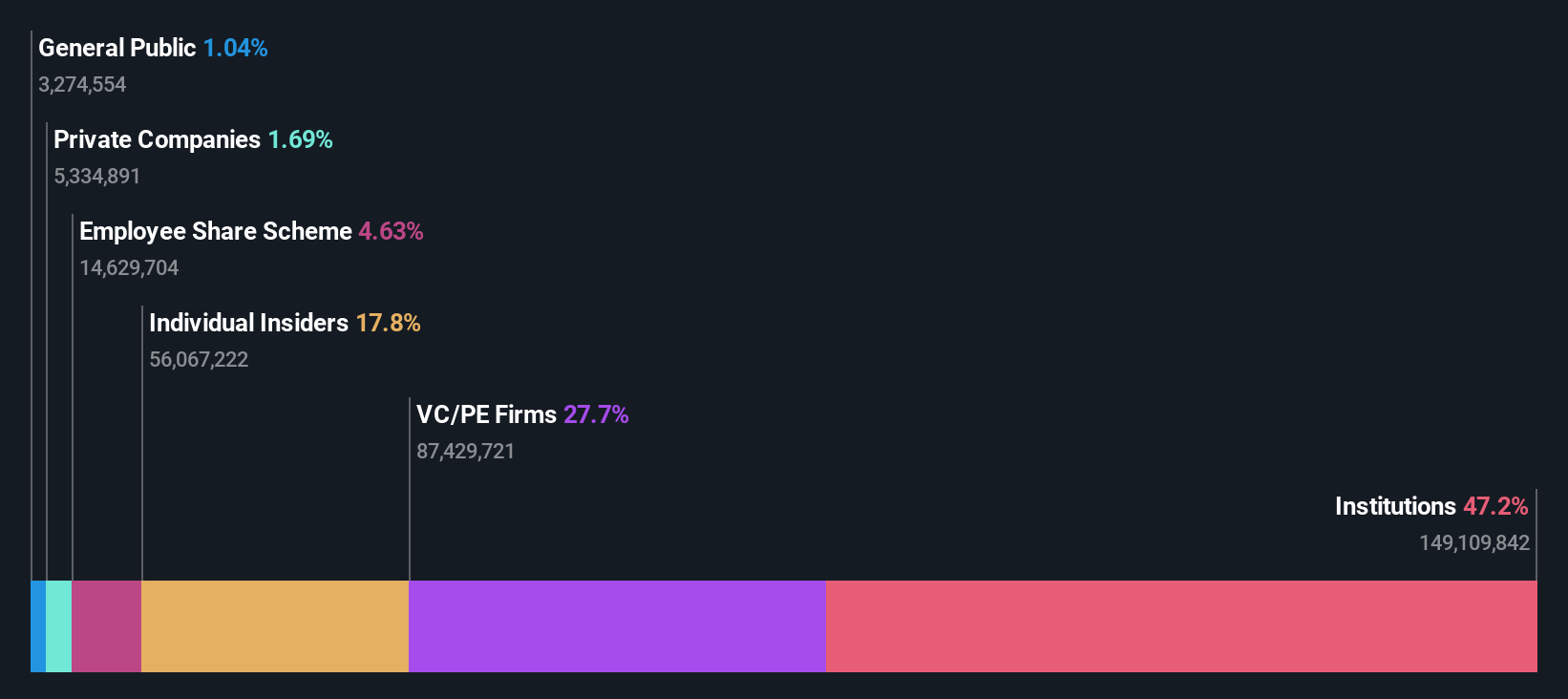

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market cap of £379.02 million.

Operations: The company generates revenue through its United Kingdom segments, FlexiPay and Term Loans, with contributions of £17.50 million and £142.60 million respectively.

Insider Ownership: 17.8%

Earnings Growth Forecast: 67.9% p.a.

Funding Circle Holdings demonstrates growth potential with significant earnings growth forecast at 67.9% annually, surpassing the UK market's average. Despite a slower revenue increase of 12.4%, it remains above market expectations. The company recently completed a £25 million share buyback, reflecting confidence in its valuation and capital structure. Leadership changes include Maeve Byrne as Chair Designate of the Audit Committee, bringing extensive financial services expertise to bolster governance amidst this growth trajectory.

- Unlock comprehensive insights into our analysis of Funding Circle Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Funding Circle Holdings shares in the market.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★☆☆

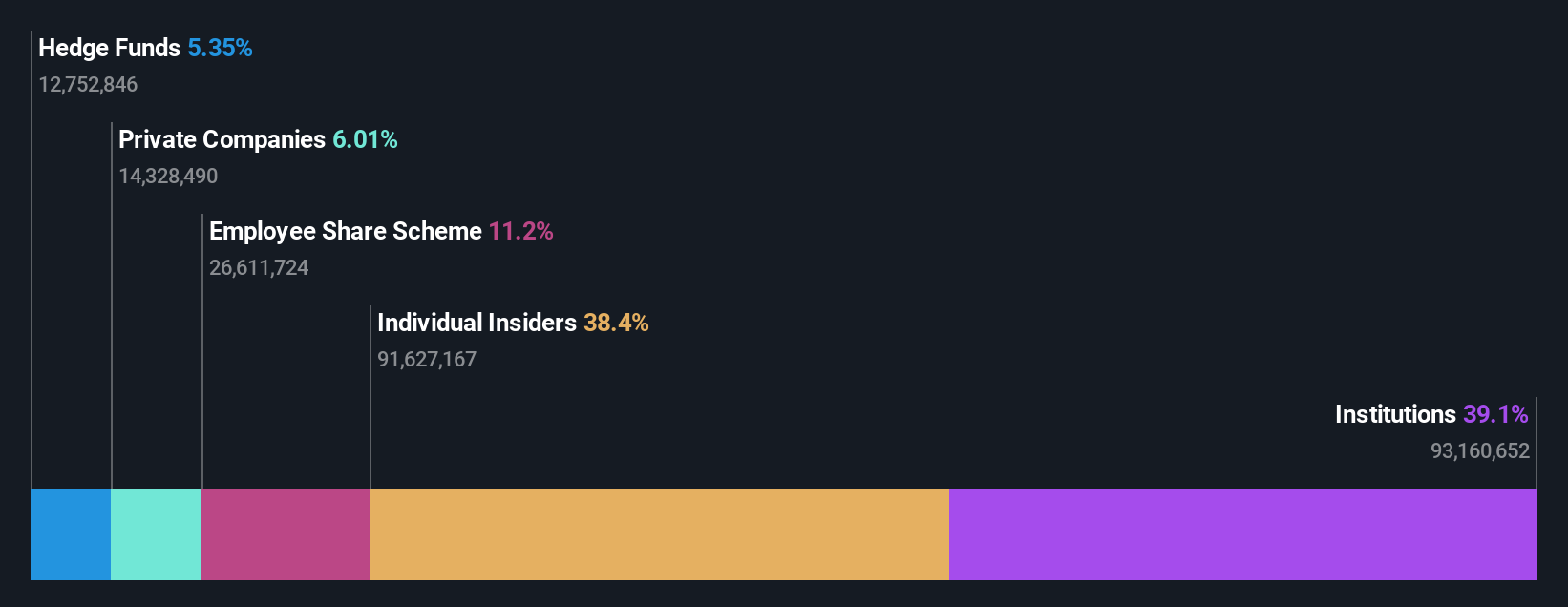

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of approximately £379.06 million.

Operations: The company generates revenue of £33.20 million from its Internet Information Providers segment.

Insider Ownership: 38.4%

Earnings Growth Forecast: 57.1% p.a.

PensionBee Group is poised for growth, supported by recent strategic partnerships and product innovations. The collaboration with Asure Software enhances its platform's appeal, while the launch of SEP IRAs addresses a critical need in the gig economy. Expected earnings growth at 57.06% annually outpaces market averages, though revenue growth at 18.6% lags behind top-tier expectations. Analysts anticipate a stock price increase of 26.6%, reflecting confidence in PensionBee's expanding retirement solutions portfolio.

- Dive into the specifics of PensionBee Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, PensionBee Group's share price might be too optimistic.

Taking Advantage

- Delve into our full catalog of 59 Fast Growing UK Companies With High Insider Ownership here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal