Top UK Dividend Stocks For June 2025

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, highlighting global economic interdependencies and their impact on domestic markets. In such fluctuating conditions, dividend stocks can offer investors a measure of stability and income through regular payouts, making them an appealing option for those seeking to navigate uncertain market environments.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.42% | ★★★★★★ |

| Treatt (LSE:TET) | 3.18% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.74% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.79% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.37% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.33% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.87% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.69% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.66% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.01% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

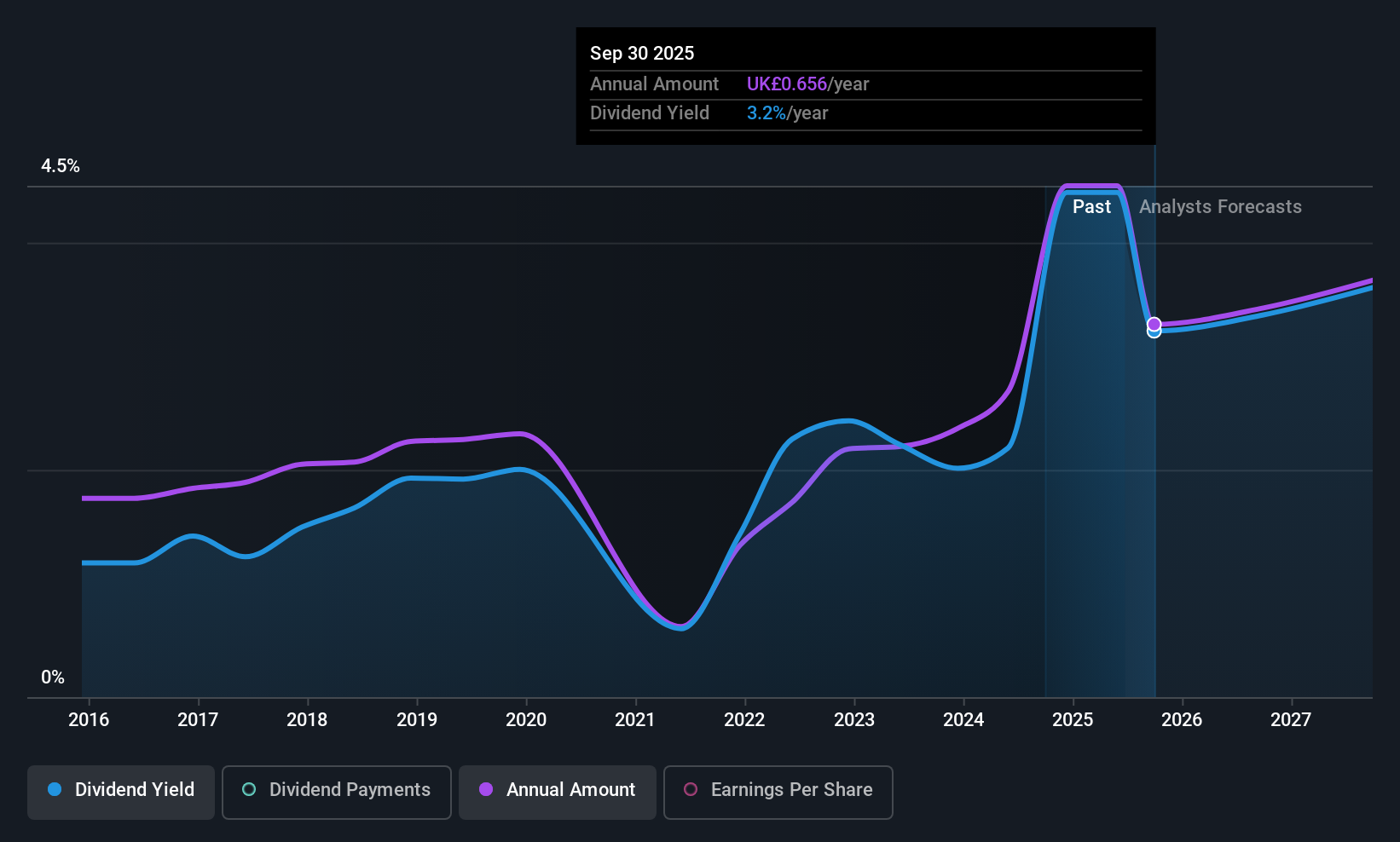

Associated British Foods (LSE:ABF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Associated British Foods plc is a diversified company engaged in food, ingredients, and retail operations globally, with a market cap of £14.82 billion.

Operations: Associated British Foods plc generates revenue through its diversified operations in sugar (£2.46 billion), retail (£9.42 billion), grocery (£4.21 billion), agriculture (£1.62 billion), and ingredients (£2.11 billion).

Dividend Yield: 4.3%

Associated British Foods has a volatile dividend history over the past decade, yet its dividends are well-covered by earnings (35.4% payout ratio) and cash flows (50.2% cash payout ratio). The current yield of 4.34% is below top-tier UK dividend payers, but the company maintains a commitment to shareholder value amidst strategic evaluations for Allied Bakeries. Recent interim dividends were affirmed at £0.207 per share, with earnings showing a decline in net income to £520 million for H1 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Associated British Foods.

- According our valuation report, there's an indication that Associated British Foods' share price might be on the cheaper side.

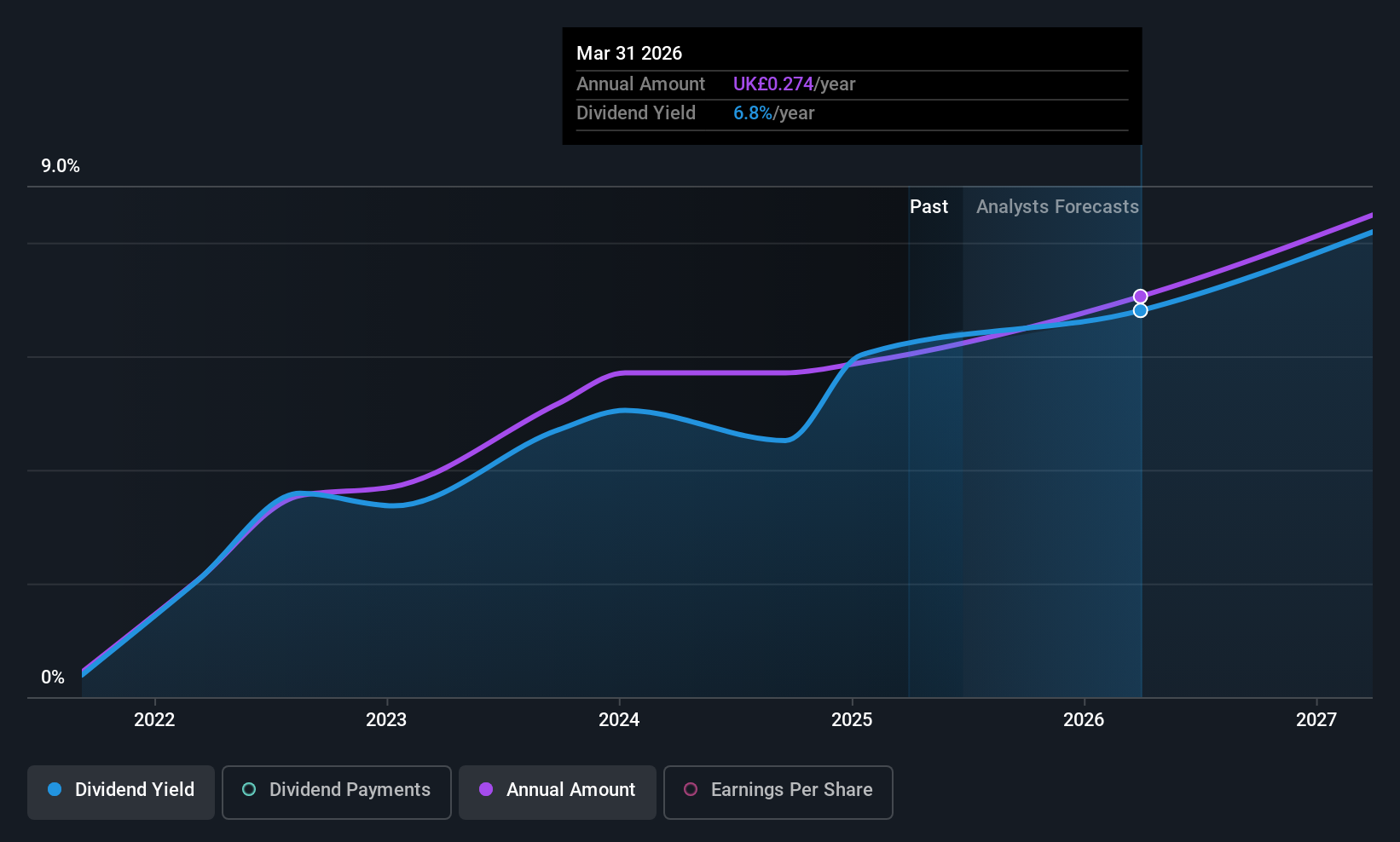

Foresight Group Holdings (LSE:FSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £449.80 million.

Operations: Foresight Group Holdings Limited generates revenue through its segments, with £87.79 million from Infrastructure, £50.78 million from Private Equity, and £8.10 million from Foresight Capital Management.

Dividend Yield: 5.7%

Foresight Group Holdings has demonstrated a strong dividend yield at 5.73%, placing it in the top 25% of UK dividend payers. Despite only four years of dividend history, payments have been stable and covered by both earnings (86.6% payout ratio) and cash flows (67.6% cash payout ratio). Recent share buyback initiatives, including a £50 million repurchase program, highlight the company's focus on shareholder value amidst growing earnings performance.

- Get an in-depth perspective on Foresight Group Holdings' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Foresight Group Holdings is trading behind its estimated value.

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial services in the UK and internationally, with a market cap of £45.17 billion.

Operations: Lloyds Banking Group generates its revenue through diverse banking and financial services offered both domestically in the UK and internationally.

Dividend Yield: 4.2%

Lloyds Banking Group's dividend yield of 4.19% is below the top UK payers, with a reasonable payout ratio of 50.6%, suggesting dividends are covered by earnings. However, its dividend history has been volatile over the past decade. Recent $3 billion fixed-income offerings indicate strategic financial maneuvers amidst significant insider selling and ongoing technological advancements with Google Cloud to enhance AI capabilities and customer service efficiency.

- Unlock comprehensive insights into our analysis of Lloyds Banking Group stock in this dividend report.

- Upon reviewing our latest valuation report, Lloyds Banking Group's share price might be too optimistic.

Taking Advantage

- Navigate through the entire inventory of 60 Top UK Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal