Chris Turner To Become CEO Of Yum! Brands (NYSE:YUM) In October 2025

Yum! Brands (NYSE:YUM) recently announced a significant executive change with Chris Turner being named as the next CEO, effective October 1, 2025, succeeding David Gibbs who retires after a notable tenure. During this announcement period, the company's share price remained flat alongside the broader market, reflecting a generally calm investor response amidst a backdrop of fluctuating global markets due to geopolitical tensions and rising oil prices. The CEO transition plan, emphasizing continuity and digital innovation under Turner's leadership, likely supported investor sentiment against the broader volatility observed in markets.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement about the CEO transition at Yum! Brands, with Chris Turner poised to take leadership from October 2025, may bolster existing narratives around enhanced operational efficiency and digital transformation. Investors might view this leadership change as a continuity of the company's focus on innovation and expansion. Despite the short-term share price stability around the announcement, it’s important to note that the stock’s total return over the past five years was 77.38%, marking a significant gain and providing context against its recent flat performance.

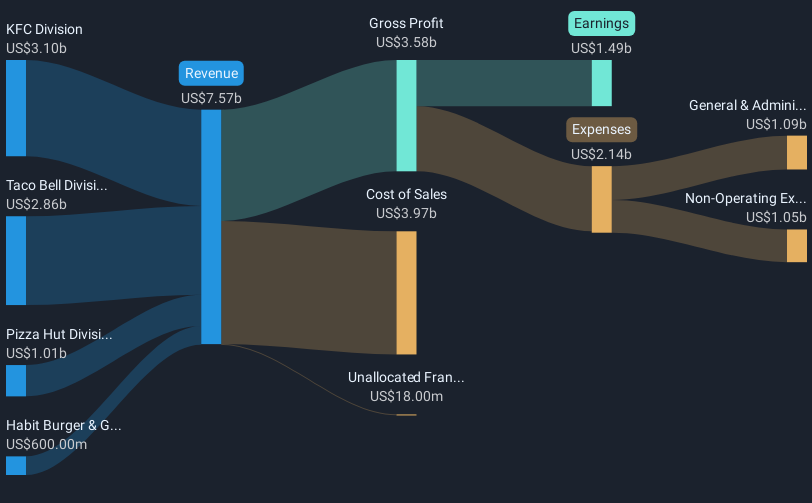

In the last year, Yum! Brands underperformed the US market, which showed a 9.9% return, indicating some challenges compared to broader industry performance. Given the projected growth rates for revenue and earnings, these leadership changes could potentially strengthen confidence in future forecasts, targeting a revenue increase to $9.3 billion and earnings escalation to $2.0 billion by 2028. Today's share price of US$148.28 sits roughly 6.3% below the consensus analyst price target of US$158.33, a margin reflecting cautious optimism. Maintaining robust gains over a five-year period underscores the company’s resilience and potential to meet those targets.

Assess Yum! Brands' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal