St Barbara Limited (ASX:SBM) Surges 31% Yet Its Low P/S Is No Reason For Excitement

St Barbara Limited (ASX:SBM) shares have continued their recent momentum with a 31% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 73%.

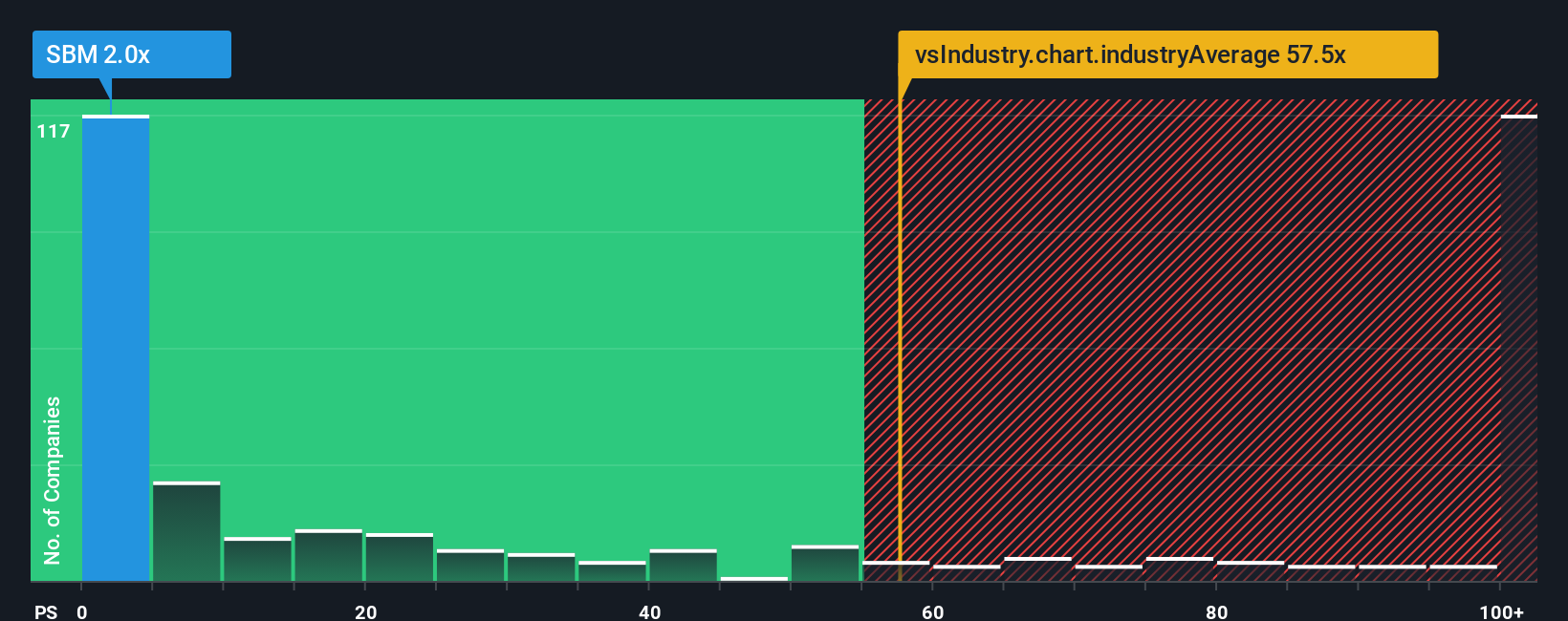

Although its price has surged higher, St Barbara may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2x, considering almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 57.5x and even P/S higher than 391x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for St Barbara

How Has St Barbara Performed Recently?

St Barbara hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on St Barbara will help you uncover what's on the horizon.How Is St Barbara's Revenue Growth Trending?

St Barbara's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 70% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 32% per annum over the next three years. That's shaping up to be materially lower than the 103% per year growth forecast for the broader industry.

With this in consideration, its clear as to why St Barbara's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From St Barbara's P/S?

St Barbara's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of St Barbara's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - St Barbara has 1 warning sign we think you should be aware of.

If you're unsure about the strength of St Barbara's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal