Enagás, S.A.'s (BME:ENG) Share Price Not Quite Adding Up

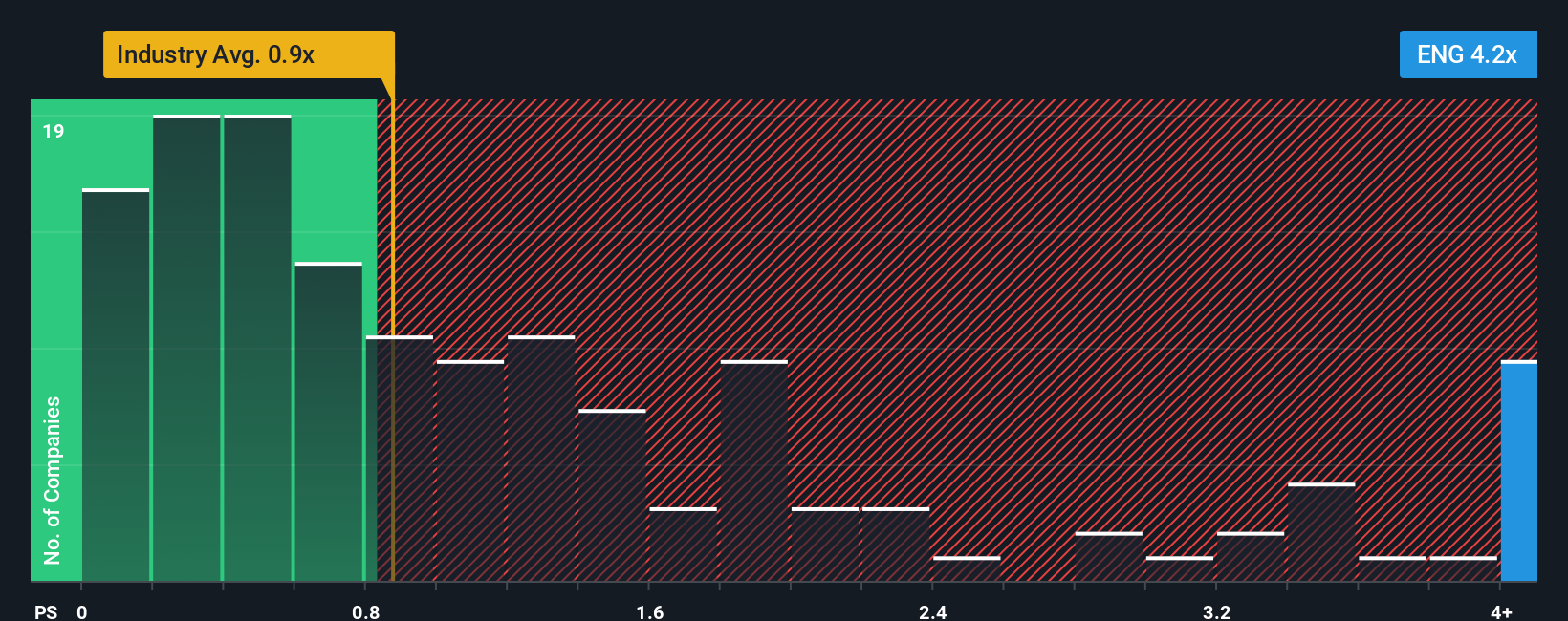

Enagás, S.A.'s (BME:ENG) price-to-sales (or "P/S") ratio of 4.2x may look like a poor investment opportunity when you consider close to half the companies in the Gas Utilities industry in Spain have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Enagás

What Does Enagás' Recent Performance Look Like?

Recent times have been more advantageous for Enagás as its revenue hasn't fallen as much as the rest of the industry. The P/S ratio is probably high because investors think this comparatively better revenue performance will continue. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Enagás will help you uncover what's on the horizon.How Is Enagás' Revenue Growth Trending?

In order to justify its P/S ratio, Enagás would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. The last three years don't look nice either as the company has shrunk revenue by 8.3% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.9% each year as estimated by the analysts watching the company. With the industry predicted to deliver 2.5% growth each year, that's a disappointing outcome.

With this in mind, we find it intriguing that Enagás' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Enagás currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Enagás you should be aware of, and 1 of them is potentially serious.

If you're unsure about the strength of Enagás' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal