There's No Escaping CureVac N.V.'s (NASDAQ:CVAC) Muted Revenues Despite A 50% Share Price Rise

Despite an already strong run, CureVac N.V. (NASDAQ:CVAC) shares have been powering on, with a gain of 50% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

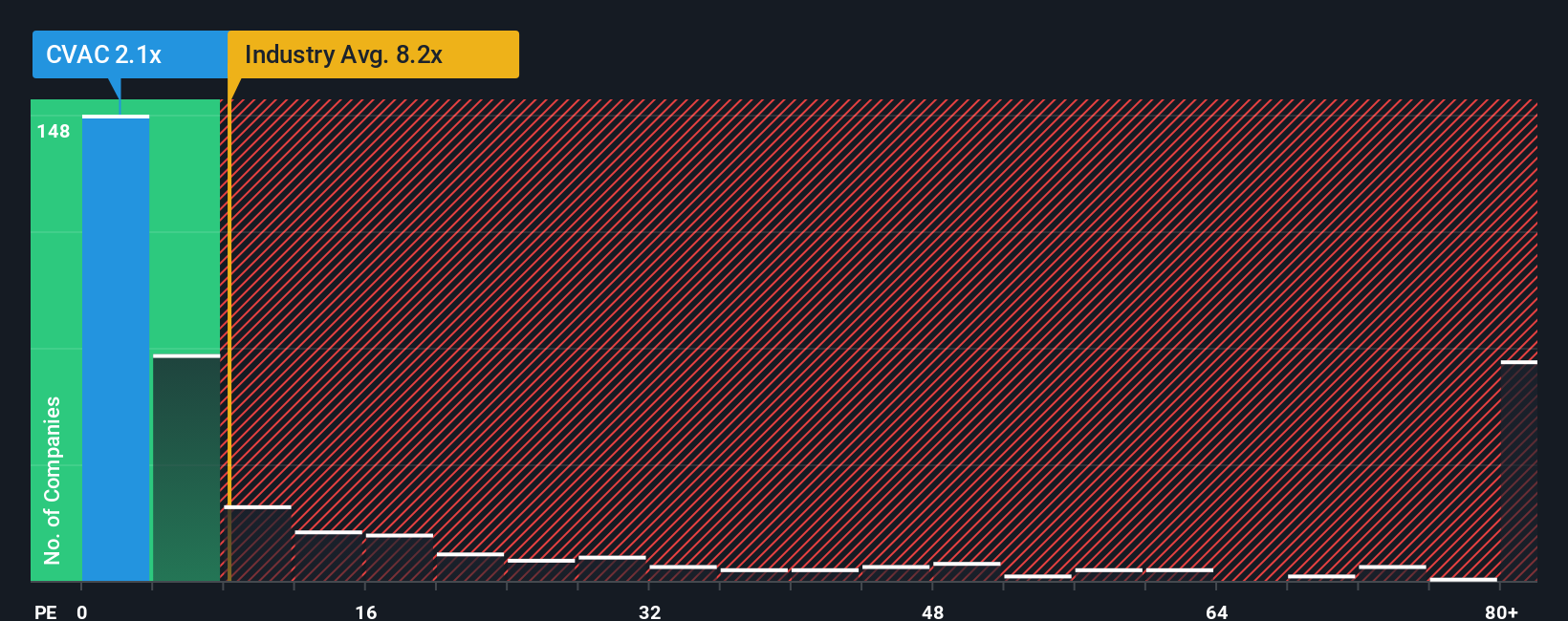

Even after such a large jump in price, CureVac may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.1x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.2x and even P/S higher than 52x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CureVac

How CureVac Has Been Performing

CureVac could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on CureVac will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For CureVac?

In order to justify its P/S ratio, CureVac would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 33% each year as estimated by the seven analysts watching the company. That's not great when the rest of the industry is expected to grow by 112% per annum.

With this information, we are not surprised that CureVac is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From CureVac's P/S?

Even after such a strong price move, CureVac's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that CureVac maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for CureVac (of which 2 are a bit unpleasant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal