UnitedHealth Group (NYSE:UNH) Reaches US$69 Million Record ERISA Settlement

UnitedHealth Group (NYSE:UNH) recently reached a $69 million settlement in a fiduciary duty lawsuit, underscoring its legal challenges. This development, coupled with UnitedHealth's exploration of selling its Latin American operations amid financial difficulties, significantly impacts the company's reputation and strategy. Last week, UnitedHealth's stock price increased by 3%, reflecting these events. The overall market remained flat during the same period, suggesting these specific developments may have contributed positively against broader market trends. As UnitedHealth addresses these hurdles, the share price movement reflects ongoing adjustments and investor reactions to these significant corporate actions.

UnitedHealth Group has 1 warning sign we think you should know about.

The recent settlement and exploration of selling UnitedHealth Group's Latin American operations highlight the company's focus on streamlining its structure and addressing legal challenges. These actions may influence investor sentiment and potentially drive strategic realignments as UnitedHealth navigates these operational hurdles. Despite these short-term developments, UnitedHealth's long-term performance shows a total return including share price and dividends of 15.36% over the past five years, reflecting steady growth. In comparison, the company underperformed the US Healthcare industry and overall US Market, both of which experienced different returns over the past year, as indicated by the industry's 17.9% decline and the market's 10.6% gain, respectively.

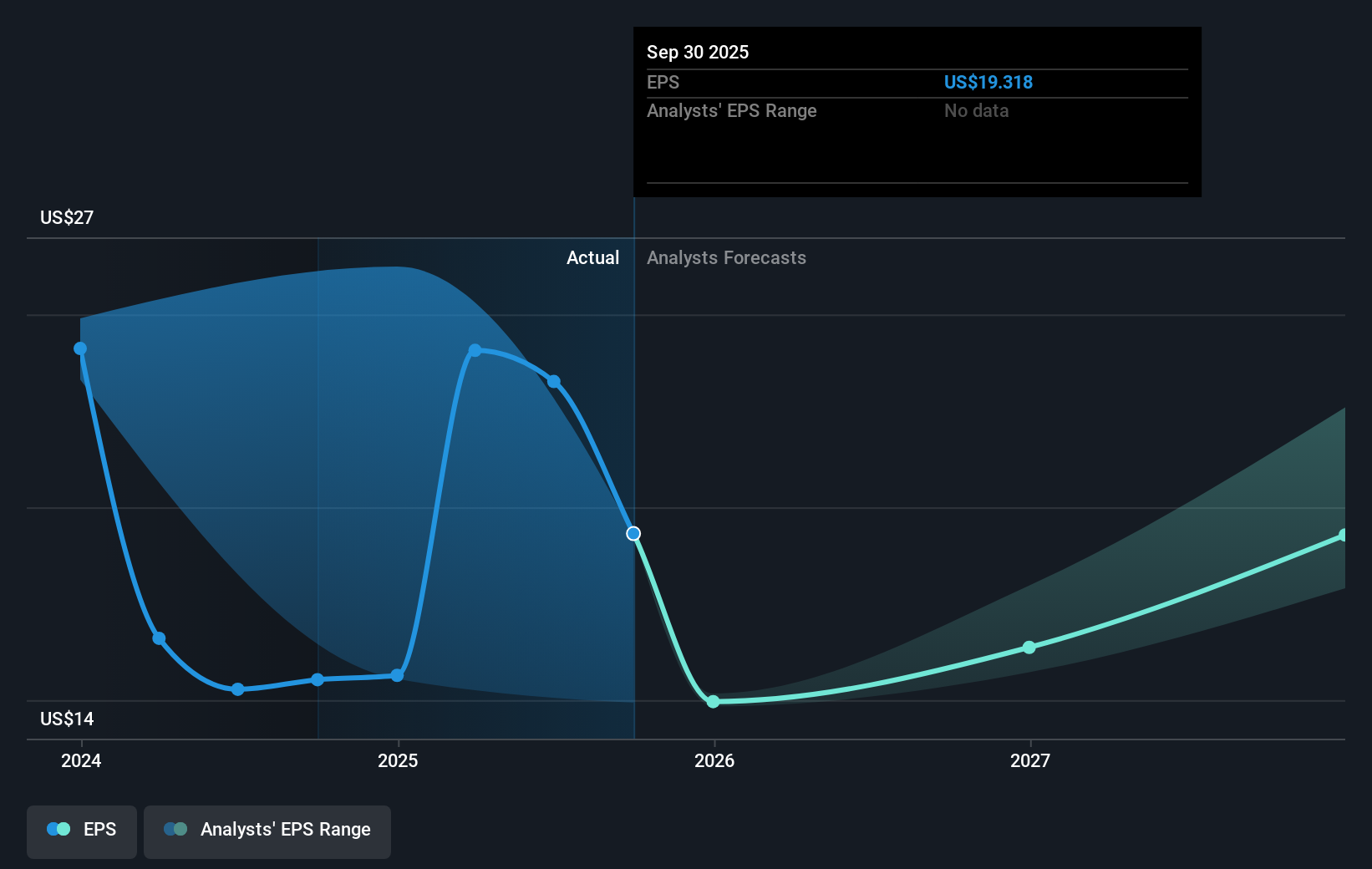

The implications of current news events on revenue and earnings forecasts are notable. The adjustments in the Medicare business and the adoption of digital tools may stabilize and expand future revenue streams, while also enhancing operational efficiency. Analysts forecast an annual revenue growth rate of 9.4% over the next three years, with earnings expected to rise to US$30.5 billion by 2028. As of today, with UnitedHealth Group's stock priced at $394.51, it trades below the analysts' consensus price target of US$547.65, creating a room for potential growth in line with market expectations, driven by anticipated improvements in profit margins and strategic executions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal